Juno Beach, Florida-based NextEra Energy, Inc. (NEE) is one of the largest electric power companies in the U.S. and a global leader in renewable energy. Valued at $172.1 billion by market cap, it delivers electricity to millions in Florida through FPL and develops wind, solar, storage, and clean-fuel projects across North America via its NextEra Energy Resources unit.

The utilities giant has notably underperformed the broader market over the past year. NextEra’s stock prices have surged 2.8% over the past 52 weeks and 14.1% on a YTD basis, lagging behind the S&P 500 Index’s ($SPX) 18.1% gains over the past year and 17.2% returns in 2025.

Even within its own sector, NextEra has lagged as the Utilities Select Sector SPDR Fund (XLU) has surged 3.7% over the past 52 weeks and returned 19% in 2025.

On Oct. 28, NextEra shares fell 2.9% after the company released its third-quarter earnings. Thanks to the robust demand for clean energy, its adjusted EPS climbed to $1.13, comfortably above expectations. While its utility arm, Florida Power & Light, continued to shine with double-digit profit growth, revenue of $8 billion fell short of the Street's expectations.

For fiscal 2025, ending in December, analysts expect NextEra to deliver an adjusted EPS of $3.68, up 7.3% year-over-year. The company has built a strong track record, beating earnings expectations in each of the last four quarters.

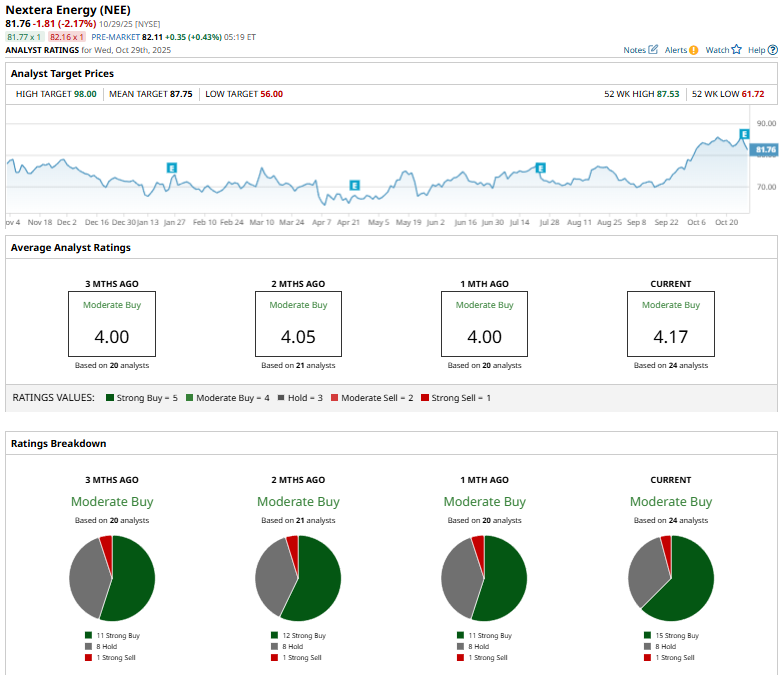

Analyst sentiment leans reasonably positive as well, with the stock carrying a consensus “Moderate Buy” rating overall. Of the 20 analysts covering the stock, opinions include 15 “Strong Buys,” eight “Holds,” and one “Strong Sell.”

This configuration is more bullish than a month ago, when 11 analysts gave “Strong Buy” recommendations.

JPMorgan Chase & Co. (JPM) Jeremy Tonet reaffirmed a “Buy” rating on NextEra Energy on Oct. 15, setting a $94 price target.

NEE’s mean price target of $87.75 suggests a 7.3% upside potential. Meanwhile, the Street-high target of $98 represents a substantial 19.9% premium to current price levels.