(Please enjoy this updated version of my weekly commentary published March 31st, 2022 from the POWR Options newsletter).

The red-hot post Fed rally finally ran into a little push back.

The S&P 500 had rallied nearly 10% off the recent late February lows to challenge the upside resistance area around $460 on the SPY.

Apple had been up for 11 straight days after the Federal Reserve meeting March 15. That was the longest stretch since 2003.

Meme mania returned in full force as GameStop, AMC and other similar names ripped higher to squeeze the shorts. Maybe another sign of over-exuberance.

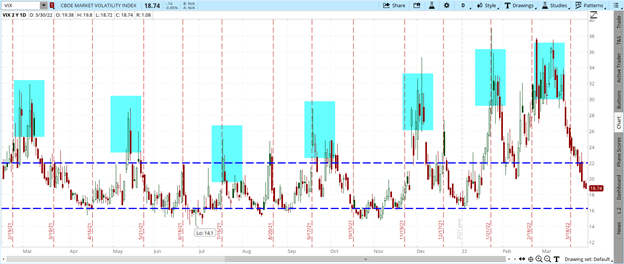

VIX dropped back to the middle of the traditional regime of implied volatility bounded by 16 to the downside and 22 to the upside.

Proof once again that implied volatility is truly mean-reverting.

Oil prices pulled back from the recent highs near $130 but still are trading over $100. The futures curve for light sweet crude remains in backwardation but has flattened dramatically.

The ten-year yield is hovering near recent highs at 2.5% but stocks don’t care.

Yield curve is inverted with the 5-year at over 2.5%. Normally a sign of recession but these are definitely not normal times.

As always, respect the price action. To quote Keynes “The market can remain irrational longer than investors can remain solvent”.

What To Do Next?

If you’re looking for the best options trades for today’s market, you should check out our latest presentation How to Trade Options with the POWR Ratings, where we show you how you can consistently find the top options trades.

If that appeals to you, and you want to learn more about this powerful new options strategy, then click below to get access to this timely investment presentation now:

How to Trade Options with the POWR Ratings

SPY shares were trading at $457.54 per share on Thursday afternoon, down $1.16 (-0.25%). Year-to-date, SPY has declined -3.37%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Tim Biggam

Tim spent 13 years as Chief Options Strategist at Man Securities in Chicago, 4 years as Lead Options Strategist at ThinkorSwim and 3 years as a Market Maker for First Options in Chicago. He makes regular appearances on Bloomberg TV and is a weekly contributor to the TD Ameritrade Network "Morning Trade Live". His overriding passion is to make the complex world of options more understandable and therefore more useful to the everyday trader. Tim is the editor of the POWR Options newsletter. Learn more about Tim's background, along with links to his most recent articles.

What the Red Hot Post Fed Rally Could Mean for the Stock Market StockNews.com