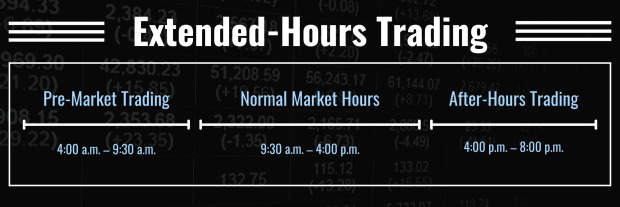

Traditionally, the two major American stock exchanges are open for trading Monday through Friday from 9:30 a.m. to 4:00 p.m. Eastern time, trading holidays excluded. But these 5.5-hour windows aren’t the only times stocks change hands—extended-hours trading allows investors to place and execute buy and sell orders after a trading session has ended and before a trading session has begun.

What Is After-Hours Stock Trading?

After-hours stock trading occurs after the market closes at 4 p.m. After the market closes, after-hours trading begins, lasting from 4:00 to 8:00 p.m. During this window, trades are executed through electronic communication networks, or ECNs, that match compatible buyers and sellers to execute trades without the need for market makers.

What Is Pre-Market Stock Trading?

Pre-market stock trading occurs before the market opens at 9:30 a.m. It begins at 4:00 a.m. and lasts until 9:30 a.m. when the market opens. Pre-market orders (like after-hours orders) are executed automatically via ECNs rather than through market makers.

How Does Extended-Hours Trading Differ From Normal Trading?

At a basic level, trading during extended-hours functions the same way as it does during normal market hours—investors place orders through their electronic brokers, and those orders are executed as soon as possible. However, many aspects of extended-hours trading make it riskier and more complicated than trading during normal market sessions.

Lower Volume

One major difference between normal trading and extended hours is trading volume—extended-hours sessions have far fewer participants, and fewer shares of stock change hands overall. The effects of low trading volume can be felt in a number of ways.

Lower Liquidity

Low volume translates to low liquidity, meaning trades can take longer to execute. market makers generally do not participate in extended-hours trading to provide liquidity, so supply and demand dictate whether or not any given buy or sell order will be executed by an ECN. Popular blue-chip stocks experience lower-than-usual liquidity during extended trading, and more obscure stocks may not even be tradable at all.

Wider Bid-Ask Spreads

Low liquidity means wider bid-ask spreads, which means buyers may end up paying more (and sellers accepting less) for their stocks. Limit orders can ensure investors don’t pay more (or accept less) than they want to for a stock, but the aforementioned lack of liquidity during extended hours can make limit orders more likely to expire unexecuted.

Higher Volatility

Fewer traders and lower liquidity also equate to higher price volatility. Large orders can swing prices much more than they would during normal trading hours, so a stock’s price could change significantly between the time an order is placed and the time it is executed.

Limited Order Types

Most brokerages do not allow investors to place more advanced order types—like stop-limit, kill-or-fill, and all-or-none orders—during extended hours. In most cases, investors can only place market and limit orders and (sell short) outside of normal trading sessions.

Why Is Extended-Hours Trading Important?

Extended-hours trading is important primarily because it can have a significant impact on stock prices. Due to after-hours trading activity, one session’s opening price for a security can deviate significantly from the previous session’s closing price.

Often, news is released after the stock market closes, and extended-hours traders react to this information, causing swings in stock prices. For instance, many companies’ earnings calls take place after the market closes, and depending on whether quarterly earnings and forward-looking guidance compare to expectations, a stock’s price can stumble or skyrocket before trading even begins the following session.

What Are the Advantages of After-Hours Trading?

Due to low volume and liquidity, wide bid-ask spreads, and increased volatility, extended-hours trading is much riskier than trading during normal market sessions. So why, then, do investors do it anyway?

There are two main advantages to trading outside of normal market hours. The first is accessibility. Many people are either at work, asleep, or otherwise indisposed during the market’s open hours due to their schedule or geographic location. Pre-market and after-hours trading sessions allow traders who are unable to participate from 9:30–4:00 p.m. Eastern time the opportunity to get in on the action.

Second, extended-hours trading allows highly active traders to react to emerging news and information efficiently. As mentioned above, data can be released outside of normal trading hours, and when this occurs, serious traders like to make moves immediately and get ahead of the trend.

Which Brokerages Offer After-Hours Trading

Many digital brokerages allow extended-hours trading, including TD Ameritrade, which probably offers the most generous extended-hours trading window. Trading on the platform is allowed from 8:00 p.m. Sunday through 8:00 pm Friday.

Below is a table that details the extended-hours trading windows offered by five other popular digital brokerages.