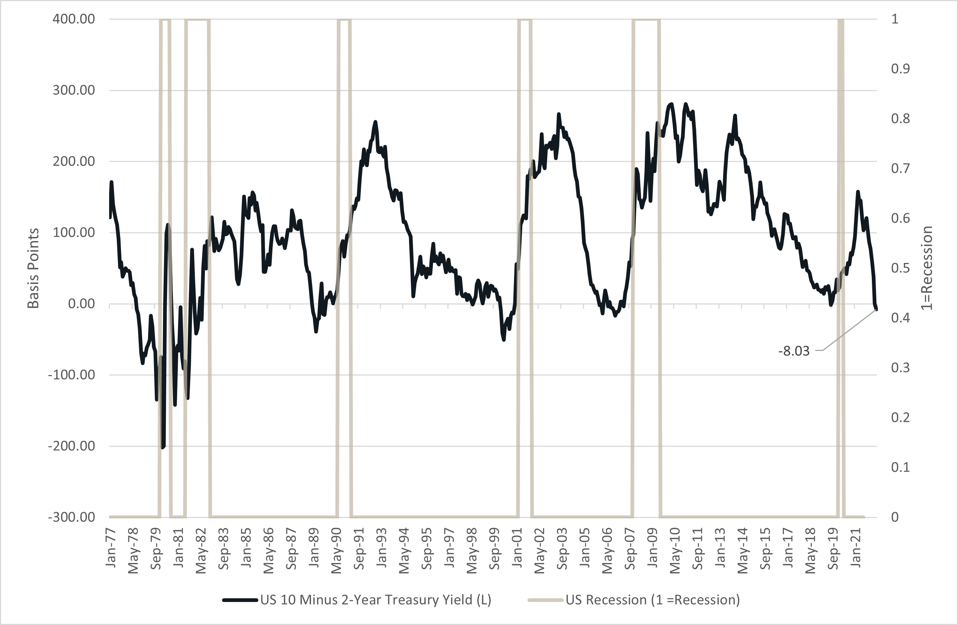

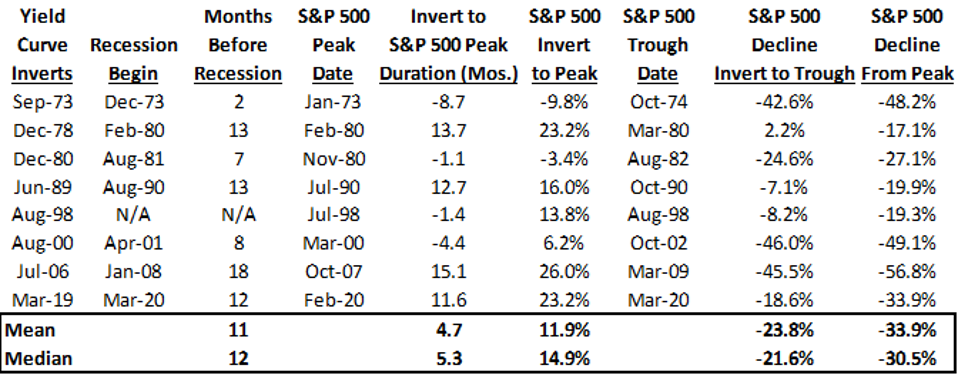

In the wake of the jobs report on Friday signaling a robust labor market and continued upward wage pressure, the bond market priced in another rate hike by the Federal Reserve (Fed). The yield curve was already on the precipice of setting off a recession warning, and the additional pressure caused it to invert decisively. Historically, when the yield on the U.S. 10-year Treasury falls below the 2-year yield, also called yield curve inverting, a recession is coming. Since the 1970s, a yield curve inversion has occurred before every recession. The only blemish on its record is the 1998 inversion which produced no subsequent economic downturn. Keep in mind that even when the signal is correct, it typically happens about a year and a half before the recession starts. In addition, the stock market tends to rise by the mid-teens percent before peaking. A previous article had an additional discussion about the pending yield curve inversion and the pressure from higher commodity costs due to the war in Ukraine.

While the 10-year Treasury minus 2-year yield is a well-known predictor of recession, the Fed recently published an updated note on a lesser-known but more robust indicator of a pending recession. The indicator is called the “near-term forward spread.” It measures the expected three-month Treasury yield eighteen months in the future minus the current three-month Treasury rate. While this might sound complicated, the near-term forward spread reflects the bond market’s expectation of Fed rate changes over the coming year and a half.

When the near-term forward spread is negative, a recession is likely coming. Further, a Fed study showed that this measure was also helpful in predicting future economic growth and stock returns. While the yield curve inverted this week and set off recession alarm bells, the near-term forward spread has moved further away from a recession signal. One caveat is that the forward spread is currently very elevated relative to history, so this could be as high as it will go before moving toward an indicator of poor future economic growth.

Like the yield curve, a near-term forward spread inversion has preceded every recession since 1973. Again just like the yield curve, the forward spread predicted a coming recession in 1998 that never materialized. The forward spread has provided a more timely indicator of the eventual economic downturn and the stock market peak than the yield curve.

The yield curve inversion is a strong signal of a future recession, but the warning sign can happen as much as two years before a recession. Adding the more powerful near-term forward spread to the recession dashboard should provide a more timely indicator. While the long-term countdown clock to the recession has likely begun, stocks have typically risen by over 10% after the yield curve inverts and signals a future economic downturn.

Investors should watch the near-term forward spread for a more timely indication of recession but be prepared for additional volatility during this period. In addition, investors should retain enough lower-risk assets like cash and high-quality bonds to support living expenses during an economic downturn. With the stock market less than five percent off its all-time high, it is probably a perfect time to confirm your risk tolerance and rebalance portfolios if warranted. As noted in a previous piece, upgrading stock portfolios toward high quality and dividend growth stocks will likely prove to be a smart move. This quality and dividend focus should allow investors to remain invested with less anxiety during economic slowdowns.