Datadog, Inc. (DDOG), headquartered in New York, operates an observability and security platform for cloud applications. Valued at $39.2 billion by market cap, the company offers cloud-based monitoring and analytics platform which integrates and automates infrastructure monitoring, application performance monitoring, and log management for real-time observability of customers.

Shares of this cloud monitoring giant have underperformed the broader market considerably over the past year. DDOG has declined 22.9% over this time frame, while the broader S&P 500 Index ($SPX) has rallied nearly 14%. In 2026, DDOG stock is down 17.9%, while the SPX is up 1.3% on a YTD basis.

Narrowing the focus, DDOG has also lagged behind the SPDR S&P Software & Services ETF (XSW). The exchange-traded fund has declined about 21% over the past year. Moreover, the ETF’s 16.9% losses on a YTD basis outshines the stock’s dip over the same time frame.

DDOG's drop is due to fears that AI agents from Anthropic and OpenAI might disrupt traditional software, making specialized apps like Datadog mere features within broader AI platforms.

For the current fiscal year, ended in December 2025, analysts expect DDOG’s EPS to decline 12.8% to $0.41 on a diluted basis. The company’s earnings surprise history is impressive. It beat or matched the consensus estimate in each of the last four quarters.

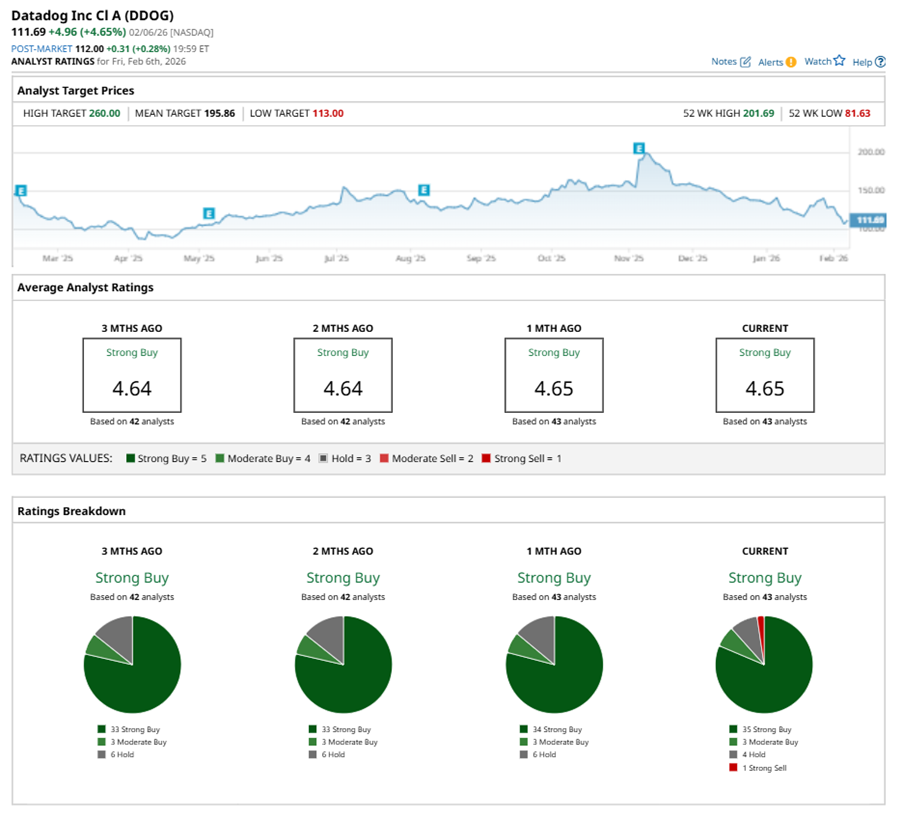

Among the 43 analysts covering DDOG stock, the consensus is a “Strong Buy.” That’s based on 35 “Strong Buy” ratings, three “Moderate Buys,” four “Holds,” and one “Strong Sell.”

This configuration is more bearish than a month ago, with no analyst suggesting a “Strong Sell.”

On Feb. 6, Cantor Fitzgerald kept an “Overweight” rating on DDOG and lowered the price target to $150, implying a potential upside of 34.3% from current levels.

The mean price target of $195.86 represents a 75.4% premium to DDOG’s current price levels. The Street-high price target of $260 suggests an ambitious upside potential of 132.8%.