Financial giants have made a conspicuous bearish move on Axon Enterprise. Our analysis of options history for Axon Enterprise (NASDAQ:AXON) revealed 12 unusual trades.

Delving into the details, we found 25% of traders were bullish, while 41% showed bearish tendencies. Out of all the trades we spotted, 4 were puts, with a value of $279,180, and 8 were calls, valued at $2,637,935.

Predicted Price Range

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $410.0 to $840.0 for Axon Enterprise over the last 3 months.

Volume & Open Interest Trends

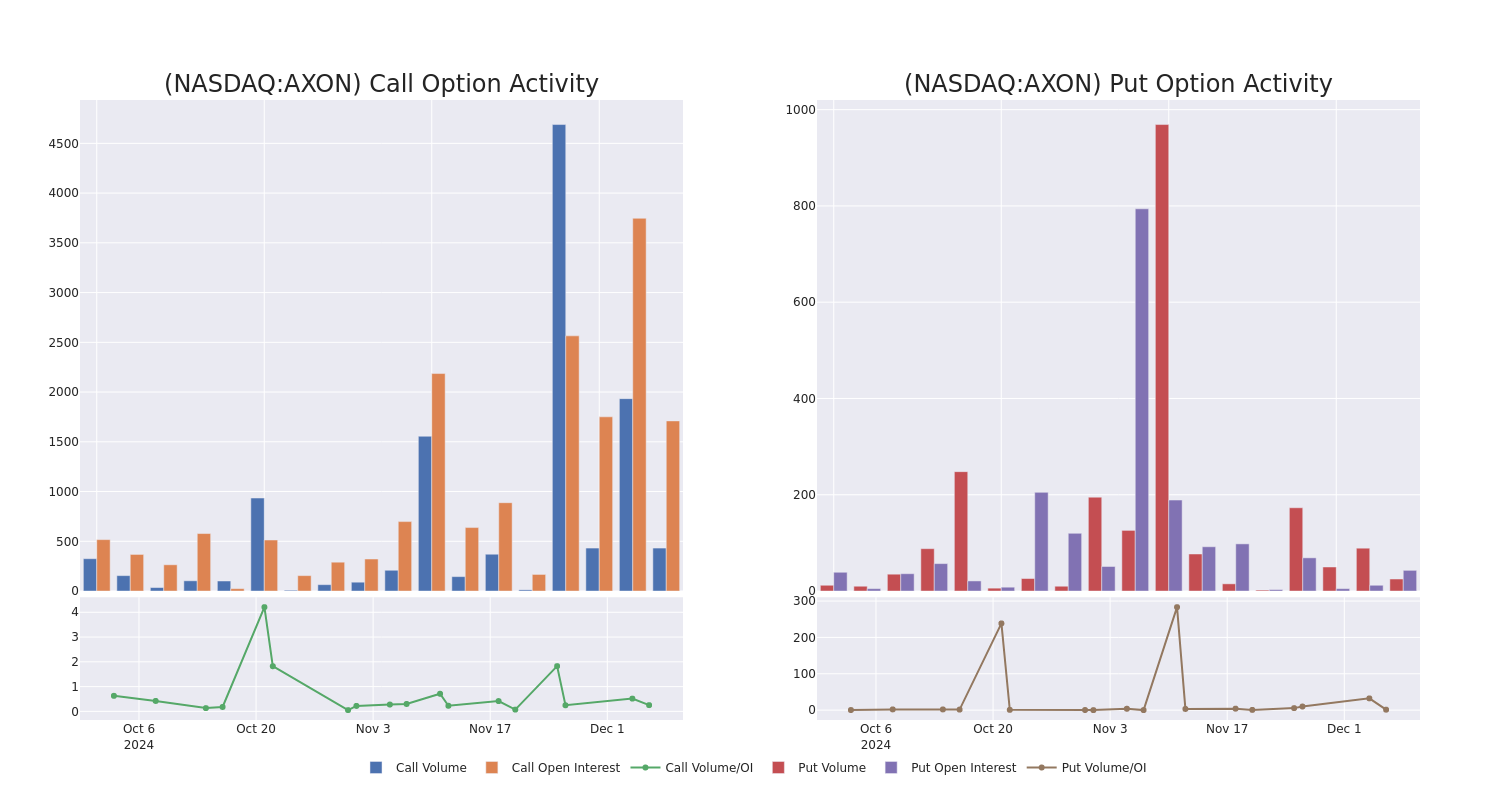

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Axon Enterprise's options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Axon Enterprise's whale activity within a strike price range from $410.0 to $840.0 in the last 30 days.

Axon Enterprise Option Activity Analysis: Last 30 Days

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| AXON | CALL | TRADE | BEARISH | 01/17/25 | $29.2 | $25.6 | $26.2 | $670.00 | $1.0M | 1.2K | 1.1K |

| AXON | CALL | SWEEP | BULLISH | 01/17/25 | $28.6 | $25.5 | $26.4 | $670.00 | $871.2K | 1.2K | 1.1K |

| AXON | CALL | TRADE | BULLISH | 01/17/25 | $29.7 | $28.3 | $29.7 | $670.00 | $561.3K | 1.2K | 859 |

| AXON | PUT | TRADE | BEARISH | 01/17/25 | $175.2 | $172.0 | $175.2 | $840.00 | $175.2K | 0 | 11 |

| AXON | PUT | TRADE | NEUTRAL | 12/20/24 | $27.0 | $23.2 | $24.84 | $680.00 | $49.6K | 104 | 40 |

About Axon Enterprise

Axon Enterprise Inc develops, manufactures, and sells conducted energy devices and cloud-based digital evidence management software designed for use by law enforcement, corrections, military forces, private security personnel, and private individuals for personal defense. The company operates in two segments: Taser and software & sensors. Taser develops and sells CEDs used for protecting users and virtual reality training. Software and sensors manufacture fully integrated hardware and cloud-based software solutions such as body cameras, automated license plate reading, and digital evidence management systems. Axon delivers its products worldwide and derives the majority of its revenue from the software & sensors segment and geographically from the United States.

Following our analysis of the options activities associated with Axon Enterprise, we pivot to a closer look at the company's own performance.

Axon Enterprise's Current Market Status

- With a volume of 103,160, the price of AXON is down -2.96% at $667.32.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 78 days.

What The Experts Say On Axon Enterprise

A total of 3 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $683.3333333333334.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access. * An analyst from Northland Capital Markets has decided to maintain their Outperform rating on Axon Enterprise, which currently sits at a price target of $550. * An analyst from Morgan Stanley has elevated its stance to Overweight, setting a new price target at $700. * Maintaining their stance, an analyst from Baird continues to hold a Outperform rating for Axon Enterprise, targeting a price of $800.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Axon Enterprise options trades with real-time alerts from Benzinga Pro.