Financial literacy isn’t just one of those things that happens by accident, we either learn it from someone in the know or we learn it the hard way, from an empty bank account. So it can be helpful to hear the stories of other’s mistakes to avoid them ourselves.

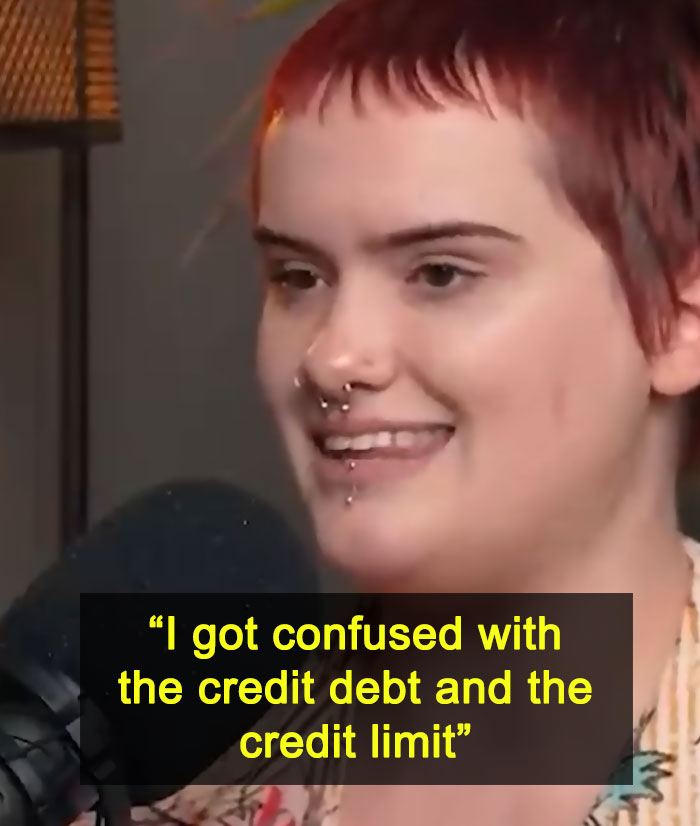

Financial advice blogger Caleb Hammer went viral on TikTok after interviewing a twenty-year-old who ended up thousands in debt after she didn’t understand the difference between credit limit and debt. We reached out to Caleb via email and will update the article when he gets back to us.

More info: TikTok

Credit cards might not be the most intuitive things to understand for a young person

But one twenty-year-old didn’t know the difference between a credit limit and debt, ending up in the latter

Rylie: With my credit card, I maxed that out to $4,000.

Caleb: What do you mean you maxed it out? Max it out or maxed it out?

Rylie: I got confused with the credit debt and the credit limit. So my parents got me a credit card. And I ended up getting a max credit limit of $8,000. So I could spend up to $8,000. That’s what that means, right? So I would use it and I would take my boyfriend, we would go out, me, my friends, we would go out and I’d pay for everybody. ‘I got it. Oh, I’ll spend the money, don’t worry about it, it’s just a credit card.’ So I would pay and pay and pay and pay. And then I called my mom one day, and I wanted her to be proud of me. So I was just like, ‘Hey, I’ve got $4,000 credit on my credit card.’ And she’s like, ‘Credit limit or credit debt?’ I was like, ‘What’s debt?’ And she’s like, ‘Oh, that’s bad.’ I’m like, ‘Oh, really? Okay. So it’s $4,000 debt, then.’ She’s like, ‘That’s bad. Why did you do that?’ I’m like, ‘I thought that was good.’ She’s like, ‘No, your credit limit at the time was $8,000.’ So I was like, ‘Okay, well, the credit limit is $8,000. That’s good, right?’ And she’s like, ‘Yes, but you are $4,000 in debt.’

Caleb: When was this?

Rylie: Last year.

Caleb: Okay, and then what?

Rylie: And then they’re like, ‘Screw it, you’re not gonna pay this off in time. Give it to me.’ So my parents took it and they’re still currently paying it off right now.

Rylie: They’ve been paying it off from $4,000. They just basically gave up and said ‘You’re not gonna pay this in time. You’re moving out and you have a $4,000 credit card, you’re not going to pay that off in time, you’re gonna get so overwhelmed. So just give it to me. And then we’ll pay it. And then whenever…’

Caleb: Listen, I don’t want you to suffer in debt. But is that helping you? Is that teaching you? I don’t think so. I think they’re done. You get it to zero, and over the next couple of years, maybe even when you start making more money and your lifestyle, inflate yourself, you just bring it right up to the $12,500. That sounds like some form of enablement to me.

Rylie: Well, I mean, they said, ‘Whenever we pay it off, over time, you can pay us back that $4,000.’ I’m like, okay, cool. And then like, ‘Well, we’re gonna keep it, but if you need help with like something with your car, or with your cat or with your dog or something, you can just ask us for it. And you can use it, and then you can pay that off.’

Caleb: Why are they just like funding [your life]… You make money?

Rylie: Yeah.

Caleb: Where’s the money going where you can’t take care of yourself as an adult? You wanted to move out, like an adult.

Rylie: Yeah.

Caleb: But you have to rely on them taking care of you? I’m confused. Why can’t you take care of your own s**t?

Rylie: Well, I can. I can. I mean…

Caleb: Then why don’t you?

Rylie: I do, I do. I mean, if…

Caleb: Not from everything you just said…

Rylie: My rent currently is $1,400, something like that.

Caleb: That’s insane, you can’t afford to live. You can’t afford to go out.

Rylie: Yes, I can.

Caleb: No, you can’t! The income that came in was $1,600, rent is $1,400. That’s not ‘affording.’ That’s your needs, 80%.

Rylie: Girl math.

Caleb: This is not a joke.

Rylie: I’m not treating it as a joke.

Caleb: *It’s girl math.* Math math says it’s about 80% of your income.

Rylie: Yeah, I mean, we get income from other ways too.

Caleb: Okay, I saw $128 came in from Lackland. And $263 came in from Cash App. So $2,000. So even still, your rent of what, again?

Rylie: Almost $1,400

Caleb: Okay. Okay. It’s 70%. You cannot afford it. It shouldn’t be higher than 30%.

Rylie: Well, what I do is I go donate on the side, too.

Rylie: But if like for whatever reason, like I feel like we’re low, a couple hundred dollars on rent, we’ll go donate for the first couple days before rent’s due, we’ll grab the money.

Caleb: No offense, you could not move out.

Rylie: I did though.

Caleb: Yeah, but you’re not affording it. And don’t say ‘I am affording it,’ because I’ll tell you how you’re not affording it. They’re paying your credit card bills. They’re taking care of expenses that pop up. You can’t afford it. You’re being enabled.

Rylie: I’m not being enabled.

Caleb: Yes. Because your money is going to f**k you.

You can watch the full video here

@calebhammercomposer 20 Year Old Doesn’t Know What DEBT MEANS!!! 🤦♂️🤬 #financialaudit ♬ original sound – Caleb Hammer

Young adults tend to have the worst financial literacy around

As much as money “runs the world,” many people tend to have no idea how to act when they get access to it. To this young woman’s credit, her first impulse was misguided generosity, although it’s worth noting that in this case, it’s not exactly her money. While it might seem ridiculous that the woman being interviewed believed that a credit limit is free money, research suggests that young people in general have the lowest financial literacy among all age cohorts.

Partially, this can be seen as a result of some social taboos around discussing money. While, contrary to the many memes out there, many schools do teach some about taxes and finances, this is all very abstract until the young adult has money in hand. How they spend it is often a reflection of what they have seen their parents do. Some parents spend a lot because they are financially stable, others are frugal, but without clear explanations of why they do what they do, their kids don’t exactly learn any new lessons.

However, generally, most adults don’t exactly discuss their financial decisions with their children and maintain a very different level of income. While it can be easy to mock someone for having no idea what a credit limit is, it might also be worth questioning why her parents gave her a credit card without actually explaining how it works.

There are even organizations that prey on unwitting young folks

A lack of financial literacy isn’t just some buzzword or abstract concept, it can often be measured in real-world impacts. For example, many young adults, like the woman in this clip, end up in debt that is realistically disproportionate to their income. The fact is that beyond simple misunderstandings about credit cards, there are predatory financial institutions that specifically offer “easy” loans to gullible folks who want an instant dose of retail therapy, leaving them in horrible debt for a long time. It’s not a scam if a willing and “informed” adult signed off on it.

Similarly, once a person is 18, they can gamble in most areas, something betting companies and casinos know very well. Technically, the odds are always “clear” but popular culture has often obfuscated just how intoxicating betting can be, leading people to throw their money away.

One example of this, at least in the US, are the ever-discussed student loans. People who would never qualify for a “normal” loan end up straddled with debt that they pay off for decades to come. There is a segment of society that still blames the loan-takers, but realistically, if we understand that statistically many of them don’t quite understand what they are getting into, can we truly hold them responsible?

Viewers shared their opinions