Deep-pocketed investors have adopted a bearish approach towards Barrick Gold (NYSE:GOLD), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in GOLD usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 8 extraordinary options activities for Barrick Gold. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 12% leaning bullish and 75% bearish. Among these notable options, 6 are puts, totaling $321,885, and 2 are calls, amounting to $199,000.

Predicted Price Range

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $16.0 to $30.0 for Barrick Gold over the recent three months.

Analyzing Volume & Open Interest

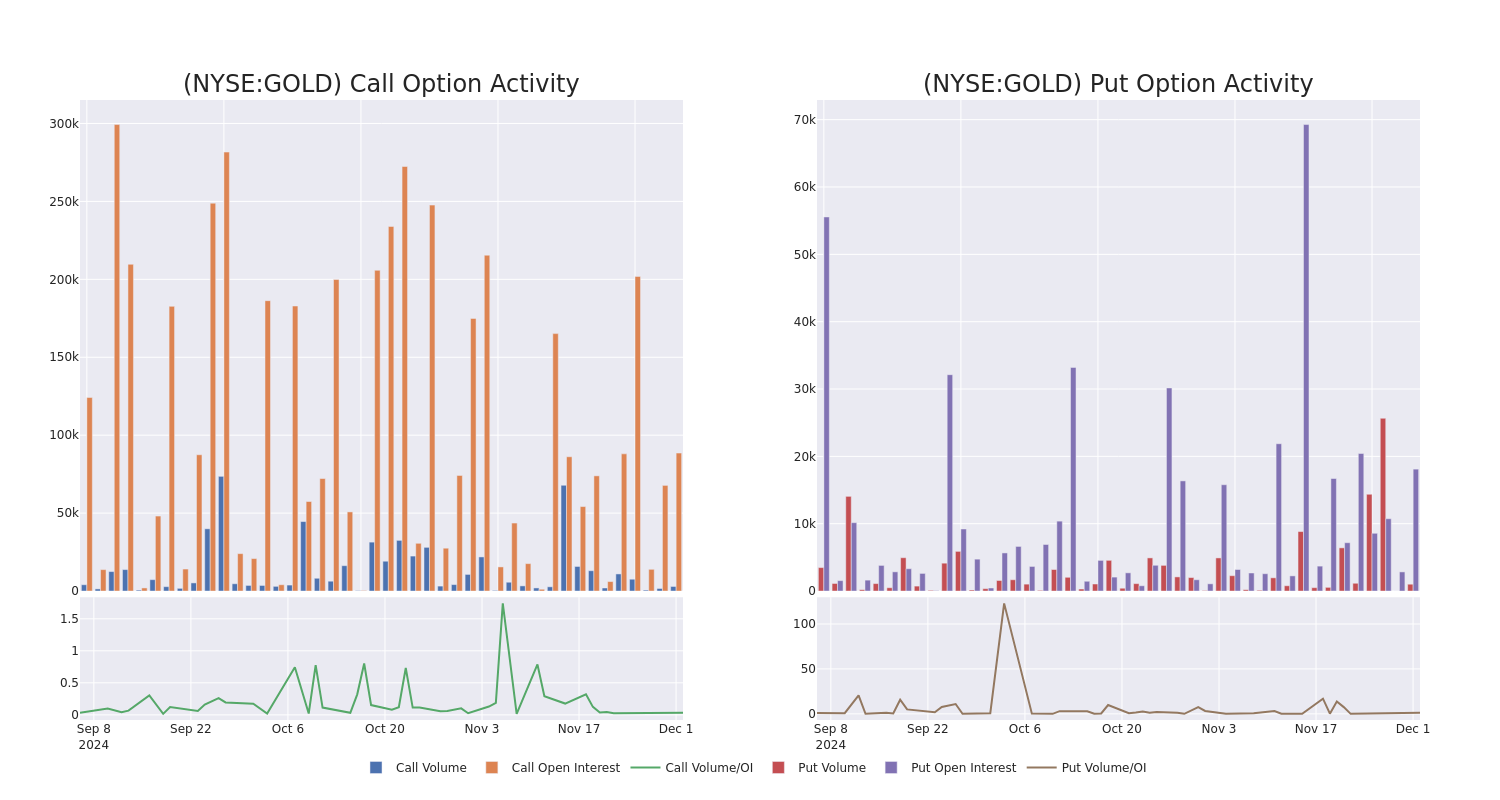

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Barrick Gold's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Barrick Gold's significant trades, within a strike price range of $16.0 to $30.0, over the past month.

Barrick Gold Option Volume And Open Interest Over Last 30 Days

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| GOLD | CALL | TRADE | NEUTRAL | 01/16/26 | $1.73 | $1.66 | $1.7 | $20.00 | $170.0K | 69.9K | 1.0K |

| GOLD | PUT | SWEEP | BEARISH | 03/21/25 | $0.54 | $0.51 | $0.51 | $16.00 | $102.0K | 5.3K | 2.0K |

| GOLD | PUT | TRADE | BULLISH | 09/19/25 | $7.55 | $7.5 | $7.5 | $25.00 | $61.5K | 907 | 141 |

| GOLD | PUT | SWEEP | BEARISH | 09/19/25 | $7.5 | $7.5 | $7.5 | $25.00 | $49.5K | 907 | 248 |

| GOLD | PUT | SWEEP | BEARISH | 09/19/25 | $7.5 | $7.5 | $7.5 | $25.00 | $44.2K | 907 | 59 |

About Barrick Gold

Based in Toronto, Barrick Gold is one of the world's largest gold miners. In 2023, the firm produced nearly 4.1 million attributable ounces of gold and about 420 million pounds of copper. At year-end 2023, Barrick had about two decades of gold reserves along with significant copper reserves. After buying Randgold in 2019 and combining its Nevada mines in a joint venture with competitor Newmont later that year, it operates mines in 19 countries in the Americas, Africa, the Middle East, and Asia. The company also has growing copper exposure. Its potential Reko Diq project in Pakistan, if developed, could double copper production by the end of the decade.

In light of the recent options history for Barrick Gold, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Present Market Standing of Barrick Gold

- Currently trading with a volume of 2,063,303, the GOLD's price is down by -0.74%, now at $17.48.

- RSI readings suggest the stock is currently is currently neutral between overbought and oversold.

- Anticipated earnings release is in 70 days.

Expert Opinions on Barrick Gold

In the last month, 3 experts released ratings on this stock with an average target price of $24.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access. * An analyst from Scotiabank persists with their Sector Outperform rating on Barrick Gold, maintaining a target price of $23. * Maintaining their stance, an analyst from Scotiabank continues to hold a Sector Outperform rating for Barrick Gold, targeting a price of $24. * An analyst from Raymond James persists with their Outperform rating on Barrick Gold, maintaining a target price of $25.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Barrick Gold with Benzinga Pro for real-time alerts.