Sprinklr (NYSE:CXM) is set to give its latest quarterly earnings report on Wednesday, 2024-12-04. Here's what investors need to know before the announcement.

Analysts estimate that Sprinklr will report an earnings per share (EPS) of $0.08.

The market awaits Sprinklr's announcement, with hopes high for news of surpassing estimates and providing upbeat guidance for the next quarter.

It's important for new investors to understand that guidance can be a significant driver of stock prices.

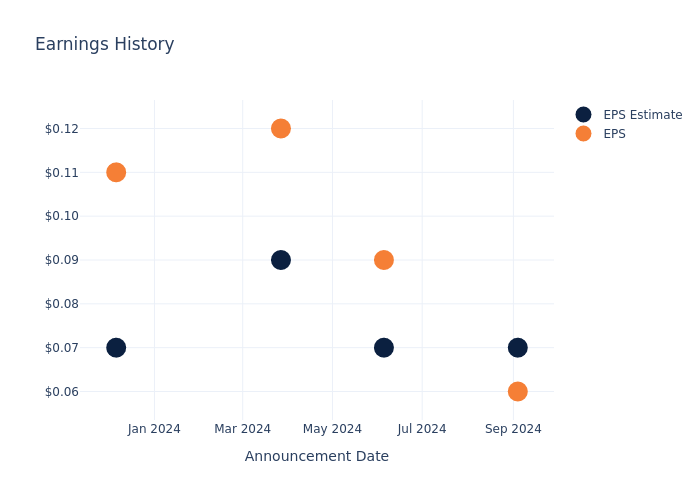

Earnings History Snapshot

During the last quarter, the company reported an EPS missed by $0.01, leading to a 9.31% drop in the share price on the subsequent day.

Here's a look at Sprinklr's past performance and the resulting price change:

| Quarter | Q2 2025 | Q1 2025 | Q4 2024 | Q3 2024 |

|---|---|---|---|---|

| EPS Estimate | 0.07 | 0.07 | 0.09 | 0.07 |

| EPS Actual | 0.06 | 0.09 | 0.12 | 0.11 |

| Price Change % | -9.0% | -15.0% | -6.0% | -33.0% |

Market Performance of Sprinklr's Stock

Shares of Sprinklr were trading at $8.41 as of December 02. Over the last 52-week period, shares are down 50.3%. Given that these returns are generally negative, long-term shareholders are likely bearish going into this earnings release.

Insights Shared by Analysts on Sprinklr

For investors, grasping market sentiments and expectations in the industry is vital. This analysis explores the latest insights regarding Sprinklr.

Sprinklr has received a total of 11 ratings from analysts, with the consensus rating as Neutral. With an average one-year price target of $9.68, the consensus suggests a potential 15.1% upside.

Peer Ratings Overview

In this analysis, we delve into the analyst ratings and average 1-year price targets of EverCommerce, NCR Voyix and Cipher Mining, three key industry players, offering insights into their relative performance expectations and market positioning.

- Analysts currently favor an Outperform trajectory for EverCommerce, with an average 1-year price target of $13.0, suggesting a potential 54.58% upside.

- As per analysts' assessments, NCR Voyix is favoring an Buy trajectory, with an average 1-year price target of $17.0, suggesting a potential 102.14% upside.

- Cipher Mining received a Outperform consensus from analysts, with an average 1-year price target of $7.53, implying a potential 10.46% downside.

Peer Metrics Summary

The peer analysis summary outlines pivotal metrics for EverCommerce, NCR Voyix and Cipher Mining, demonstrating their respective standings within the industry and offering valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Sprinklr | Neutral | 10.50% | $142.89M | 0.34% |

| EverCommerce | Outperform | 0.87% | $116.98M | -1.18% |

| NCR Voyix | Buy | -12.11% | $166M | 232.33% |

| Cipher Mining | Outperform | -20.47% | $-5.70M | -12.73% |

Key Takeaway:

Sprinklr ranks at the top for Revenue Growth and Gross Profit among its peers. It is in the middle for Consensus rating. However, it has the lowest Return on Equity compared to its peers.

Get to Know Sprinklr Better

Sprinklr Inc is engaged in providing enterprise software that enables every customer-facing function across the front office, from Customer Care to Marketing, to collaborate across internal silos, and communicate across digital channels. Its products include Sprinklr Service, Sprinklr Social, Sprinklr Insights and Sprinklr Marketing. The company operates in Americas, EMEA and other countries. It derives maximum revenue from Americas.

A Deep Dive into Sprinklr's Financials

Market Capitalization: With restricted market capitalization, the company is positioned below industry averages. This reflects a smaller scale relative to peers.

Revenue Growth: Sprinklr displayed positive results in 3 months. As of 31 July, 2024, the company achieved a solid revenue growth rate of approximately 10.5%. This indicates a notable increase in the company's top-line earnings. When compared to others in the Information Technology sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Net Margin: Sprinklr's net margin is impressive, surpassing industry averages. With a net margin of 0.93%, the company demonstrates strong profitability and effective cost management.

Return on Equity (ROE): Sprinklr's ROE falls below industry averages, indicating challenges in efficiently using equity capital. With an ROE of 0.34%, the company may face hurdles in generating optimal returns for shareholders.

Return on Assets (ROA): Sprinklr's ROA stands out, surpassing industry averages. With an impressive ROA of 0.17%, the company demonstrates effective utilization of assets and strong financial performance.

Debt Management: Sprinklr's debt-to-equity ratio is below the industry average at 0.11, reflecting a lower dependency on debt financing and a more conservative financial approach.

To track all earnings releases for Sprinklr visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.