While professional sports can be extremely lucrative, student athletes can also clear quite a bit of income before they turn pro. In 2021, the NCAA established interim guidelines allowing student athletes to capitalize on income opportunities related to their name, image and likeness (NIL). Since then, quite a few student athletes are earning NIL income of more than $1 million per year. Talk about enterprising!

Indeed, that word, “enterprising,” is key for student athletes who obtain money from NIL opportunities, because it is taxed as self-employment income. Managing — and maximizing — the NIL income student athletes are allowed to earn, especially from a tax perspective, can feel daunting.

What NIL income encompasses

The NCAA’s guidelines allow student athletes in all sports to earn NIL income through a variety of opportunities, including autograph signings, speaking engagements and hosting sports camps and training clinics.

Like their professional counterparts, student athletes may earn compensation from commercial endorsement deals with brands and companies, licensing deals and social media partnerships. They can monetize their personal brands on platforms like Instagram and TikTok, create sponsored content and charge for subscriptions to online content they create.

The NCAA guidelines also enable student athletes to forge deals with local businesses for appearances, endorsements, joint marketing initiatives or promotions.

Of course, the NCAA’s rules regarding pay-to-play and impermissible inducements for recruitment still apply to student athletes taking advantage of NIL opportunities, as do NIL rules at individual schools and in different states and conferences.

And, just like all income, NIL money is subject to one of two certainties in life — taxes.

Navigating ‘the jock tax,’ self-employment taxes and more

Opportunities to capitalize on NIL can bring student athletes more income, but more income brings more taxes.

When you travel to another state, you need to file a non-resident tax return for income you earn while in that state. This rule is often referred to as “the jock tax” because college athletes usually have to travel to different states where they don’t live to compete. Any autograph signings or other personal appearances — anything that accrues NIL income for them while they are in other states for competition — is subject to taxes.

Money that is earned from NIL ventures is considered self-employment income by the tax man. If a student athlete receives more than $600 in NIL income from any single source, they should receive Form 1099-NEC from the payor of that income, or if they receive the payment via apps like Venmo or Zelle, they will receive Form 1099-K. The income shown on these forms is reported to the IRS and must be reported on the athlete’s tax return.

It is up to student athletes to keep track of all the documentation related to their NIL income and expenses, which they will need when they fill out their Schedule C tax form for business operators and sole proprietors when filing their taxes. On top of federal and possible state income tax, NIL income, like all self-employment income, is taxed at a rate of 15.3% (consisting of 12.4% for Social Security and 2.9% for Medicare) — just like if the student athlete was earning a paycheck from an employer.

Additionally, anything student athletes receive in the course of competing in games and earning NIL money — food, clothing, discounts, etc. — can be counted as income. All of these tokens have to be reported as income, at the value they are worth when athletes receive them.

Further tips for student athletes managing NIL income include:

- Be mindful of financial aid. Income from NIL opportunities must be included in taxable income reported by students on their Free Application for Federal Student Aid (FAFSA) application forms. If a student athlete’s taxable income is considered high, they could receive less aid than they request.

- Keep track of potential deductions. Self-employed individuals can deduct expenses related to their work. Costs for travel, meals, hotel stays, agency fees and more could be deducted against taxes on NIL income.

- Pay estimated taxes. Since taxes are generally not withheld from NIL income, and student athletes are considered self-employed, they should consider paying quarterly federal and state estimated taxes. Allocating money from NIL income for estimated tax payments can help athletes avoid potential penalties.

- Income from collectives is always taxable. Collectives established by athletic program boosters and fans at some universities to pool donor-driven revenue can help student athletes obtain NIL deals. Some of these collectives have tax-exempt 501(c)(3) nonprofit status from the IRS, though the agency has revoked the status from certain collectives. Student athletes need to be aware that, regardless of whether a collective has tax-exempt status, the NIL income they earn via collectives is still taxable and must be reported.

- Maintain separate bank accounts and credit cards for NIL purposes. Student athletes can keep track of NIL income and related expenses by keeping separate bank savings and checking accounts, and credit cards, for these opportunities.

Working with a trusted financial adviser can help student athletes utilize the same skills that make them successful on the playing field to create plans for saving and optimizing NIL income to meet long- and short-term financial goals. In addition to crafting budgets for meeting short-term expenses, advisers can also help student athletes record documentation and manage payments for taxes and demonstrate how certain saving and investing strategies can maximize NIL income to open a business or make other dreams a reality when an athlete’s playing career is over.

Student athletes understand the importance of planning, teamwork and coaching for winning on the court and on the field. The same tactics apply to managing income from NIL opportunities and making that income work for athletes during and after their playing careers.

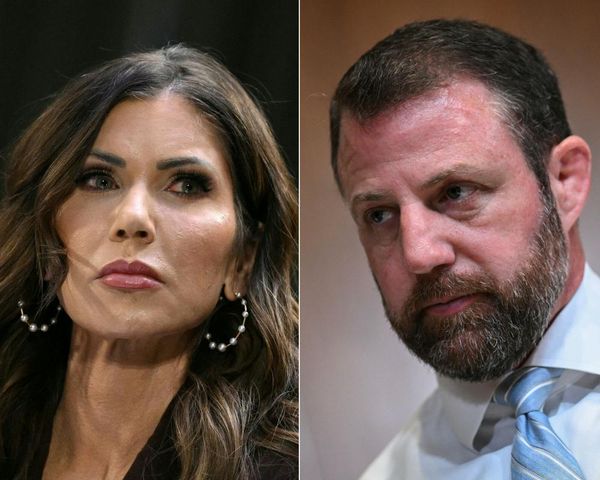

Charles R. Johnson and Richard Pianoforte, CFP, are Wealth Director and Managing Director of Tax, respectively, at Fiduciary Trust International.