Federal government shutdowns aren't bad for stocks, at least historically speaking.

Although the market generally doesn't like the threat of a federal governmewhnt shutdown, the S&P 500's performance during past closures has been pretty good.

Not that we needed another "funding cliff." Washington is heading toward a partial shutdown if the Senate doesn't approve a $1.2 trillion spending bill by midnight on Friday, January 30, 2026.

If the threat of a shutdown seems particularly irksome at the moment, it might be because we just had a 43-day total government shutdown a few months ago.

Meanwhile, markets are trading at record levels – and rich valuations – despite the effects of tariffs, above-target inflation and a softer labor market. No one wants dysfunction in Washington to rattle already tense nerves.

Stock performance during government shutdowns

Happily, for market participants, the historical record for stocks when the federal government shuts down is far from one of doom and gloom.

There have been 23 government shutdowns since 1976, but on only five occasions were operations affected for more than one business day, writes Jeffrey Buchbinder, chief equity strategist at LPL Financial. That leaves us with only five "true" shutdowns, Buchbinder notes.

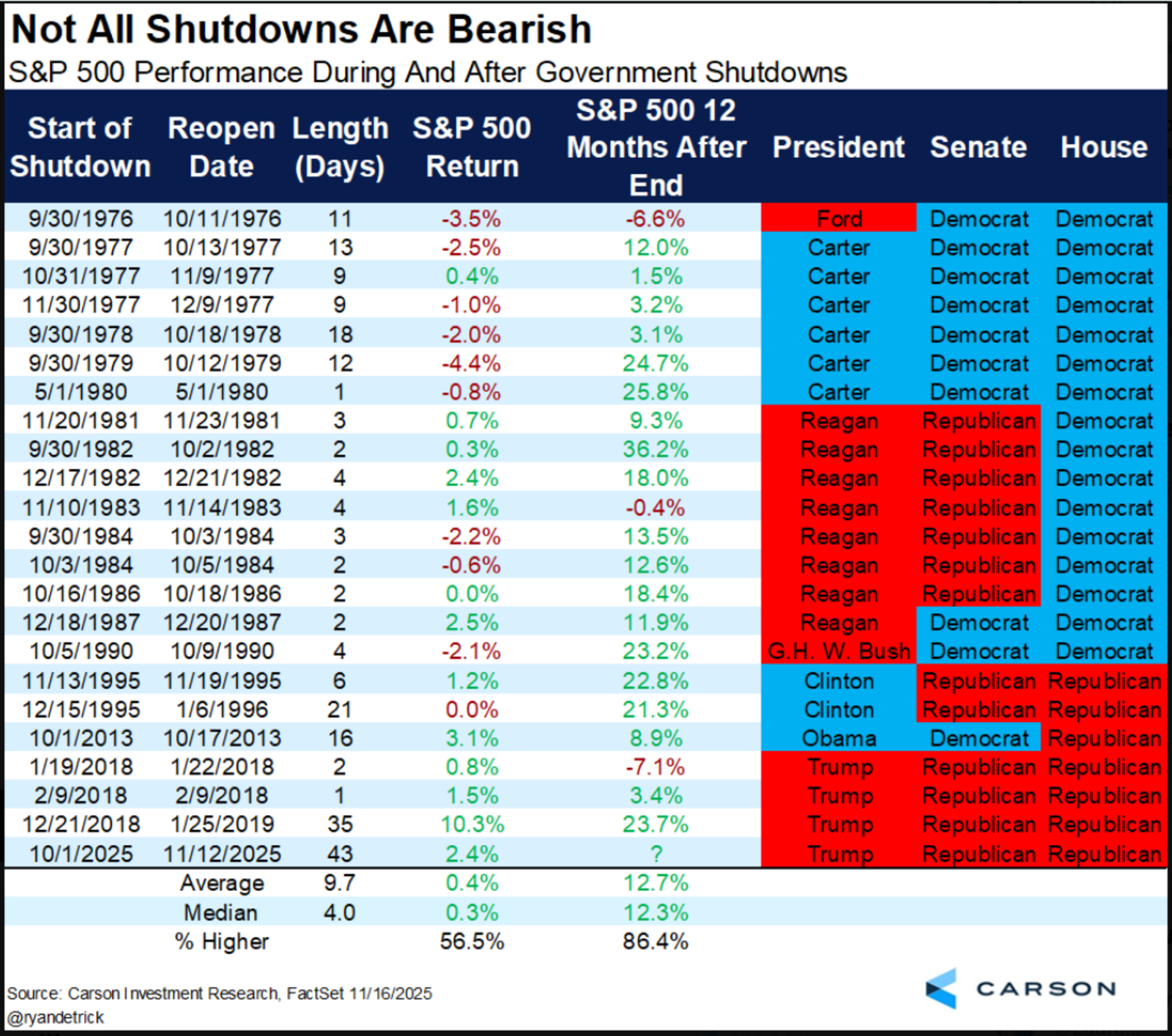

It's tough to remember now, but the S&P 500 returned 10.3% during the 35-day shutdown of 2018-2019. Have a look at the chart below:

Stocks did fine during the extended shutdown of 2025, too, as the S&P 500 gained 2.4%.

It's sort of counterintuitive, but in past government shutdowns, the S&P 500 rose 57% of the time, generating an average return of 0.4%, according to data from Carson Group.

Even better, 12 months after the end of the shutdown, the S&P 500 was higher 86% of the time, with an average return of 12.7%.

"The good news is history says shutdowns have little to no effect on stocks," writes Carson Group Chief Market Strategist Ryan Detrick. "Most shutdowns last only a few days, so just enough to get in the headlines, and then it is over just as quickly."

Past performance is no guarantee of future results, but the record for stocks in government shutdowns is almost encouraging.

Related content

- How Social Security Would Be Affected By A Government Shutdown

- What A Government Shutdown Means For Student Loan Payments

- A Government Shutdown Could Disrupt Your Travel Plans — Eventually

- How Medicare Would Be Affected By A Government Shutdown

- What Would a Government Shutdown Do to the IRS in 2026?