Wavebreakmedia from Getty Images; Canva

What Is the VIX and How Does It Measure Volatility?

In finance, the term VIX is short for the Chicago Board of Exchange’s Volatility Index. This index measures S&P 500 index options and is used as an overall benchmark for volatility in the stock market. The higher the index level, the choppier the trading environment, which makes its other nickname pretty apt: the fear index.

It’s important to point out that the VIX measures implied, or theoretical, volatility. It measures the expectation of future volatility based on a snapshot of the previous 30 days’ worth of trading activity.

What Do the VIX Numbers Mean?

- A VIX level above 20 is typically considered “high.”

- A VIX below 12 is typically considered “low.”

- Anything in between 12 and 20 is considered “normal.”

When there is increased activity on put options, which means that investors are selling more puts, the VIX registers a high number. Investing in a put option is like betting that the price of a stock will go down before the put contract expires because puts give investors the right to sell shares of a stock on a specific date at a specific price.

These are bearish investments, ones that can take advantage of emotions like fear. There is a saying on Wall Street that does “When the VIX is high, it’s time to buy” because the general belief is that volatility may have reached a peak, or a turning point.

When the VIX falls, that means that investors are buying more call options. Investing in a call is like betting that the price of a stock will go up before the call contract expires. In other words, a falling reading on the VIX indicates that the overall sentiment in the stock market is more optimistic, or bullish.Although the VIX isn't expressed as a percentage, it should be understood as one. A VIX of 22 translates to implied volatility of 22% on the SPX. This means that the index has a 66.7% probability (that being one standard deviation, statistically speaking) of trading within a range 22% higher than—or lower than—its current level within the next 12 months.

How Is the VIX Calculated? What Is the VIX Formula?

In a nutshell, the VIX is calculated by the Chicago Board of Options Exchange using market prices of S&P 500 put and call options with an average expiration of 30 days. It uses standard weekly SPX options and those with Friday expirations, but unlike the S&P 500 index, which contains specific stocks, the VIX is made up of a constantly changing portfolio of SPX options. The Chicago Board of Options website goes into more detail about its methodology and selection criteria.

How Do I Interpret the VIX?

There are many ways to interpret the VIX, but it’s important to note that it’s a theoretical measure and not a crystal ball. Even the sentiment it tracks, fear, is not itself measured by hard data, such as the latest Consumer Price Index. Rather, the VIX uses options prices to estimate how the market will act over a future timeframe.

It's also important to understand how much emotion can drive the stock market. For example, during earnings season, a company’s stock may report solid growth yet see shares plummet, because the company did not meet analyst expectations. So much of what goes on in the market can be summed up by feelings, like greed, as investors spot appreciation potential and place buy orders, which drive prices higher overall. Fear is evidenced when investors try to protect their investments by selling their shares, driving prices lower.

At its worst, fear-driven selling can send the market into a tailspin and lead to emotions like panic, which can result in capitulation.

But the VIX is not designed to cause panic. It is simply a gauge of volatility. In fact, some investors, especially traders, view the increased turbulence as a signal to buy, so that they make a profit either through speculation or hedging and thus capitalize on the situation.

Can the VIX Go Above 100?

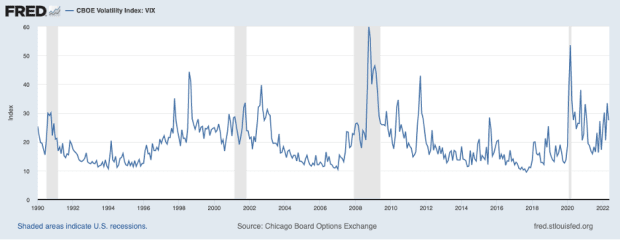

Theoretically speaking, the VIX can top 100, although it has never reached that point since data collection began in 1990.

The two highest points the VIX has ever reached were the following:

- On October 24, 2008, at the height of the Financial Crisis, which stemmed from the global implosion of mortgage-backed securities, the VIX reached 89.53.

- On March 16, 2020, during the beginning of the COVID-19 pandemic, the VIX recorded a high of 82.69.

Analysts also believe that had data collection begun in the 1980s, the VIX would have topped 100 during the Black Stock Market Crash, on Monday, October 19, 1987.

This chart from FRED, the Federal Reserve’s data center, details the VIX from 1990 to 2022. Shaded areas illustrate periods of recession:

How Do I Trade the VIX? Can You Buy Options on the VIX?

Investors can’t invest directly in the VIX, but they can invest in derivatives that track the VIX, such as VIX-based exchange-traded funds (ETFs), such as ProShares VIX Mid-Term Futures ETF (VIXM), and exchange-traded notes, like the iPath Series B S&P 500 VIX Short-Term Futures ETN (VXX) and the iPath Series B S&P 500 VIX Mid-Term Futures ETN (VXZ).

What Is the VIX at Today?

To view the VIX’s current reading, visit the webpage maintained by the Chicago Board of Options Exchange; it is updated daily.

What Are the VIX’s Current Volatility Predictions?

The stock market has been in choppy waters for most of 2022. Tech stocks, the Nasdaq, and stocks with high P/E ratios have taken a beating as investors worry about continued inflation, the Russia/Ukraine war’s effect on energy prices, the aggressive pace of interest rate hikes from the Federal Reserve, as well as continued supply chain snarls stemming from China’s “zero-COVID” policies. All of these things are causing the storm clouds to gather around the possibility of recession.