/Uber%20Technologies%20Inc%20logo%20on%20phone-by%20DenPhotos%20via%20Shutterstock.jpg)

San Francisco, California-based Uber Technologies, Inc. (UBER) is a global technology company that provides ride-hailing, food delivery, and logistics services. Valued at a market cap of $201.2 billion, the company leverages data, mapping, and AI-driven algorithms to efficiently match supply and demand across its network, transforming urban mobility worldwide.

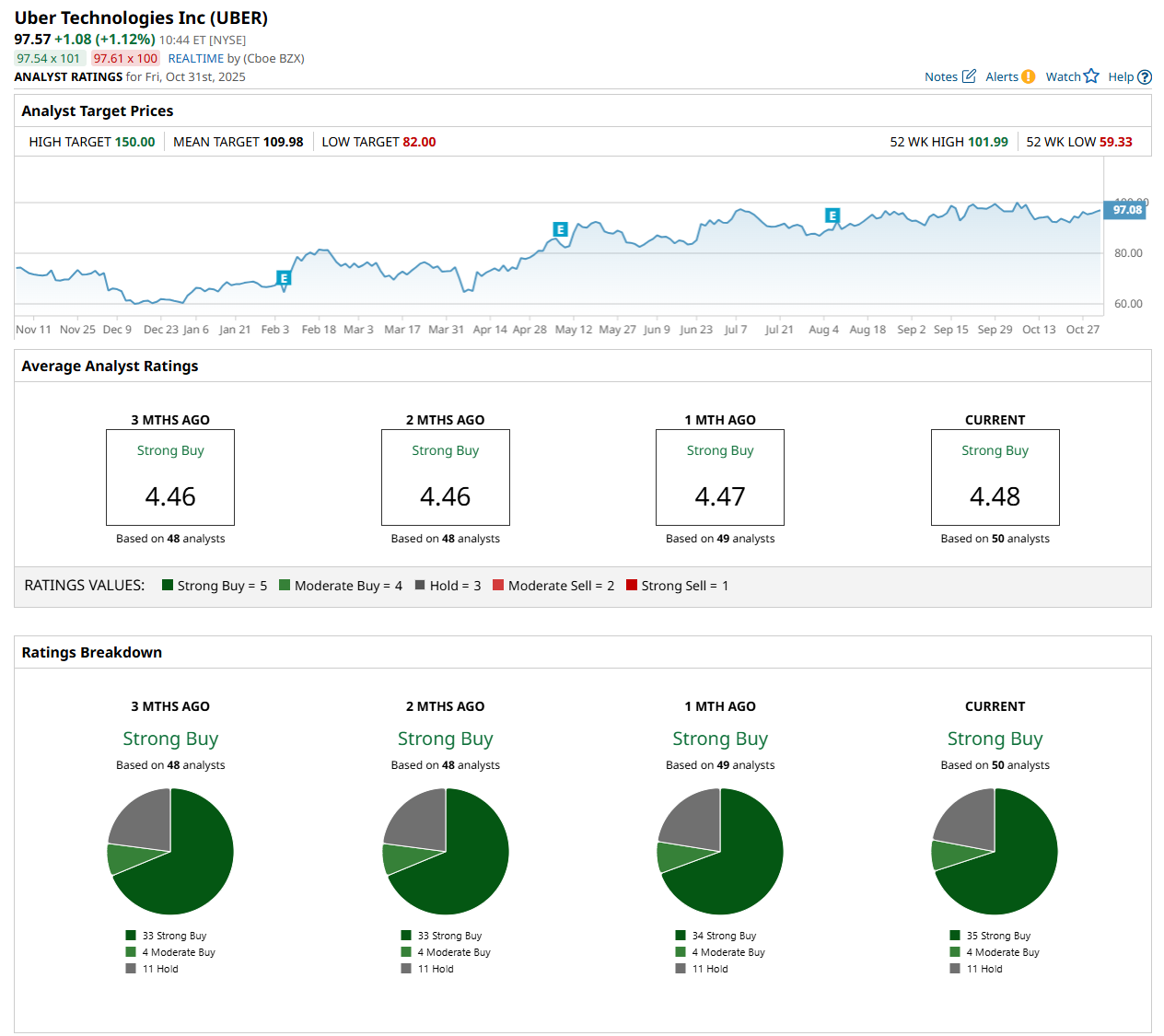

This transportation company has outpaced the broader market over the past 52 weeks. Shares of UBER have soared 22.8% over this time frame, while the broader S&P 500 Index ($SPX) has gained 17.9%. Moreover, on a YTD basis, the stock is up 61.7%, compared to SPX’s 16.6% rise.

Moreover, zooming in further, UBER has also outperformed the Technology Select Sector SPDR Fund’s (XLK) 29.9% uptick on a YTD basis. However, it has lagged behind XLK’s 31.5% surge over the past 52 weeks.

On Oct. 6, UBER’s shares rose 3.6% after California’s governor signed a bill allowing ride-hailing drivers to unionize while reducing the company’s insurance costs. The law lets more than 800,000 drivers for firms like UBER join unions and negotiate for better pay and benefits while remaining independent contractors. In return, the state eased insurance requirements for accidents involving underinsured drivers, a change expected to significantly lower the expenses of firms like UBER.

For the current fiscal year, ending in December, analysts expect UBER’s EPS to decline 36.4% year over year to $2.90. The company’s earnings surprise history is promising. It exceeded the consensus estimates in each of the last four quarters.

Among the 50 analysts covering the stock, the consensus rating is a "Strong Buy,” which is based on 35 “Strong Buy,” four “Moderate Buy,” and 11 "Hold” ratings.

This configuration is slightly more bullish than a month ago, with 34 analysts suggesting a “Strong Buy” rating.

On Oct. 29, Roth MKM analyst Rohit Kulkarni maintained a "Buy" rating on UBER and set a price target of $110, implying a 12.7% potential upside from the current levels.

The mean price target of $109.98 represents a 12.7% premium from UBER’s current price levels, while the Street-high price target of $150 suggests an ambitious upside potential of 53.7%.