What Is a Pullback in Stock Trading?

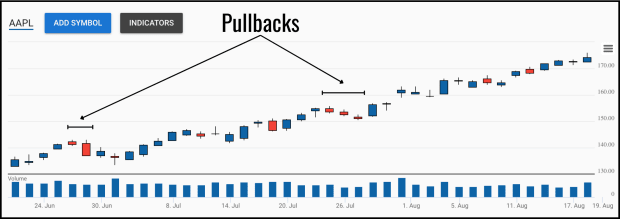

A pullback is a short-term downtrend in the price of a stock that occurs during a longer-term uptrend. In other words, a pullback describes a brief dip in a stock’s price during the midst of a much longer, steady increase.

Typically, pullbacks signal that shorter-term traders are taking profits—often after positive news has driven a stock’s price higher—while longer-term investors are holding onto their positions due to a company’s solid underlying fundamentals.

What Are the Characteristics of a Pullback?

Pullbacks are usually noticeable but not extremely drastic. Most investors consider a temporary 5 to 10% decline in a stock's price a pullback, so long as the previous uptrend resumes fairly quickly.

Pullbacks tend to be brief—they often last just a few trading sessions. That being said, what qualifies as a pullback can differ between investors based on their time horizons. As mentioned above, medium and longer-term investors who buy stocks they believe are healthy with the intention of holding them for weeks, months, or years might see a three-day decline as a pullback. Day traders, on the other hand, might consider a two-hour intraday decline a pullback due to the frequency with which they buy and sell stocks.

Pullbacks are most often seen during bull markets when most healthy stocks are appreciating in the long term. They represent shortlived selloffs that usually aren’t based on negative changes to a stock’s fundamentals. During bear markets and market corrections, even healthy stocks lose value, so uptrends (and thus pullbacks) are less common.

Pullback vs. Reversal: What’s the Difference?

While a pullback is a short retreat in a stock’s price during a longer-term uptrend based on solid fundamentals, a reversal is a change in the longer-term direction of a stock’s price, often due to important information about the underlying company’s performance coming to light.

Like most stock market phenomena, identifying a pullback is much easier done in retrospect than in real-time. Pullbacks must be both mild and shortlived, both of which are characteristics that are much easier to observe after a phenomenon has occurred than while it is happening. That being said, both fundamental and technical analysis can offer some clues as to whether a price drop is merely a pullback or a true reversal that marks the beginning of a new downtrend.

First, if a stock’s fundamentals are strong and haven’t changed for the worse during a recent uptrend, a mild price decline is more likely to be a temporary pullback than the beginning of a reversal—especially if it follows the release of positive information like higher-than-expected earnings and guidance.

Good news can boost a stock’s price, which can trigger a short-term selloff by profit-takers. Because the stock remains healthy, however, buyers and longer-term investors will likely outnumber sellers again relatively soon, allowing the stock to resume its uptrend. Bad news or poor earnings/guidance, on the other hand, can trigger a true reversal, or at least a correction.

On the technical side, investors can look at indicators like a stock’s moving average and dynamic support level. If the stock in question falls below its 50-day moving average and/or an established support level, a reversal may be occurring, and a cautious “wait and watch” approach may be advisable.

Pullback vs. Correction: What’s the Difference?

While pullbacks are usually characterized by a shortlived 5 to 10% decline in a stock’s price, corrections are more severe and may last longer. Generally, a temporary decline of 10 to 20% in the price of a stock is considered a correction, but the duration of a correction may be longer than a few days. Unlike a pullback, which just signals profit-taking, a correction may signal the return of an overvalued stock toward its intrinsic value.

During a correction, something like mediocre earnings guidance can cause an initial wave of profit-taking that can drive a stock’s price down enough to trigger a string of stop orders. A significant enough price drop can scare off more risk-averse investors, causing a temporary period of capitulation among a stock’s more nervous holders as its price continues to drop until buyers once again take over.

Is a Pullback a Good Buying Opportunity?

Assuming a pullback is, in fact, a pullback and not a reversal or a correction, it certainly can be a good buying opportunity. The old adage “buy low, sell high” rings true whether you’re a buy-and-hold investor or a technical trader.

Because pullbacks occur during longer uptrends, buying at the bottom of a pullback is a good way for an investor to minimize their cost basis and maximize their gains when they eventually sell. However, as mentioned above, pullbacks are most easily recognized in hindsight, so buying in at the bottom of a pullback is easier said than done.

For this reason, buying into pullbacks is more popular among active traders (who buy and sell based on technical indicators like short and mid-term support levels and moving averages) than it is among longer-term value investors. More passive investors who prefer to avoid watching their stock picks vigilantly would likely do better by dollar-cost averaging into stocks with healthy fundamentals.