/Airbnb%20Inc%20logo%20with%20red%20background%20by-%20viewimage%20via%20Shutterstock.jpg)

Valued at a market cap of $79.6 billion, Airbnb, Inc. (ABNB) is a platform that enables hosts to offer stays and experiences to guests. The San Francisco, California-based company enables individuals to rent homes, apartments, and alternative lodging across more than 190 countries.

This travel services company has lagged behind the broader market over the past 52 weeks. Shares of Airbnb have gained marginally over this time frame, while the broader S&P 500 Index ($SPX) has surged 15.5%. Moreover, on a YTD basis, the stock is down 3.3%, compared to SPX’s 1.9% return.

Narrowing the focus, ABNB has also underperformed the State Street Consumer Discretionary Select Sector SPDR ETF (XLY), which soared 5.1% over the past 52 weeks and 2.1% on a YTD basis.

ABNB reported its Q3 results on Nov. 6, and its shares surged marginally in the following trading session. The company’s overall revenue increased 9.7% from the year-ago quarter to $4.1 billion, coming in line with analyst estimates. Other key business metrics also remained strong, with Gross Booking Value (GBV) rising 13.9% to $22.9 billion and Nights and Seats Booked increasing 8.8%, supported by strong demand in the U.S. and the rollout of new offerings such as Reserve Now, Pay Later. However, while its net income per share also increased 3.8% from the prior-year quarter to $2.21, it fell short of the consensus estimates.

For the current fiscal year, ending in December, analysts expect ABNB’s EPS to grow 1% year over year to $4.15. The company’s earnings surprise history is mixed. It exceeded the consensus estimates in two of the last four quarters, while missing on two other occasions.

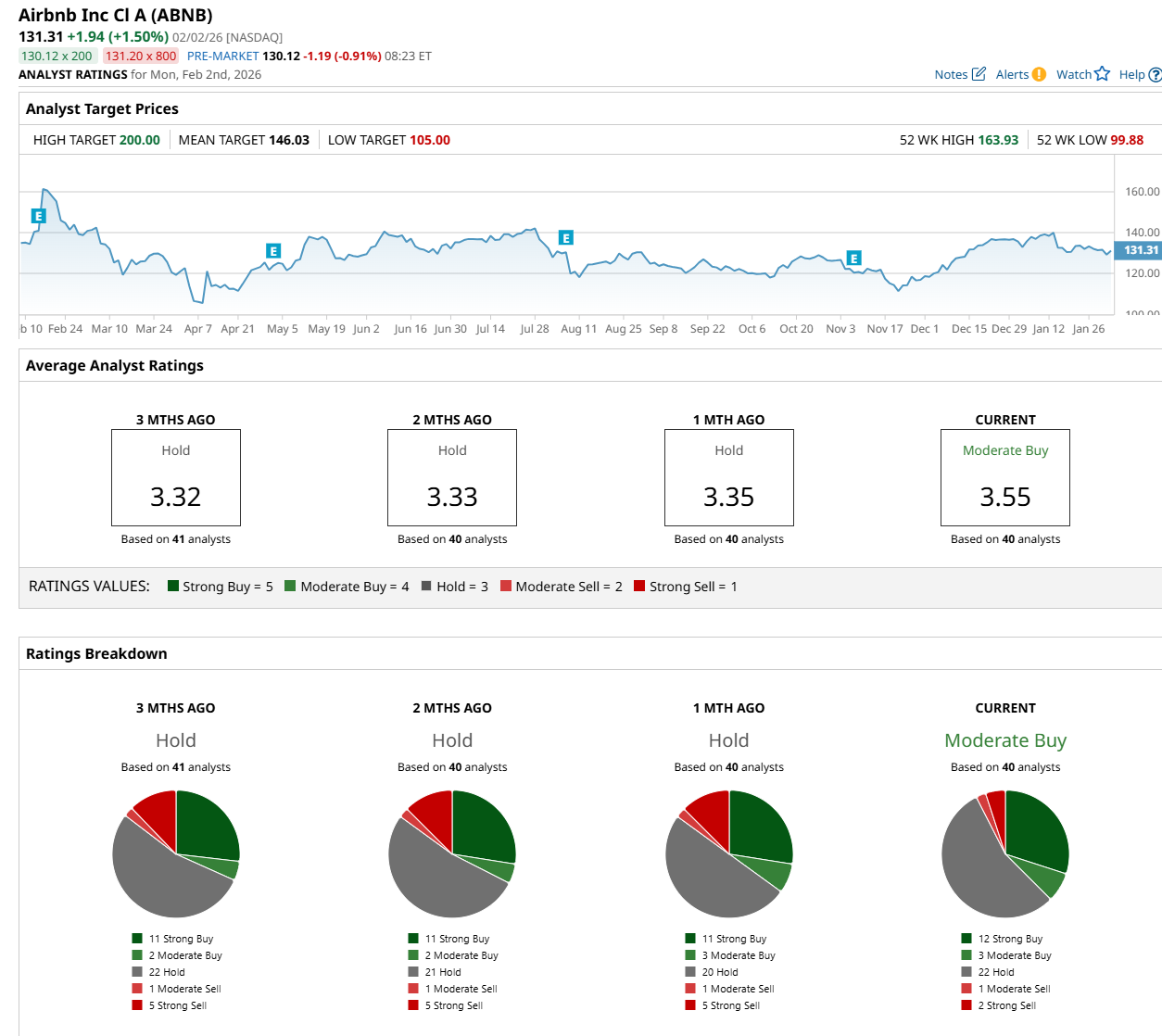

Among the 40 analysts covering the stock, the consensus rating is a "Moderate Buy,” which is based on 12 “Strong Buy,” three "Moderate Buy,” 22 “Hold,” one "Moderate Sell,” and two “Strong Sell” ratings.

The configuration is more bullish than a month ago, with an overall “Hold” rating, consisting of 11 "Strong Buy” and five “Strong Sell” ratings.

On Jan. 29, AllianceBernstein Holding L.P. (AB) analyst Richard Clarke maintained a “Buy” rating on ABNB and set a price target of $162, indicating a 23.4% potential upside from the current levels.

The mean price target of $146.03 represents an 11.2% premium from ABNB’s current price levels, while the Street-high price target of $200 suggests a 52.3% potential upside from the current levels.