What Is Transitory Inflation?

Inflation that moves above a steady rate for a short period and then reverts toward that steady rate is considered transitory. Also, inflation that rises temporarily is considered transitory.

For example, if the inflation rate as measured by the Federal Reserve’s preferred barometer—the Personal Consumption Expenditure Price Index—moves to 8 percent in one month after being at 2 percent for a prolonged period, that move up is viewed as transitory. However, if the inflation rate continues to move at a rate higher than the steady rate already established, and the movement is prolonged, that would be considered persistent.

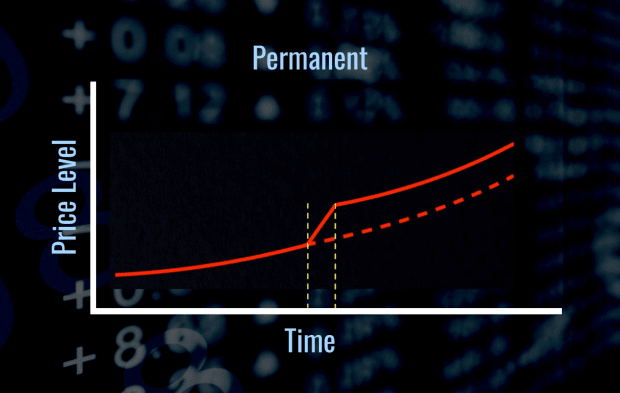

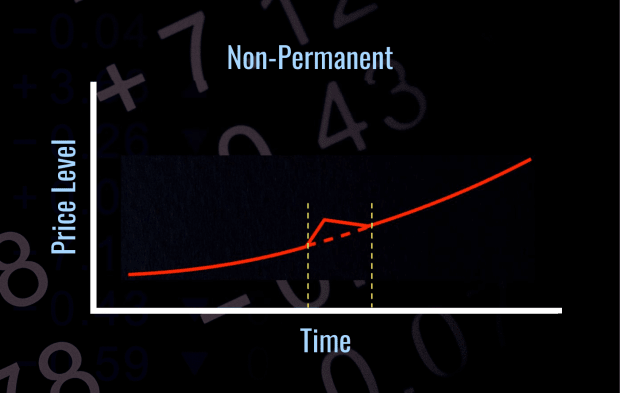

Graph Examples: Permanent and Non-Permanent Price Effects

Inflation that is transitory can have permanent as well as non-permanent effects on prices. While persistent inflation refers to persistent increases in price changes, permanent refers to prices moving steady but without marked change.

In the graph below, the inflation rate increases from one period to the next. The rate moves higher before restabilizing and holding steady. This would have a permanent effect on prices because the rate of inflation jumps and establishes a new norm without heading lower.

In the graph below, the inflation rate has increased from one period to the next. The rate moves higher before heading lower and returning to its previous pace. In this case, there is no permanent effect on prices.

When Does Transitory Inflation Become Persistent?

Inflation switches from transitory to permanent when the rate moves much higher than the normy and stays at a high level. During the Great Inflation, inflation moved from transitory to persistent, and that period of persistent inflation lasted from the mid-1970s to early 80s. It can be difficult to determine on a monthly basis whether the inflation rate has moved to persistent from transitory or has peaked and is likely to head lower.

How Does Transitory Inflation Affect Monetary Policy?

The Fed has a dual mandate to use monetary policy to keep inflation low, targeted at 2 percent, and to achieve full employment. It constantly monitors consumer prices and economic indicators, including the Personal Consumption Expenditure Price Index. If the PCE suddenly rises above the Fed’s targeted 2 percent inflation rate from one month to the next, it is not likely to act by tightening monetary policy. Instead, the central bank may monitor price movements on a monthly basis, and if the inflation rate continues to move higher, it may act in response with its main monetary policy-setting tool—the Federal Funds Rate.

Still, it remains a challenge for Fed officials to determine when transitory inflation becomes persistent and how to act with monetary policy because of concerns about the lag effect of higher interest rates potentially curbing economic growth.