Credit Discount Window at the St. Louis Fed [Photograph], accessed on April 17, 2023.

What Is the Federal Reserve’s Discount Window?

The discount window, or “disco,” for short, is an interest rate offered by the Federal Reserve to help financial institutions with short-term credit needs, usually overnight. This rate is not available to the public; rather, it is designed to provide assistance to banks and other depository institutions to cover daily funding shortages or liquidity issues—or to prevent them from failing altogether.

According to the Fed, the discount window acts like a “safety valve” in relieving pressures during times of systemic stress. It provides aid to banks that have no other borrowing options, which is why the Fed itself is famously known as the “lender of the last resort.”

The discount window really achieves a dual goal: By supporting banks with liquidity, the Fed helps to maintain stability throughout the banking system so that its monetary policies can be implemented effectively. Added liquidity certainly helps to keep a bank afloat, but it also helps that bank’s customers, so that they can obtain mortgages, buy cars, attend college, or expand operations, thus keeping the economy healthy.

The discount window is different from the fed funds rate, which is the interest rate the Fed sets on a bank’s required reserves. It’s also not the same as the prime rate, which a bank offers to its most creditworthy customers—in fact, the discount window is typically higher than both rates, because it is intended to serve as a backup source of funding in the event that one bank cannot obtain credit from another bank (i.e. “their last resort”).

Discount window rates are published daily on the Federal Reserve’s website.

An Example of the Discount Window in Action

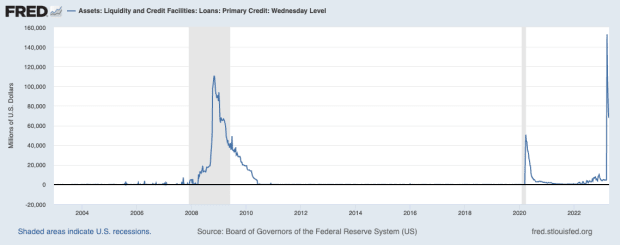

Historically, borrowing from the discount window was like an S.O.S. signal that a bank was in distress. However, in the wake of Silicon Valley Bank and Signature Bank’s 2023 failures, to contain the threat of financial contagion, the Fed took away any stigma associated with using the discount window—in fact, the week after the Fed’s announcement, borrowing skyrocketed to $152.9 billion.

In addition, the Fed created a new short-term tool called the Bank Term Funding Program, which facilitates up to $25 billion for banks, savings associations, credit unions, and other eligible institutions.

The term for these collateralized loans is one year, and, in this instance, the Fed is actually lending against Treasuries valued at their original price (known as par). By doing so, they are hoping to reduce interest-rate risk and add further ballast to the banking system.

How Long Has the Discount Window Been Around?

Back in the 1960s, a discount window actually existed at Federal Reserve banks; pictured above is Bernie Berns at the discount window of the Federal Reserve Bank of St. Louis in 1967.

Since maintaining liquidity was one of the original purposes of establishing a central bank like the Federal Reserve, the statutory framework behind the discount window is contained in Section 10B of the Federal Reserve Act. There were no open market operations at the time of its formation, and so the Fed would use the discount window to lend directly to banks.

In the early 1900s through the 1920s, there was no stigma attached to using the discount window, although the Fed made note of which banks were “habitual borrowers” and adopted restrictions on borrowing after the Great Depression. The Fed kept the discount rate lower than market rates for more than 80 years, partly to finance government deficits.

However, in 2003, the Fed established a Primary Credit Facility and added a penalty rate to the discount window, further limiting which institutions would be eligible for assistance, although those who were eligible would receive credit with no questions asked.

How Does the Discount Window Work?

There are three types of borrowing programs available through the discount window.

- Primary credit: This is the main “safety valve” for lending, available to depository institutions in “generally sound financial condition,” with no restrictions on the use of funds. This rate is normally set at 100 basis points above the federal funds rate, but during the COVID-19 recession, the Fed narrowed the spread between this rate and overnight interest rates and extended the loan period to 90 days.

- Secondary credit: This rate is available to banks who are less financially sound and is set at 50 basis points above the primary credit rate.

- Seasonal credit: This rate, available to small depository institutions facing liquidity pressures of a seasonal nature, is the average of the fed funds rate and 90-day certificate of deposit rates.

Every 14 days, the Reserve Banks adjust the primary credit rate, which is then reviewed and approved by the Board of Governors.

In order to borrow from the discount window, an institution must meet all requirements as well as pledge eligible collateral. This ensures that the Fed is lending to an “illiquid but solvent institution,” thus cutting back on the “excessive” numbers of borrowers seen in the early days of the discount window.