Headquartered in Dallas, Texas, Kimberly-Clark Corporation (KMB) designs, manufactures, and markets everyday essentials that power households. With a market cap of roughly $34.7 billion, it steers category leaders such as Huggies, Kleenex, Scott, Kotex, and Depend through major retailers, distributors, and e-commerce channels.

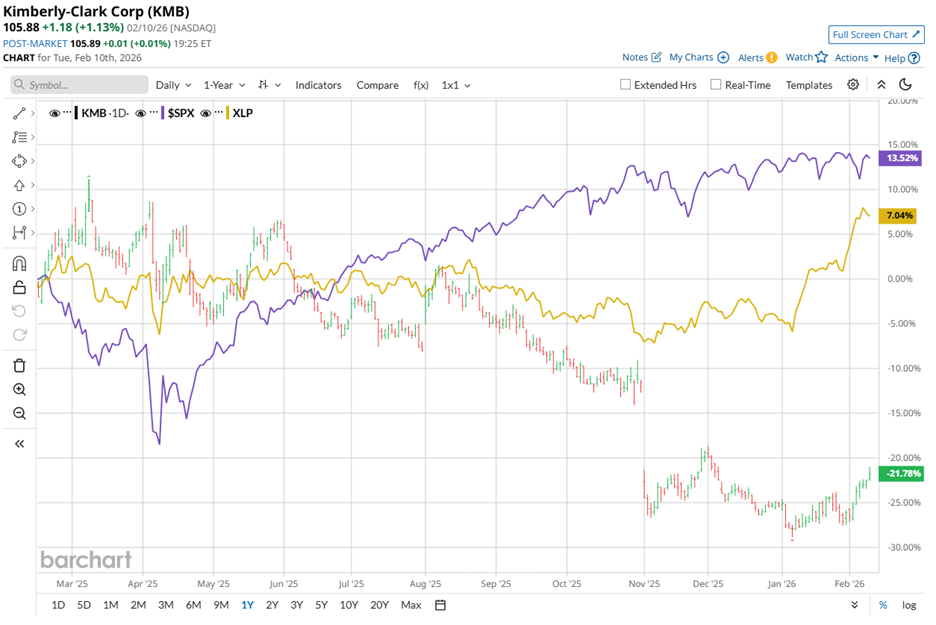

Over the past 52 weeks, KMB stock fell 19.4%, sharply lagging the S&P 500 Index’s ($SPX) 14.4% gain. Yet 2026 has opened on steadier footing, with Kimberly-Clark’s shares up nearly 5% year-to-date (YTD), outperforming the broader index’s modest 1.4% rise.

Against its sector benchmark, Kimberly-Clark has struggled to keep pace. The State Street Consumer Staples Select Sector SPDR ETF (XLP) gained 9.2% over the past 52 weeks and surged 12.2% YTD, decisively outperforming KMB stock.

On Jan. 27, Kimberly-Clark’s shares edged lower following the release of its fourth-quarter 2025 results. The stock slipped another 1.1% the next day as revenue dipped slightly year over year to $4.08 billion, roughly in line with the $4.09 billion consensus estimate. However, adjusted EPS rose 24% to $1.86 from the prior-year period, topping analysts’ $1.81 forecast.

Cost controls and steady demand for core products such as Huggies diapers and Kleenex tissues across major markets supported results. In recent years, the company cut jobs and exited lower-margin operations, including private-label diapers and personal protective equipment, reinforcing margin stability.

Building on that leaner base, Kimberly-Clark has expanded its affordable lineup, offering lower-priced products that still carry premium features and brand equity. At the same time, it has advanced its transformation through a $48.7 billion deal for Tylenol maker Kenvue Inc. (KVUE), expected to close by year-end and redefine its long-term strategic direction.

Looking ahead to fiscal 2026, which ends in December, analysts forecast diluted EPS of $7.06, a projected 6.2% decline. Even so, Kimberly-Clark has beaten EPS estimates in each of the past four quarters, establishing a pattern of operational outperformance that tempers concern about near-term pressure.

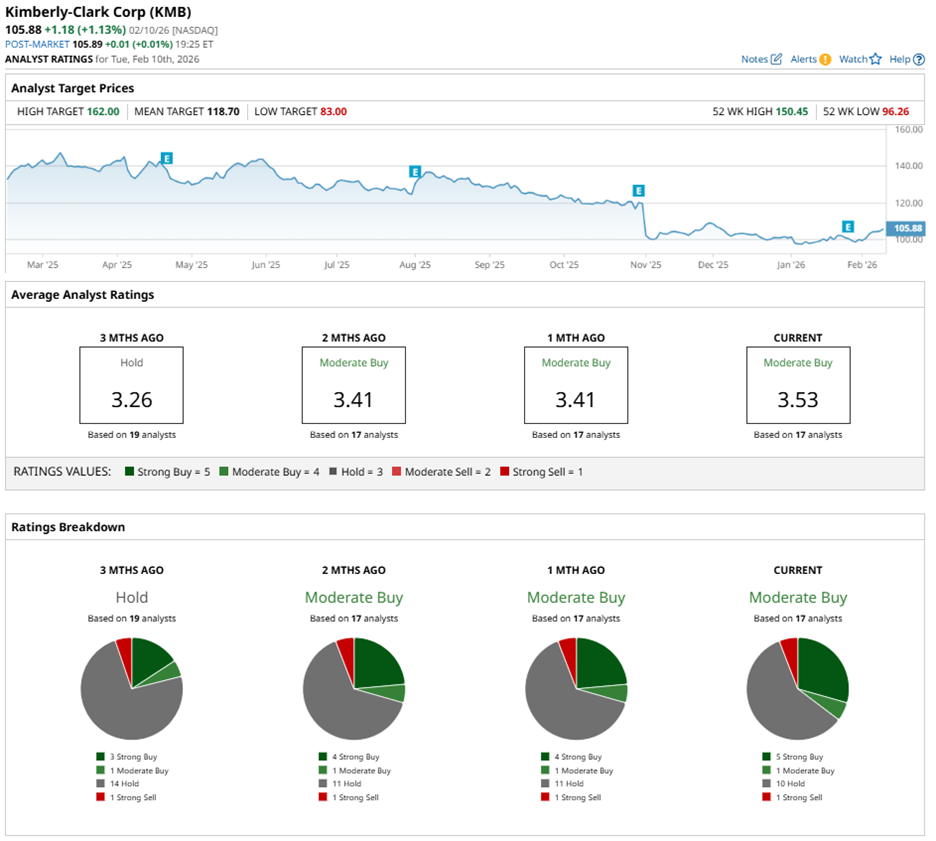

Wall Street sentiment remains firmly supportive, assigning KMB stock an overall “Moderate Buy” rating. Among 17 analysts, five have issued a “Strong Buy” rating, one recommends “Moderate Buy,” 10 advises “Hold,” while one has assigned a “Strong Sell.”

Importantly, analyst sentiment has improved from three months ago, when only three analysts rated it “Strong Buy.”

Encouragingly, analysts continue to express confidence in the company’s long-term trajectory, even as they fine-tune their models. On Jan. 28, Bank of America Corporation (BAC) analyst Anna Lizzul trimmed her price target to $130 from $148 while reiterating a “Buy” rating.

She cited valuation compression across the sector, applying a lower P/E multiple to 2027 EPS estimates. However, she acknowledged steady progress in the company’s transformation plan.

Turning to forward expectations, analyst targets provide a concise gauge of sentiment. KMB’s average price target of $118.70 implies potential upside of 12.1%. Meanwhile, the Street-high target of $162 suggests a gain of 53% from current levels.