/Dexcom%20Inc%20HQ-by%20JHVEPhoto%20via%20Shutterstock.jpg)

With a market cap of $26.6 billion, DexCom, Inc. (DXCM) is a medical device company that designs, develops, and commercializes continuous glucose monitoring (CGM) systems for diabetes and metabolic health management in the United States and internationally. It offers products such as Dexcom G6, Dexcom G7, Dexcom ONE, and Stelo, serving patients, caregivers, and clinicians worldwide.

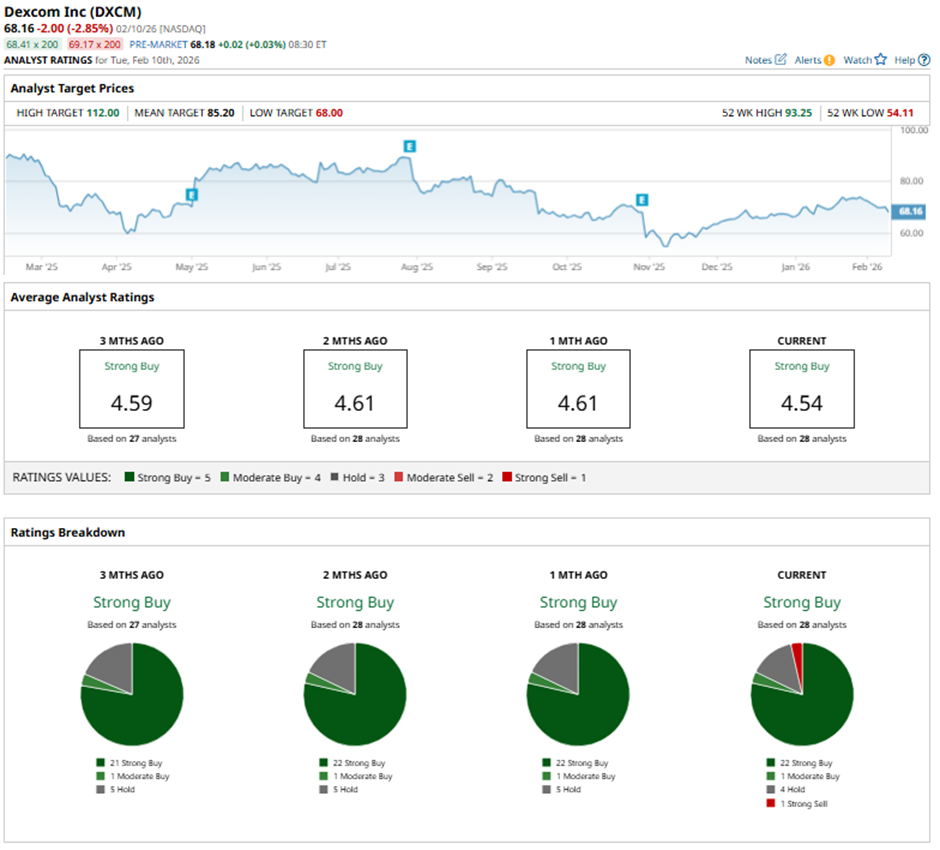

Shares of the medical device company have underperformed the broader market over the past 52 weeks. DXCM stock has declined 22.8% over this time frame, while the broader S&P 500 Index ($SPX) has gained 14.4%. However, the stock has risen 2.7% on a YTD basis, slightly outpacing SPX's 1.4% gain.

Further, shares of the San Diego, California-based company have also lagged behind the State Street Health Care Select Sector SPDR ETF's (XLV) 6.2% rise over the past 52 weeks.

Despite reporting stronger-than-expected Q3 2025 adjusted EPS of $0.61 and revenue of $1.21 billion on Oct. 30, 2025, DexCom shares tumbled 14.6% the next day. Investor sentiment weakened after the company cut its 2025 adjusted gross margin guidance to ~61% from 62%. The sell-off was compounded by management’s decision not to issue 2026 guidance, with commentary suggesting growth could come in below Street expectations, heightening worries over longer-term growth and D7 product execution risks.

For the fiscal year that ended in December 2025, analysts expect DXCM's adjusted EPS to increase 26.2% year-over-year to $2.07. The company's earnings surprise history is mixed. It beat the consensus estimates in two of the last four quarters while missing on two other occasions.

Among the 28 analysts covering the stock, the consensus rating is a “Strong Buy.” That’s based on 22 “Strong Buy” ratings, one “Moderate Buy,” four “Holds,” and one “Strong Sell.”

On Jan. 20, TD Cowen analyst Josh Jennings reaffirmed a “Buy” rating on DexCom and maintained a price target of $84.

The mean price target of $85.20 represents a premium of 25% to DXCM's current levels. The Street-high price target of $112 implies a potential upside of 64.3% from the current price levels.