Because of its use across many sectors, copper is seen as a leading indicator of economic health. After all, it is used practically everywhere – in homes and in factories, in electronics, and in power generation. And in recent years, copper’s role in growing electric vehicle production has further boosted demand for the metal.

Because of this, when demand for copper increases, it typically indicates a growing economy, while a decrease in copper demand can portend an upcoming economic slowdown. Copper had a bullish run the past few years during the pandemic for a few reasons:

- Record fiscal stimulus helped provide tailwinds to strong economic demand as Covid lockdowns came to an end, leading to a surge in manufacturing. Specifically, China, which is the world’s largest buyer of copper, saw its economy recover quickly and grow throughout 2020.

- There were many mining and refining disruptions which resulted in reduced supply, leading to historically low inventories almost everywhere in the world.

- The U.S. dollar weakened significantly during the pandemic. Copper and the U.S. dollar have an inverse relationship because it is traded in U.S. dollars.

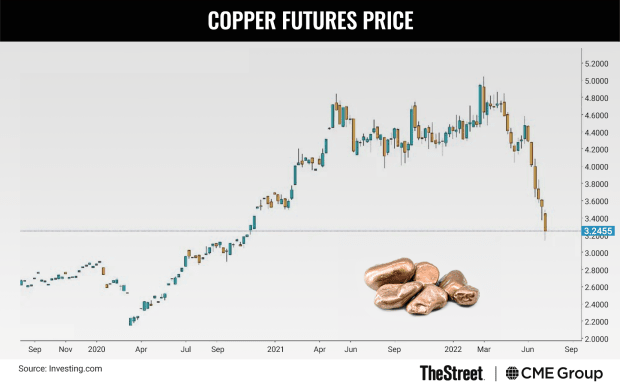

Copper prices reached $4.80 in May 2021 and recently peaked at just over $5 in March 2022. Those highs were last seen in February 2011. But copper has been sliding recently, as interest rate hikes and fears that a global recession is looming have dampened expectations that demand will hold up in the near term. As of Aug. 24, 2022, the price of copper had dropped more than 25% from its peak in March. Since the resurgence of Covid in China, demand concerns have hit the market, far outweighing any lack of supply. Rising interest rates around the globe also hurt, as this historically curtails economic expansion. And just as the weak U.S. dollar helped lift copper prices in 2020 and 2021, the opposite is now true with the recent rise in the dollar’s value providing major headwinds.

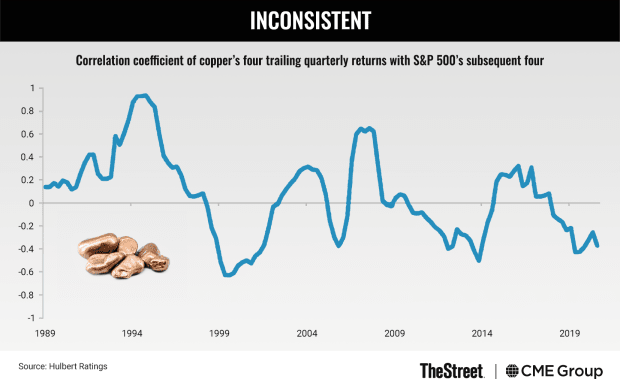

Though copper’s demand has had a direct correlation to economic activity, it has not been a leading indicator of stock market performance. Over the past 40 years, there has actually been an inverse correlation between copper prices and S&P 500 returns. Perhaps the most recognizable example of this inverse correlation came between early 2011 and early 2016. Over those five years, copper fell nearly 60%, and the S&P 500 nearly doubled over the following four years. Though this overall correlation is inverse, it is anything but steady over time.

Given current inflationary fears, the rising interest rate environment, and the possibility of a global recession, economists and investors alike will continue to keep a close eye on copper’s price as an indicator for the health of the economy.