Lands' End (NASDAQ:LE) is set to give its latest quarterly earnings report on Thursday, 2024-12-05. Here's what investors need to know before the announcement.

Analysts estimate that Lands' End will report an earnings per share (EPS) of $0.02.

Investors in Lands' End are eagerly awaiting the company's announcement, hoping for news of surpassing estimates and positive guidance for the next quarter.

It's worth noting for new investors that stock prices can be heavily influenced by future projections rather than just past performance.

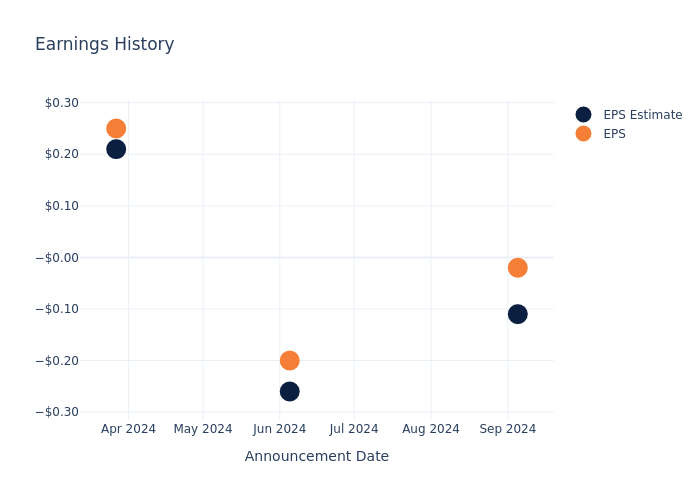

Overview of Past Earnings

Last quarter the company beat EPS by $0.09, which was followed by a 7.64% drop in the share price the next day.

Here's a look at Lands' End's past performance and the resulting price change:

| Quarter | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| EPS Estimate | -0.11 | -0.26 | 0.21 | -0.17 |

| EPS Actual | -0.02 | -0.20 | 0.25 | -0.11 |

| Price Change % | -8.0% | -0.0% | 8.0% | 14.000000000000002% |

Lands' End Share Price Analysis

Shares of Lands' End were trading at $16.42 as of December 03. Over the last 52-week period, shares are up 87.85%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

Analyst Views on Lands' End

Understanding market sentiments and expectations within the industry is crucial for investors. This analysis delves into the latest insights on Lands' End.

A total of 6 analyst ratings have been received for Lands' End, with the consensus rating being Buy. The average one-year price target stands at $20.0, suggesting a potential 21.8% upside.

Comparing Ratings Among Industry Peers

The following analysis focuses on the analyst ratings and average 1-year price targets of and Lands' End, three prominent industry players, providing insights into their relative performance expectations and market positioning.

Snapshot: Peer Analysis

Within the peer analysis summary, vital metrics for and Lands' End are presented, shedding light on their respective standings within the industry and offering valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Lands' End | Buy | -1.91% | $151.88M | -2.28% |

Key Takeaway:

Lands' End ranks at the bottom for Revenue Growth, with a decrease of 1.91%. It also ranks lowest for Gross Profit, showing a decline of 2.28%. Additionally, Lands' End has the lowest Return on Equity among its peers. Overall, Lands' End lags behind its peers in all key financial metrics analyzed.

Discovering Lands' End: A Closer Look

Lands' End Inc is a United States-based multi-channel retailer of casual clothing, accessories, and footwear, as well as home products. The company's operating segment includes U.S. eCommerce; International; Outfitters; Third Party and Retail. It generates maximum revenue from the U.S. eCommerce segment. The U.S. eCommerce segment offers products through the company's eCommerce website. Geographically, it derives a majority of its revenue from the United States.

A Deep Dive into Lands' End's Financials

Market Capitalization Perspectives: The company's market capitalization falls below industry averages, signaling a relatively smaller size compared to peers. This positioning may be influenced by factors such as perceived growth potential or operational scale.

Decline in Revenue: Over the 3 months period, Lands' End faced challenges, resulting in a decline of approximately -1.91% in revenue growth as of 31 July, 2024. This signifies a reduction in the company's top-line earnings. When compared to others in the Consumer Discretionary sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Net Margin: Lands' End's net margin is below industry standards, pointing towards difficulties in achieving strong profitability. With a net margin of -1.66%, the company may encounter challenges in effective cost control.

Return on Equity (ROE): Lands' End's ROE is below industry averages, indicating potential challenges in efficiently utilizing equity capital. With an ROE of -2.28%, the company may face hurdles in achieving optimal financial returns.

Return on Assets (ROA): Lands' End's ROA is below industry standards, pointing towards difficulties in efficiently utilizing assets. With an ROA of -0.66%, the company may encounter challenges in delivering satisfactory returns from its assets.

Debt Management: Lands' End's debt-to-equity ratio is below the industry average at 1.28, reflecting a lower dependency on debt financing and a more conservative financial approach.

To track all earnings releases for Lands' End visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.