High-rolling investors have positioned themselves bullish on ConocoPhillips (NYSE:COP), and it's important for retail traders to take note. \This activity came to our attention today through Benzinga's tracking of publicly available options data. The identities of these investors are uncertain, but such a significant move in COP often signals that someone has privileged information.

Today, Benzinga's options scanner spotted 8 options trades for ConocoPhillips. This is not a typical pattern.

The sentiment among these major traders is split, with 75% bullish and 25% bearish. Among all the options we identified, there was one put, amounting to $70,000, and 7 calls, totaling $286,971.

Predicted Price Range

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $100.0 to $115.0 for ConocoPhillips during the past quarter.

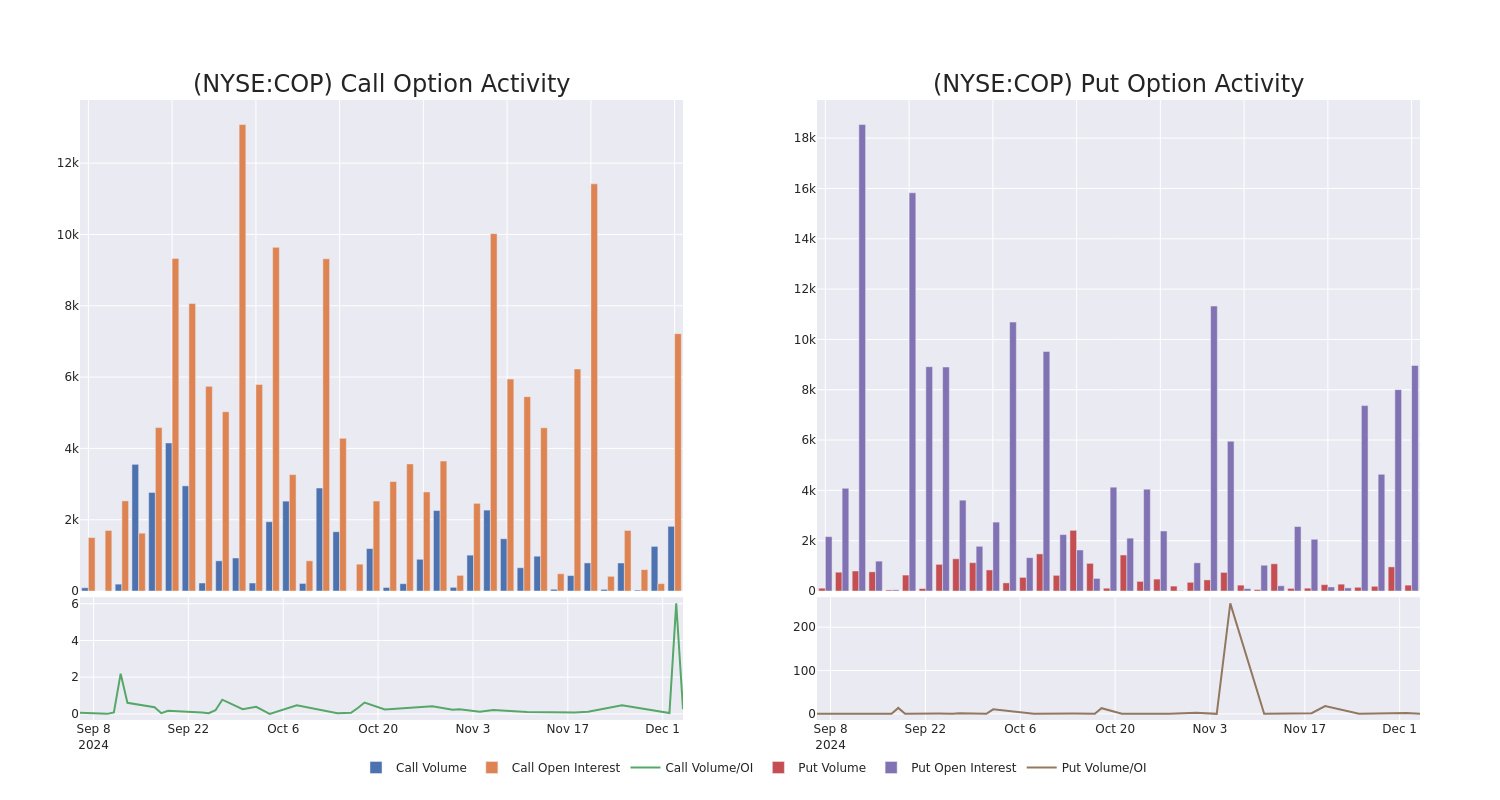

Volume & Open Interest Development

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for ConocoPhillips's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across ConocoPhillips's significant trades, within a strike price range of $100.0 to $115.0, over the past month.

ConocoPhillips Call and Put Volume: 30-Day Overview

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| COP | PUT | TRADE | BEARISH | 01/17/25 | $7.05 | $6.9 | $7.0 | $110.00 | $70.0K | 8.9K | 235 |

| COP | CALL | SWEEP | BULLISH | 01/17/25 | $3.15 | $3.0 | $3.14 | $105.00 | $62.8K | 2.3K | 217 |

| COP | CALL | TRADE | BULLISH | 02/21/25 | $1.44 | $1.3 | $1.39 | $115.00 | $59.0K | 2.8K | 163 |

| COP | CALL | SWEEP | BEARISH | 12/20/24 | $1.91 | $1.8 | $1.79 | $105.00 | $39.4K | 902 | 444 |

| COP | CALL | TRADE | BULLISH | 01/16/26 | $7.35 | $7.35 | $7.35 | $115.00 | $36.7K | 499 | 57 |

About ConocoPhillips

ConocoPhillips is a US-based independent exploration and production firm. In 2023, it produced 1.2 million barrels per day of oil and natural gas liquids and 3.1 billion cubic feet per day of natural gas, primarily from Alaska and the Lower 48 in the United States and Norway in Europe and several countries in Asia-Pacific and the Middle East. Proven reserves at year-end 2023 were 6.8 billion barrels of oil equivalent.

In light of the recent options history for ConocoPhillips, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Where Is ConocoPhillips Standing Right Now?

- Trading volume stands at 3,826,716, with COP's price down by -2.9%, positioned at $102.97.

- RSI indicators show the stock to be may be oversold.

- Earnings announcement expected in 64 days.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for ConocoPhillips with Benzinga Pro for real-time alerts.