What Are Same-Store Sales?

Same-store sales, or comparable-store sales, are an important metric in the retail industry used to gauge whether customers continue to make purchases at stores that have been operating for at least 12 months.

While many companies describe same-store sales based on stores that have been open for at least 12 months, the comparable sales data use 13 months—based on the current month and prior 12-month period. Some companies use a longer duration, extending the timeframe to as long as 18 months.

Same-store sales was a term that originally focused on department stores, but it is also applicable to other industries and has taken on different names in different sectors. Fast-food companies, for example, are constantly adding new stores in the U.S. and globally, and most refer to their metric as same-restaurant sales.

Why Are Same-Store Sales Important?

Same-store sales can indicate whether foot traffic to their stores is increasing. While a company may open many new stores from one month to the next, comparing sales based on stores that have been operating for at least a year can show organic growth. This prevents the number from getting distorted by newer stores that generated disparate sales from a company's core average. It keeps the comparison apples-to-apples.

The sales data can also be viewed as an economic indicator. Higher same-store sales figures for many companies suggest that consumers have more disposable income and are spending that money to buy clothes, shoes, fast food, electronics, and other items. Investors and analysts tend to look at same-store sales as a leading indicator on potential spending habits of consumers.

When Are Same-Store Sales Data Released?

Companies typically release their same-store sales data for the previous month or quarter on a monthly or quarterly basis. For example, January sales data tend to be released around the first week of February. For the quarter that ends in March, sales performance data are usually released sometime in April, when a company releases its quarterly financial statement.

How Are Same-Store Sales Data Compiled?

Sales at a company’s stores that have been opened for at least a year are compiled and are calculated on a year-over-year basis at the end of each month or quarter.

How to Interpret Same-Store Sales

Comparing same-store sales of companies in the same industry is preferable to comparing those from stores in different industries. These can be clothing retailers, electronics sellers, and fast-food restaurant operators. A strong sales result could show that a company’s strategy is working, be it in marketing a new line of products or services, opening new stores, cutting back on expenses, hiring new employees, or whatever operation it may be. Weak sales could also result as a backlash to those actions and others—opening too many stores at the same time, introducing a product line that was costly to market and had a poor reception, or bad timing.

Like with retail sales, sales at comparable stores for many companies would spike during certain times of the year, such as during the Christmas holiday season and just before the start of the school year.

Same-Store Sales Example: Wendy’s (NYSE: WEN)

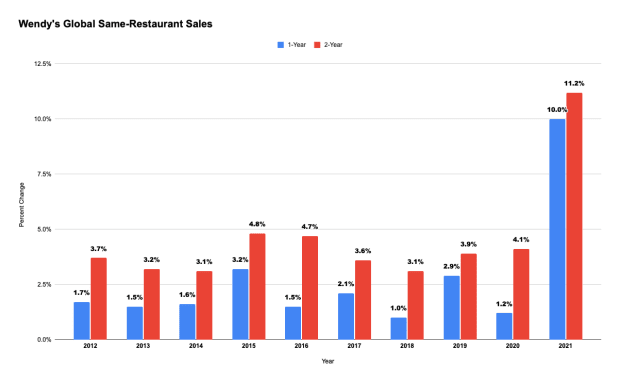

Below is a graph of the same-restaurant sales for Wendy’s. The fast-food operator embarked on a strategy involving opening new stores in the U.S. and other countries, and it also introduced a new breakfast menu.

The company opened new stores over several years, but the spike in same-restaurant sales didn’t happen until 2021. Wendy’s compiles its same-store sales data based on outlets that have been open not only for one year but also for two years. The comparison shows that two-year sales growth has always outpaced one-year sales growth, indicating that longer-term sales growth is strong and new customers continue to flock to its restaurants.

How Does the Stock Market React to Same-Store Sales?

A strong same-store sales report for a company might lead to a higher stock price, while a weak one might drag down its share price. Still, it’s only one part of a company’s operational performance. Other company measures, such as revenue and profit, also affect the price of a stock.