A credit score is a number, usually between 300 and 850, that provides a snapshot of a consumer’s creditworthiness. Lenders use these scores to decide whether a potential borrower is qualified for a loan, and in many cases, to set the interest rate and other terms.

By tracking and keeping a score in the good range or better, consumers may qualify for one of the best rewards credit cards or for other types of loans.

One of the best ways to track your credit score is by using a monitoring service like myFico. It'll alert you if there are any changes to your credit report so you can address them promptly.

What is a good credit score?

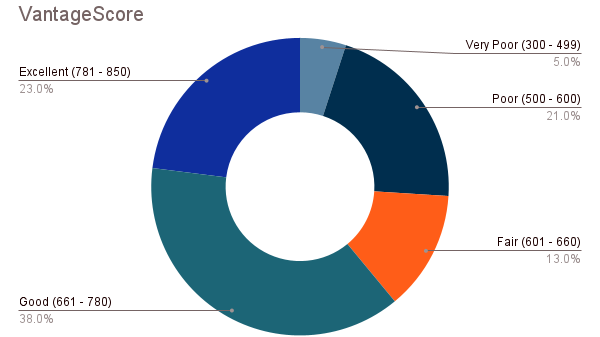

Two companies control the market for credit scores: FICO and VantageScore. FICO considers a score of 670 to 739 as good, while VantageScore rates a score of 661 to 780 as good.

FICO boasts that 90% of top lenders rely on their scores, and consumers generally need to focus on their FICO score first. Credit card companies, however, often consider both FICO and VantageScores.

How do you measure up to other borrowers?

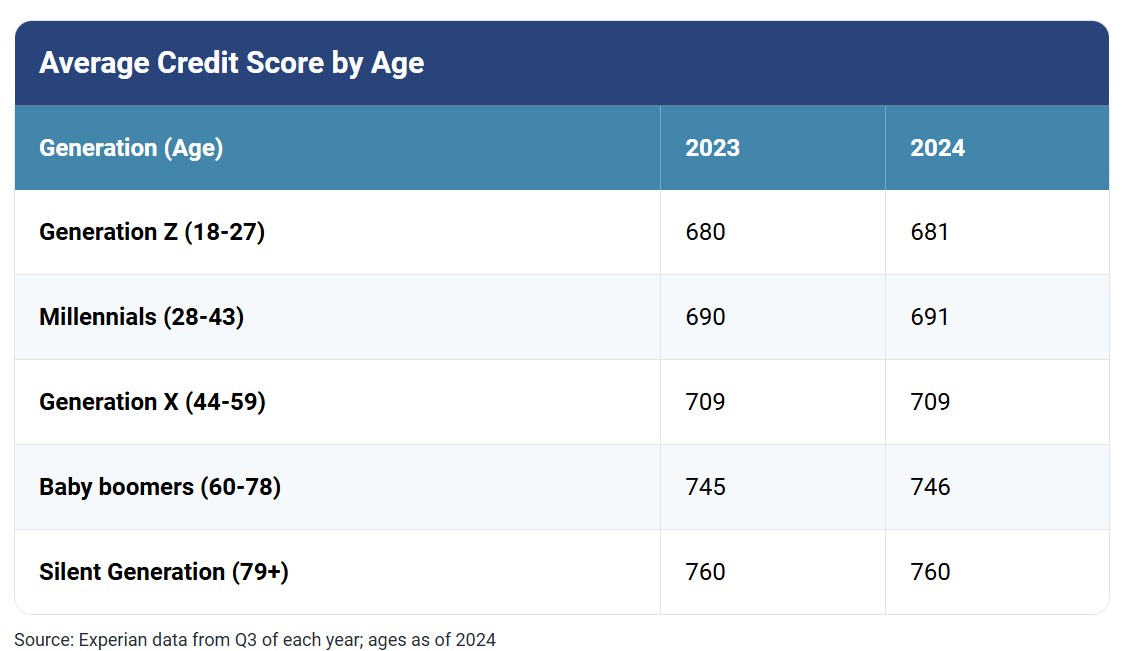

The average FICO score in the U.S. was 705 as of January 2026. Want to see how you measure up? Here's a table of average credit scores by age:

The latest versions of the VantageScore also use a 300 to 850 scale, with about 61% of Americans having a Good VantageScore or better.

How to check your credit score?

There are three ways to see your FICO credit score for free.

- Many banks and credit card issuers offer customers free FICO scores every month, so look at your account online or your credit card statement.

- Equifax, one of the three credit bureaus, offers free scores at myFICO.com/free.

- Experian also provides a free score and credit report at www.freecreditscore.com.

- To check your VantageScore, sign up for Chase Bank’s free credit monitoring service, Credit Journey, or see other programs offered by VantageScore partners.

Checking your credit score using FICO or Vantage, called a “soft pull,” will not harm your credit score. But when you apply for a credit card or loan, the lender will conduct a “hard pull,” running a report that will temporarily lower your credit score.

That is why knowing your credit score is so important before applying for a loan or card. If you have applied for a few credit cards and been rejected, your credit score will be lower and it will be even harder to qualify for a new card until some time has passed and your credit score has recovered.

Why do I have more than one credit score?

There are myriad factors that determine your credit score. FICO and VantageScore base their algorithms on the same underlying data but assign a different weight to the same criteria.

FICO and VantageScore get these data in turn from three credit bureaus that track your credit activity: Equifax, Experian and TransUnion. As a result, you may see slightly different scores based on whether data was pulled from all three bureaus or just one.

Credit bureau and scoring algorithms also have different versions; sometimes a lender will use a score drawn from the latest version or rely on an older, even years-old version of the algorithm.

What affects my credit score?

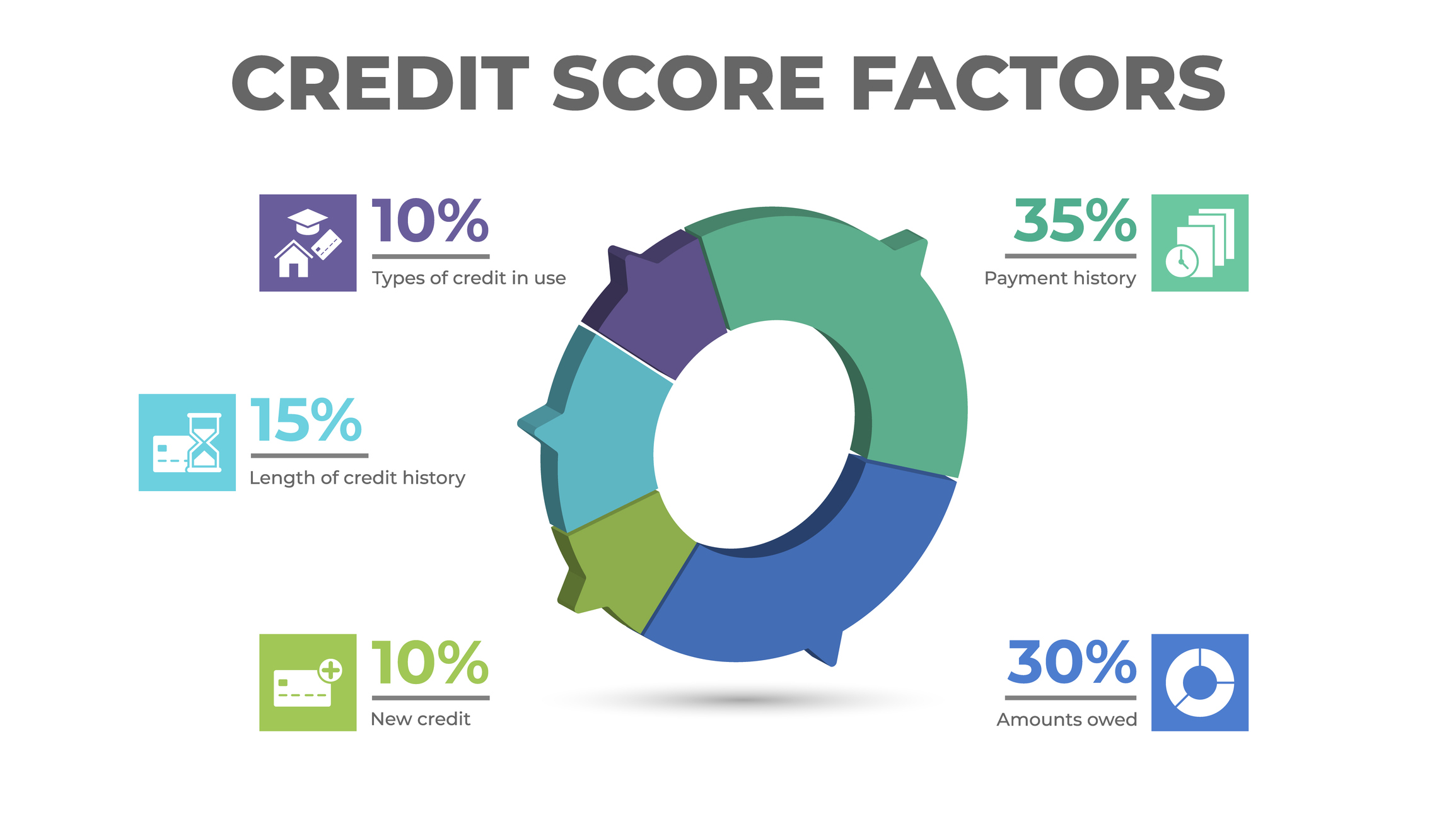

Across all of the credit reporting and scoring services, these are the most important factors that go into your credit score.

Payment history is based on your record of paying bills on time and is the most important criterion for determining your score. Late or missed payments can significantly lower your credit score. That's why it's important to add credit card payments to your budget. Use a budgeting app like Quicken's Simplifi, which can project future cash flow to ensure you have money on hand for payments.

Credit utilization reflects the amount of credit you are using relative to your credit limit. Using more than about 30% of your available credit will likely lower your score.

Length of credit history refers to the amount of time you have had your accounts. A long credit history demonstrates that you have had plenty of practice managing debt payments.

Credit mix refers to the types of credit you rely on. Having both installment (mortgages and car loans) and revolving (credit cards) loans will increase your score since it shows you can handle different types of payments and terms. If you're thinking of taking on a Buy Now Pay Later loan, see below for details on how they may affect your score.

New credit accounts or applications can lower your credit score by generating a “hard pull” and by lowering your average length of credit history.

Retiring may reduce your income and use of credit cards and loans that bolster your score. Be sure you understand how retirement could hurt your credit score (but doesn't have to).

Tips for increasing/protecting your credit score

Here are tried-and-true strategies to boost your credit score.

Pay your bills on time and if you can, pay the total amount due each month.

Keep your credit utilization low, ideally below 30% of your credit limit. Paying off your statement balance is ideal because it allows you to maximize credit card rewards without incurring interest.

Don’t close old credit card accounts. If you are thinking of closing a credit card that you’ve had for many years to avoid an annual fee, consider asking the card issuer to roll the account onto a similar card with no fee. You'll maintain your long credit history even if you never use the card.

Check your credit report and credit score periodically. You can now get free credit reports for free from all three credit bureaus at annualcreditreport.com, every week. Look for incorrect information or fraudulent activity, and know how to fix your credit report if you find errors. Not sure what a credit report is? Check out our article showing the difference between credit scores and credit reports.

Once you get a good or even excellent credit score, don’t rest on your laurels. Good credit hygiene, like keeping up with all of your credit card or loan payments, can help you qualify for choice loans in the future.

What credit score do I need to buy a house?

Conventional loans. When you buy a home, you will most likely take out a conventional loan. The minimum credit score you'll need is 620 to 660, depending on the lender. A higher score usually means you will get a better deal on your mortgage interest rate.

Jumbo loans are generally defined as loans over $832,750. You will typically need at least a 700 credit score, though the average score is 740, according to Bankrate.

Other types of loans. Lenders typically require a credit score of 620 for VA loans, 500 for FHA loans and 580 for USDA loans.

What credit score do I need to buy a car?

If you're shopping for a car, you should ensure your credit score is 661 or higher. According to the Experian State of the Automotive Finance Market report, as of the fourth quarter of 2024, more than 68% of borrowers met or exceeded that threshold.

Less than one-fifth of borrowers had scores of 600 or less.

Credit score myths

No, not everyone 18 or older in the U.S. has a credit score, even though 42% of Americans think it is true. That's one of the many misconceptions consumers have about how to monitor and build good credit. According to a study by Capital One Insights Center, there are a host of myths surrounding credit scores; here are some of the biggest doozies.

My spouse's credit will affect my credit score - False. If your spouse has a low credit score and you apply for a joint loan, that low score may impact your ability to get a loan with good terms, but the score itself will not drag down your own score.

A hard credit check (or credit "pull") will not affect my score - False. There are two kinds of credit card inquiries: hard and soft. Hard inquiries will lower your score temporarily, and too many hard pulls in quick succession could really damage your score. Lenders perform a hard pull when you apply for new credit, like a credit card, a car loan or a mortgage. Hard inquiries stay on your credit report for two years, so it is important to think strategically when you want to trigger one. Soft credit checks that will not affect your score include instances when your bank updates your free FICO score, or your employer checks your credit after you are offered a job.

Carrying a balance (not paying the total amount due) on your credit card each month is a good way to increase your credit score - False. Most older consumers knew this statement was false on the Capital One survey, but almost half of millennials polled, and 53% of Gen-Z respondents, thought this statement was true. By not paying your balance in full each month, you risk paying high interest rates and increasing your credit utilization rate, which can lower your credit score.

Buy Now Pay Later (BNPL) and your credit score

Some consumers are turning to Buy Now Pay Later (BNPL) to make large purchases over time, usually in four payments with no interest due. These loans, sometimes called "point-of-sale installment loans" or "pay-in-4" have grown rapidly.

There is no cookie-cutter version of BNPL. The lending agency may be your own credit company, a bank or an app-based service like Affirm or Afterpay. This lender diversity means that terms may vary, so it's crucial to do your research before signing up for BNPL.

Anyone considering a BNPL should be wary. Hidden fees and weak regulation have led BNPL plans to come under scrutiny and criticism from a host of government agencies and consumer watchdog organizations like Consumer Reports.

Ways BNPL services can improve your credit score.

- For consumers who have poor or even no credit history, a small BNPL loan may help make ends meet for an important purchase. Since most BNPL services do not conduct a hard credit pull, consumers can get access to credit without lowering their credit score.

- Some BNPL lenders provide services to help you improve your credit score. For example, customers of Sezzle can elect to have their payments reported to all three credit bureaus in a program called Sezzle Up. If you can make on-time payments, your credit score may improve. However, if you miss a payment or are late, that will also be reported, so only elect to use this service if you have enough cash flow to pay fully and on time.

How BNPL services may harm your credit score

- If you don't understand the terms of a BNPL loan, you may wind up paying expensive fees that could unnecessarily stress your financial health. For example, some BNPL lenders charge an installment fee, essentially acting as interest on the loan. Late fees may also make paying back your loan more difficult.

- A high number of BNPL customers rack up overdraft fees from their bank. A recent survey from the Consumer Federation of America and the Center for Responsible Lending found that 37% of these borrowers were charged an overdraft fee in the last six months.

- If you fail to make a payment, some BNPL lenders (such as Zip, may turn over your account to a collections agency, harming your credit score.

- If you return an item or an item is damaged, the BNPL lender may not be able to credit your account quickly. In that case, you may still have to make payments to avoid late fees. If you've already paid the full BNPL loan but the item is unusable, you may not get a refund. And of course, if you can't make those payments your credit score may be harmed.

- If you elect to pay BNPL installments with a credit card, you may be charged interest by that card if you are unable to make your monthly payment. Late or incomplete credit card payments will damage your credit score.

On-time rent payments can boost your score

Your landlord does not typically report on-time rent payments to the three credit bureaus that generate your credit reports. This disadvantages renters; they cannot demonstrate responsible financial practices with one of their biggest monthly expenditures — their rent.

You might think that charging rent payments to a rewards credit card would help solve this problem and maybe earn you some cash back or miles to boot. But credit cards charge a fee to pay your rent that may cancel out or even exceed the rewards you earn. There is one exception to this rule. The BILT credit card allows you to pay rent on the card without those fees, and you earn serious travel rewards. BILT reports your on-time payments to credit bureaus, helping you increase your credit score.

The real estate technology firm Zillow launched a similar program. Tenants renting through Zillow can ask the company to report their rental payments to credit bureaus. Zillow will not report late payments.

Hiow a good credit score affects your personal finances

Your credit score touches many areas of your financial life: From the interest rates you'll pay on loans to insurance premiums, your credit score can determine whether you pay more or less for the things you need.

Knowing the factors that influence credit scores can help adjust behaviors to ensure you're earning the highest score possible. That way, you don't pay more than you have to on loans, insurance and credit cards.