Last year, the CEO of financial technology (fintech) company Revolut added a UK banking license to his 2022 Christmas wish list, telling startup news outlet Sifted: “I would love to have it as a Christmas present. A present for me personally and for the business.”

But it’s nearly Christmas 2023 and Revolut still hasn’t secured the right to take deposits from the UK customers – the main benefit to the company of getting a UK license.

Revolut has been offering e-money services such as currency exchange and transfers (which do not require a UK banking licence) in the UK since 2015. It generated £196 million in revenue from this in 2021, or nearly one-third of its business – the rest mostly comes from banking activities in 18 EU countries.

Revolut, which says it has more than 30 million retail customers worldwide, now wants to join other “challenger banks” (those attempting to break the historical dominance of the “big four” UK banks: Barclays, Lloyds, HSBC, NatWest) in becoming a fully licensed bank in the UK.

The main benefit of this would be that it could take deposits and handle more loan business instead of “outsourcing” these activities to a number of UK-licensed banks. It could also boost financial inclusion by providing people in the UK with more choice and access to products that help manage money – a key concern amid the current cost of living crisis.

Whether deposits are handled directly by Revolut or through a third-party provider is unlikely to make much difference to customers. But for Revolut, outsourcing means additional costs so this could provide the company with cheaper access to finance. So, in theory, Revolut could pass any savings on to its customers.

Getting a UK banking license involves an extensive application process but typically takes about a year. Once a bank gets one, it has to adhere to more stringent reporting and monitoring requirements.

During the nearly two years since Revolut first applied in January 2021, it has experienced IT system issues that have delayed its reporting of annual accounts. Requesting an extension is not an unusual process, but concerns were also raised by Revolut’s auditor BDO about its 2021 revenue reporting.

In March 2023, a Revolut spokesperson told Reuters the concerns were “remedied” in 2021. The company’s chief financial officer Mikko Salovaara said: “There is not any doubt over the completeness of the balance sheet, which, in turn, logically means that total revenue is also correct.”

More recently, Revolut has simplified its ownership structure – its use of different classes of shares was more common in EU countries – which could help unblock the UK banking license application process for the company.

Whether, after all of this, customers would actually benefit from lower operating costs will depend on various factors, including what the competition is charging and the need for Revolut to maintain its profitability.

Another possible (perceived) benefit for customers could be greater financial security. Deposits of up to £85,000 held with licensed banks are secured through the Financial Services Compensation Scheme (FSCS). However, the outsourcing model already offers the same protection to Revolut users if its third-party provider operates with its own UK banking license anyway.

Enhancing UK financial inclusion

More generally, fintech companies offer easier and often cheaper access to financial products than traditional banks, which means they boost financial inclusion according to research-based definitions.

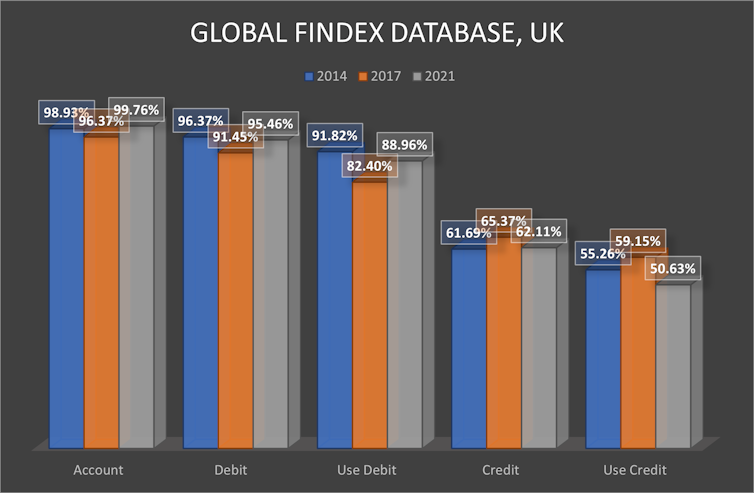

World Bank research on financial inclusion suggests the UK scores almost perfectly in this area: 99.76% of respondents to World Bank surveys have personal current accounts and 95.46% with a debit card (although only 88.91% say they use their card).

How people bank in the UK:

But the limited sample size for the UK (the World Bank’s survey relies on 128,000 adults in 123 countries) makes it difficult to truly identify the small number of “unbanked” people in the UK and their struggles. The Financial Conduct Authority’s (FCA) more comprehensive Financial Lives Survey puts the number of unbanked people in the UK at 1.1 million in 2022, down from 1.7 million in 2014 but largely unchanged since 2017.

The UK Treasury’s Financial Inclusion Report 2021-22 argues that the more basic bank accounts now offered by all banks have improved financial inclusion, but it also stresses the importance of fintechs in increasing choice and launching innovative products like mobile budgeting tools.

On the other hand, fintech’s reliance on mobile and internet banking arguably widens an existing digital divide. According to the World Bank, 92% of UK respondents had access to the internet and used mobile phones in 2021, leaving some without access to fintech products.

For those that can access them, fintech solutions could help reduce costs and provide tools to manage people’s stretched budgets. This could help mitigate the current cost of living crisis while also enhancing financial inclusion. Studies show better financial inclusion can reduce income inequality under certain conditions.

Becoming a challenger bank

Revolut has a convincing track record of obtaining banking licences in its short history. After its 2015 UK launch, Revolut obtained its first banking licence in Lithuania in 2018. It has operated as a bank in 18 EU countries since 2021. That same year, Revolut applied to become a deposit-taking institution in Australia. This is a good sign that its UK banking licence should be achievable.

However, the benefits for customers are less clear. Most customers already use e-money accounts together with traditional bank accounts. Looking at Metro Bank’s recent problems – investors were concerned that it could not meet regulatory requirements on its capital levels, although it has since secured additional financing and continues to serve customers as normal – it is not evident that one more challenger bank will benefit UK customers.

On the other hand, a more comprehensive range of different types of financial service providers tends to stabilise the financial system. In this sense, diversity could enhance financial stability.

gerhard.kling@abdn.ac.uk receives funding from the ESRC-NSFC (Newton Fund), FP7, FP6, and the Maava Foundation.

Aravinda Meera Guntupalli receives funding from ESRC, GCRF, World Cancer Research Fund, Canadian government and World Bank.

This article was originally published on The Conversation. Read the original article.