/Stryker%20Corp_%20HQ%20sign%20-by%20Sundry%20Photography%20via%20Shutterstock.jpg)

Valued at a market cap of $140.5 billion, Stryker Corporation (SYK) is a leading medical technology company that develops innovative products and solutions across orthopaedics, medical and surgical equipment, and neurotechnology. The Portage, Michigan-based company is known for its cutting-edge implants, robotic surgical systems, advanced hospital equipment, and life-saving devices.

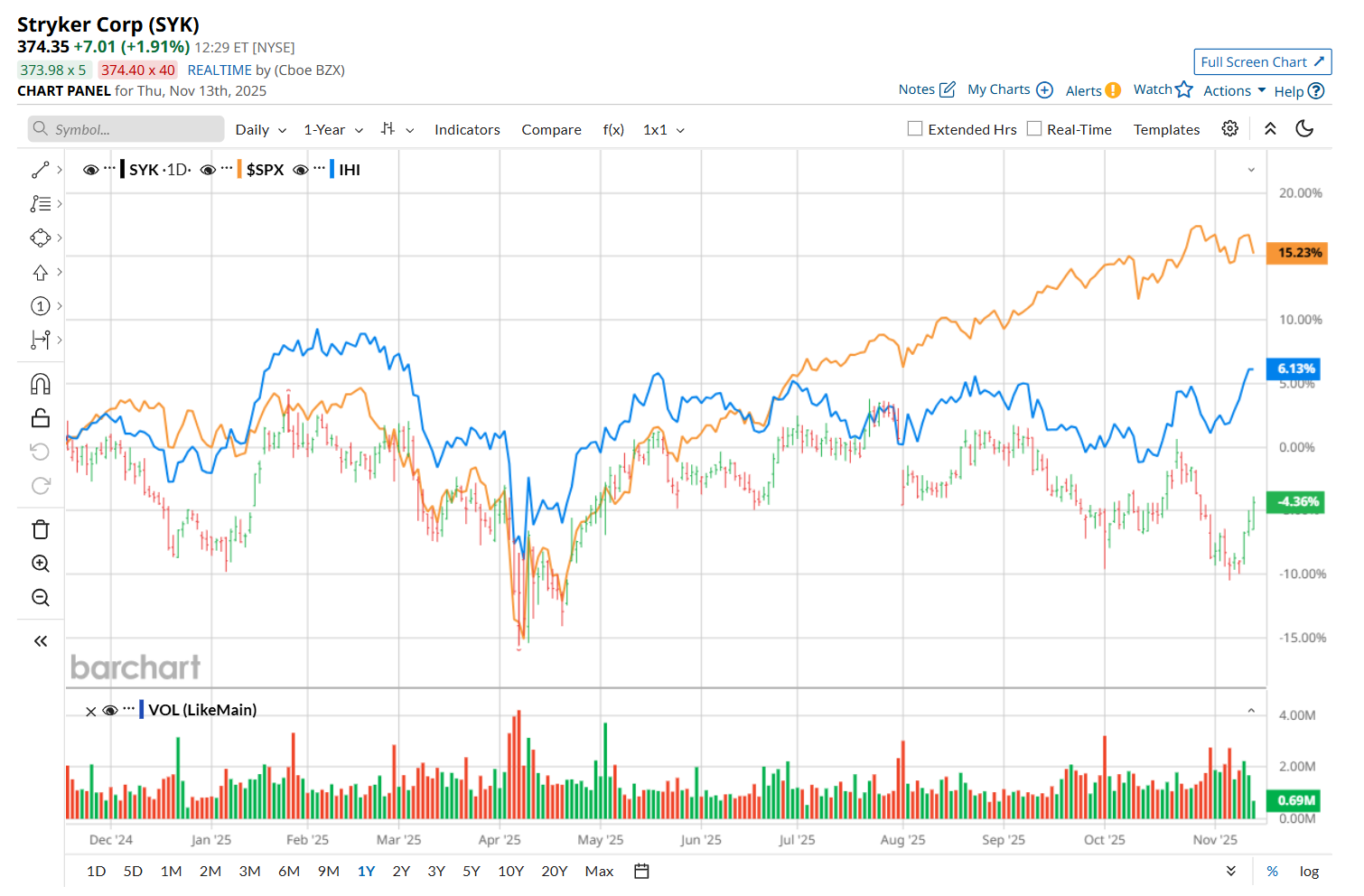

This healthcare giant has lagged behind the broader market over the past 52 weeks. Shares of SYK have declined 4.1% over this time frame, while the broader S&P 500 Index ($SPX) has gained 13.1%. Moreover, on a YTD basis, the stock is up 3.5%, compared to SPX’s 15.1% return.

Narrowing the focus, SYK has also underperformed the iShares U.S. Medical Devices ETF’s (IHI) 5.3% uptick over the past 52 weeks and 8.3% YTD rise.

On Oct. 30, SYK posted better-than-expected Q3 results, yet its shares plunged 3.5% in the following trading session. On the upside, the company’s overall revenue improved 10.2% year-over-year to $6.1 billion and marginally surpassed the consensus estimates. Moreover, its adjusted EPS of $3.19 grew 11.1% from the year-ago quarter, topping analyst expectations of $3.14. Additionally, SYK raised its fiscal 2025 guidance, now expecting organic net sales growth of 9.8% to 10.2% and adjusted EPS to be between $13.50 and $13.60.

However, investors appeared to focus on a decline in margins. The company's operating margin contracted to 18.7% from 19.7% recorded in the prior-year quarter, making investors jittery.

For the current fiscal year, ending in December, analysts expect SYK’s EPS to grow 11.2% year over year to $13.56. The company’s earnings surprise history is promising. It exceeded the consensus estimates in each of the last four quarters.

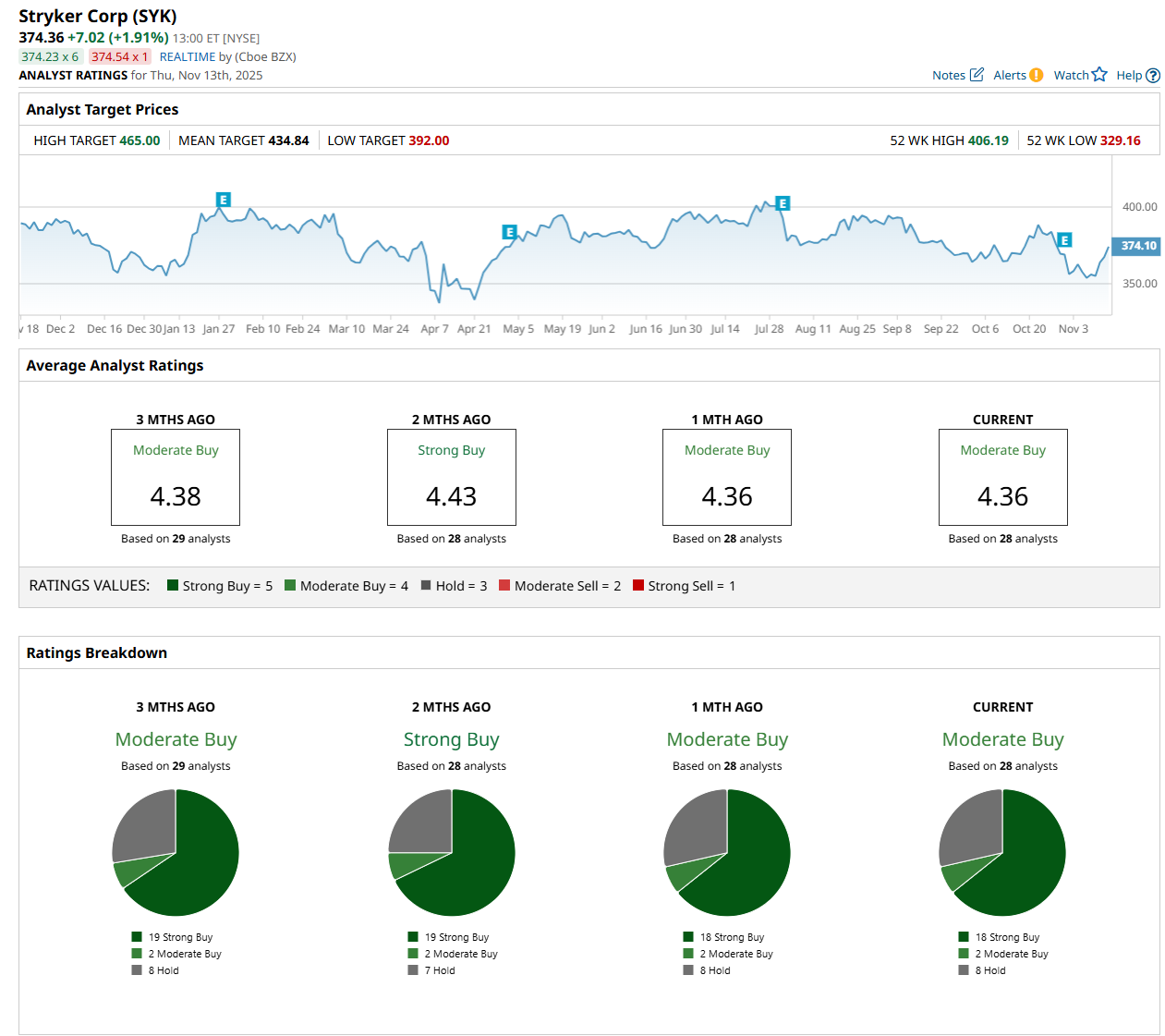

Among the 28 analysts covering the stock, the consensus rating is a "Moderate Buy,” which is based on 18 “Strong Buy,” two "Moderate Buy,” and eight "Hold” ratings.

This configuration is slightly less bullish than two months ago, with 19 analysts suggesting a “Strong Buy” rating.

On Nov. 10, Travis Steed from Bank of America Corporation (BAC) maintained a “Buy” rating on SYK, with a price target of $450, indicating a 20.2% potential upside from the current levels.

The mean price target of $434.84 represents a 16.2% premium from SYK’s current price levels, while the Street-high price target of $465 suggests an ambitious 24.2% potential upside from the current levels.