Crypto might be tanking, but metaverse spending is bounding to new heights.

Investments in the metaverse surged to $12 billion in 2021 from $5.9 billion in 2020 to more than$5.9 billion in 2020 to more than. The metaverse could grow to $13 trillion – more than half the size of the entire U.S. 2022 economy – by 2030, according to Citi Bank estimates.

Continued growth of the metaverse economy depends on normalizing the luxury features of web3’s into standard fare, much as air conditioning in cars went from a expensive novelty in 1968 to a basic feature by 1978. Or the transition of cell phone-based banking from a curiosity in 2005 to a ubiquity in 2022. Today web3 is mostly a luxury good, such as metaverse concerts by Ariana Grande and Justin Bieber. It’s these novelties that captivate the media now. But, soon enough, metaverse features will become standard utilities for airline tickets, spa reservations, and dentist appointments.

This is exactly what has started to happen. More and more, consumer services are being delivered by online tokens and other web3 tools.

But transitioning everyday activities into digital spaces includes an inherent risk: the loss of community and relationships between companies and their customers, as well as their suppliers and staff. Without being able to run your fingers across the softness of a cashmere sweater or look a waiter in the eye or hear an executive explain his returns to his shareholders, and a thousand other similar quotidian things, something vital is lost between a company and the people it depends on. Too easily, the intangible becomes abstract and remote.

Now entrepreneurs are emerging to combat this depersonalization. By offering consumers engaging and fun metaverse experiences ranging from education to banking, these startups promise to not only deliver the standard services, but also build community and wonder out of them.

Consider Quontic, a self-styled “adaptive digital bank.” The founders of Quontic know that digital banking needs to offer the same services at the same quality as traditional banks, but they also recognize that being purely digital puts them at a disadvantage when it comes to connecting with customers. So, how do they overcome this challenge?

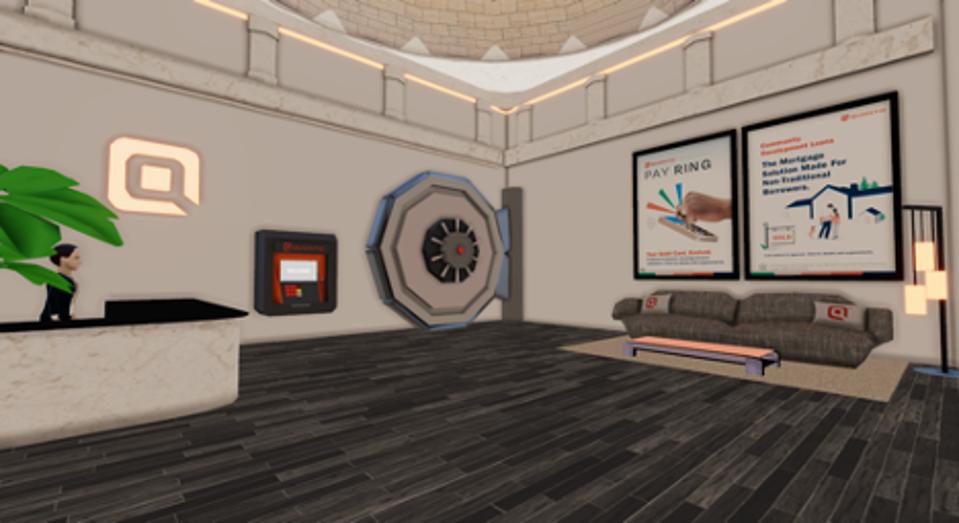

Quontic built a single structure on two plots within the metaverse. As you walk up to the building, you’re faced with a neoclassical facade, complete with marble staircases and columns. When you enter the digital outpost, the style shifts into more modern furniture and decor, with posters that will take you to Quontic’s website to learn more about some of their offerings.

At the counter is a teller named Steve (named after Quontic’s CEO), and beyond Steve is an ATM. If you interact with the ATM, it opens up a traditional, 100-year-old bank vault. Walk through the vault, and you enter a pool-party scene, ringed with green leafy plants and, near the center, a disc-spinning D.J., who will give you a free Quontic NFT.

This scene is designed to be welcoming. “We want to invite you into web3, into the metaverse, in a very clean, practical way. So we created a landing page with a call to action that says, ‘Jump in,’ and we give you instructions, and we explain what NFTs are and what Decentraland is,” said Aaron Wollner, Chief Marketing Officer at Quontic.

Quontic realized early on that their primary audience and customer base was not the few thousand people who have already bought into the metaverse. Instead, most of their audience consists of the “metaverse-curious.” By giving away free NFTs and designing a bank filled with educational material, Quontic has reduced the learning curve for using services in the metaverse and drawn in people who maybe otherwise would not have joined that space.

But, of course, Wollner and the rest of the Quontic team knew the risks of conducting business in a purely digital environment. “The internet can be a cold, sort of flat, two-dimensional experience. We love our dot-com, we’re very proud of it. But there are limits,” says Wollner. So as they built their metaverse banking service, Quontic worked hard to accomplish their second goal: to create an ecosystem of experiences that would allow relationships to develop and strengthen, rather than atrophy. “Quontic in the metaverse in 2022 is about planting a flag and being there. It’s not about conducting banking,” said Wollner.

Cogni, a new digital banking platform, provides another demonstration of innovation in the way that banking services are getting more exciting and personalized. Cogni announced a purchase of a Bored Ape Yacht Club, a collection of NFTs built on Ethereum, some of which have been purchased by Eminem, Serena Williams, Stephen Curry, Shaquille O’Neal, Justin Bieber and other celebrities. (A “Bored Ape” is a series of images, created using a unique algorithm, that are seen as a humorous commentary on Establishment figures.) Now Cogni is taking advantage of the Ape’s unique intellectual property rights to create a Bored Ape debit card that provides a differentiated and exciting web3 experience for customers.

Applications of blockchain technology have many practical benefits too. Scalable approaches to authentication could enable people who do not have a social security number, but are in the U.S. for business purposes, to gain access to credit and build up a credit history. “We are looking for ways to allow users to build credit on a swipe,” said Archie Ravishankar, CEO and founder of Cogni. Ultimately, NFT applications to authenticating identities using different pieces of information will not only improve security, but also convenience.

These success stories highlight a simple truth: customers are looking for informative, future-oriented conversations with their bankers. A high-quality conversation with a banker, relative to a low-quality one, is 4.2 times more likely to produce a sale with a customer if the conversation was initiated by the banker, according to Gallup’s 2021 Retail Banking Study.

Banking has long been a boring and banal process for consumers, but there are increasing examples of technology companies using web3 technologies to disrupt the sector by offering more immersive, enjoyable and profitable experiences. As these innovations pay off, others will follow. That’s why investment will continue flooding into the metaverse, no matter what happens with crypto.

Edited by Virginia Van Zandt