Houston, Texas-based LyondellBasell Industries N.V. (LYB) is one of the leading plastics, chemical, and refining companies globally. Its products are used in electronics, automotive parts, packaging, construction materials, and biofuels. With a market cap of $13.9 billion, LyondellBasell’s operations span North America, Europe, Indo-Pacific, and internationally.

LyondellBasell has substantially underperformed the broader market over the past year. LYB stock prices have plunged 38.7% on a YTD basis and 45.5% over the past 52 weeks, compared to the S&P 500 Index’s ($SPX) 14.6% gains in 2025 and 12.6% returns over the past year.

Narrowing the focus, LyondellBasell has also underperformed the sector-focused Materials Select Sector SPDR Fund’s (XLB) 4.1% uptick in 2025 and 5.5% decline over the past 52 weeks.

LyondellBasell’s stock prices gained 2.7% in the trading session following the release of its better-than-expected Q3 results on Oct. 31. The company has continued to face pressure on its topline due to softness in the chemicals industry. Its topline for the quarter dropped 10.2% year-over-year to $7.7 billion, but surpassed the Street’s expectations by 3.1%. Meanwhile, its adjusted EPS plunged 47.1% year-over-year to $1.01, but exceeded the consensus estimates by 26.3%.

For the full fiscal 2025, ending in December, analysts expect LYB to deliver an adjusted EPS of $2.47, down 61.4% year-over-year. The company has a mixed earnings surprise history. While it missed the Street’s bottom-line estimates twice over the past four quarters, it met or surpassed the projections on two other occasions.

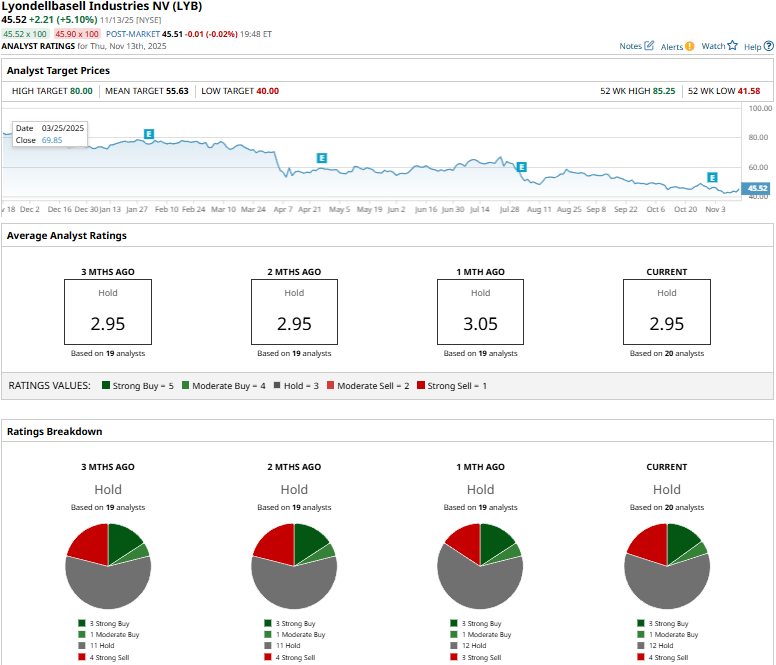

Among the 20 analysts covering the LYB stock, the consensus rating is a “Hold.” That’s based on three “Strong Buys,” one “Moderate Buy,” 12 “Holds,” and four “Strong Sells.”

This configuration is slightly less pessimistic than a month ago, when three analysts gave “Strong Sell” recommendations.

On Nov. 11, Evercore ISI Group analyst Stephen Richardson maintained an “In-Line” rating on LYB and lowered the price target from $65 to $57.

Bio-Techne’s mean price target of $55.63 represents a 22.2% premium to current price levels. Meanwhile, the street-high target of $80 suggests a 75.7% upside potential.