What is a meme stock?

The term “meme stock” refers to any stock that, for some reason or another, has gained a frenzied following of retail investors, often due to its status as an “underdog” in the market. Meme stocks are discussed heavily on social media—especially Reddit and X (formerly Twitter)—where amateur investors come together to share research and theories about which struggling stock might be the next one to go “to the moon.”

Many meme stocks are companies with declining cultural relevance in the digital age (e.g., retail stores) whose stock prices have been beaten down by short sellers betting on their demise. A large part of meme stock culture is the idea that retail traders can use their collective influence to “stick it to the man” by pumping up the value of stocks that have been heavily shorted by large, institutional investors like hedge funds.

Why are meme stocks called meme stocks?

Meme stocks derive their name from the concept of a meme, which is a visual joke or comic shared widely on social media. And much like memes that explode in popularity on social media apps, meme stocks, too, tend to “go viral,” experiencing drastically increased trading volume and volatility once being brought into the limelight on social media by speculative retail traders.

A short history of meme stocks and their rise to prominence

While the meme stock phenomenon has no agreed-upon start date, most investors and analysts point toward 2020’s COVID-19 lockdown era as the breeding ground for the phenomenon, which has since become a major force in the stock market. At the time, the now-infamous “stonks” meme (above) had been circulating on Facebook, Reddit, Twitter (now X), and elsewhere for a year or two, and a new generation of stimulus-check-fueled retail investors with nothing but free time and fee-free trading apps had taken its bold and irreverent message to heart.

r/WallStreetBets: The meme-stock breeding ground

The nexus of this growing community was a Reddit messageboard called r/WallStreetBets, a speculative, crass, and reckless cousin of traditional investing subreddits like r/stocks and r/investing. The subreddit’s users (known within the community as “apes”) encourage and applaud risky investment moves known as “YOLOs” (you only live once), in which users bet large amounts of money (like their entire retirement savings) on a single stock, or even on derivative securities like options contracts.

As time passes, those who YOLOd their savings eventually post the results of their big bets, usually in the form of screenshots from their investment apps showing massive losses (or, less commonly, massive gains). These screenshots are known colloquially among the r/wallstreetbets community as “loss p*rn” and “gain p*rn.”

It’s important to note, however, that despite the community’s endorsement of incredibly risky trades (and its widespread use of politically incorrect terminology), many of the messageboard’s users are dedicated traders who conducted in-depth stock market research (known in the community as DD, or due diligence) and explained the reasoning behind their trades in depth to others on the forum.

Keith Gill and the Gamestop short squeeze saga

The first generation of meme stocks was born out of this non-traditional community of uncouth online retail traders around August 2020. At this time, a user named Keith Gill (known as Roaring Kitty on YouTube and u/DeepF**kingValue on Reddit) posted a video in which he explained that GameStop (NYSE: GME), a brick-and-mortar video game retailer known for operating stores out of shopping malls, was fundamentally undervalued and had the highest short interest of any publicly traded stock at the time, making it ripe for a short squeeze (a rapid rise in price caused by short sellers scrambling to buy shares to cover their short positions) should enough investors buy its stock.

In fact, Gamestop’s short interest was around 140%, meaning that almost 40% more shares had been sold short than even existed as float (publicly available shares). The video gained traction, people took notice, and many investors began buying stock in the struggling retailer. Activist investor and former Chewy.com CEO Ryan Cohen got in on the action and bought a massive amount of GME stock, accumulating over 10% of the company’s shares by November 2020 and joining its board soon after. This, combined with the buying action of Reddit’s army of retail investors, caused the stock’s price to rise rapidly.

As Gamestop’s stock continued to rise in price, hedge funds began to buy large volumes of shares to cover their positions, much like Gill had predicted. This took time because more shares were sold short than were available, and in the interim, both institutional and retail investors were pressing the buy button left and right, causing demand to far outweigh supply and sending the stock’s price skyward.

GME eventually reached a high of nearly $500 per share (after starting from a low of around $5 at the time of the release of Gill’s video), marking the peak of the meteoric short squeeze that made “meme stocks” a household term.

During and after the GME short squeeze, a number of other meme stocks emerged, and some experienced short squeezes of their own, although none were as drastic as Gamestop’s. Other meme stocks popularized during and after 2020 included theater operator AMC, software company BlackBerry, and struggling brick-and-mortar retailer Bed Bath & Beyond, all of which, like Gamestop, were considered by most of Wall Street to be “past their prime.”

A guide to meme-stock lingo

Meme stock traders, especially those who frequent r/WallStreetBets, share a unique vernacular that can be difficult to interpret for those who are unfamiliar with the community. The following are some of the most common colloquial words and phrases popularized by the subreddit.

- Apes: The term “apes” refers to meme stock traders who work together to buy and hold heavily shorted stocks to put upward pressure on their prices. “Apes together strong” is a popular anthem among meme-stock holders when encouraging one another to continue to hold onto struggling stocks rather than capitulating.

- Bagholders: A “bagholder” is anyone who has amassed a significant amount of a particular meme stock and stands to benefit should its price rally due to a short squeeze.

- Buy the dip: “Buy the dip” is a phrase used to encourage other apes and bagholders to take advantage of declining meme stock prices by buying more shares when prices fall in order to lower one’s average cost per share.

- DD: “DD,” or “due diligence” refers to research conducted about the fundamental and technical factors that could make a stock a good buy because it is undervalued, ripe for a short squeeze, or both. Many r/WallStreetBets users write up in-depth DD reports and share them on the forum for other users to review.

- Degenerates: Users of WSB often refer to themselves and each other as “degenerates” in reference to their proclivity for gambling large amounts of money on speculative stock trades.

- Diamond and paper hands: “Diamond hands” refers to users who maintain conviction in their chosen meme stocks, refusing to sell even as their prices plummet. “Paper hands” is the concept’s counterpart, used to refer to users who capitulate and sell their meme stocks as prices decline out of fear of additional losses.

- FOMO: FOMO, or “fear of missing out” refers to the action of buyers who are late to hop on a trend, buying into a stock not because of research, but because its price is rising and they don’t want to miss out on gains should it continue to do so.

- Gain and loss p*rn: “Gain and loss porn” refer to screenshots posted by retail investors that show the decline or increase in value of a previously initiated position in a stock. Typically, these are posted in r/WallStreetBets as follow-ups to previously shared “YOLO” posts.

- Hold the line: “Hold the line” is a popular imperative shared between community members to encourage one another to maintain their positions in a meme stock whose price is falling.

- Stonks: “Stonks” is a reference to the widely shared meme above and is used in the WSB community to refer to meme stocks and/or stocks in general.

- Tendies: “Tendies,” short for chicken tenders, is a euphemism for the capital gains that could result from a successful stock market play. This term is a somewhat self-deprecating nod to the immature nature of WSB users, as chicken tenders are popularly found on children’s menus.

- To the moon: “To the moon” refers to the massive rise in price users hope will occur should a meme stock they’ve invested in experience a short squeeze (e.g., “I just bought 30 more shares—GME to the moon!”).

- We like the stock: “We like the stock” is a popular collective retort uttered by WSB users in response to any questioning as to the “why” behind their risky investments. Jim Cramer, famed investor and founder of TheStreet, repeated the phrase on air during a late January episode of CNBC's "Halftime Report" in 2021 amid the height of the GME short squeeze.

- YOLO: “YOLO,” which stands for “you only live once,” is a popular phrase used to explain the rationale behind unusual or risky decisions. The WSB community adopted it to refer to large investments in a single company—essentially “all-in” style bets, usually on a popular meme stock.

How much influence does r/wallstreetbets have in the stock market?

It is difficult to quantify exactly how much influence an online community has on the price movements of securities that are traded at a massive scale on a daily basis, but Wall Street certainly took notice when Reddit’s mob of retail investors nearly toppled some of its largest players during the GameStop short squeeze.

Overall, hedge funds that had shorted Gamestop lost at least $10 billion over the course of the squeeze as a result of the collective efforts of r/WallStreetBets users and the loosely associated diaspora of GME retail investors. Melvin Capital, a large hedge fund that had a particularly large short position in GME, lost around $6.8 billion over the course of the meme stock rally.

It’s clear that in the digital age, retail investors have more market influence than ever before. Between fee-free trading apps like Robinhood and online communities like Reddit where amateur investors can share information and learn how to analyze stocks, institutional investors are more weary than ever of the threat that a loose collective of everyday investors could pose to their bottom line.

Interestingly, a 2022 study published by the Lund University School of Economics and Management failed to yield a statistically significant correlation between the sentiment of WSB users and the returns of the forum’s 10 most-discussed stocks.

This certainly doesn’t mean that the group lacks material influence, however. Analyzing the sentiment of an irreverent online community is far from an exact science, and even if there was a reliable way to do so, countless factors influence the movements of stock prices, so isolating the influence of any single factor isn’t a particularly realistic goal.

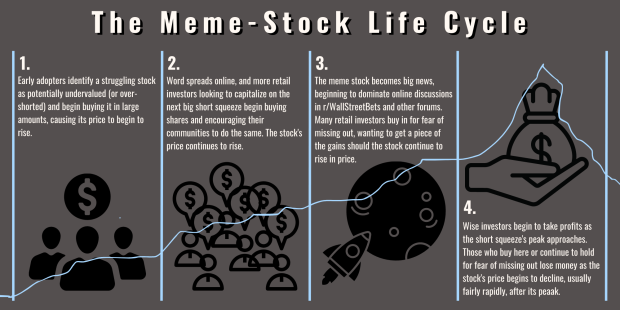

The meme-stock short-squeeze life cycle

Meme stock short squeezes typically have four general phases:

- During the “early adopter” phase, certain investors identify a stock they believe is undervalued, over-shorted, and could be ripe for a squeeze. They begin investing large amounts in it, potentially causing the price of the stock to rise.

- During the “information-sharing” phase, other retail traders with an ear to investing messageboards learn about the case for the stock and begin buying shares and spreading information online, encouraging others to do the same.

- During the “FOMO” phase, the meme stock gains widespread popularity online and possibly even in the news. A herd mentality develops, and more casual retail investors begin buying in as the price continues to rise for fear of missing out on large gains.

- During the “peak” phase of the squeeze, prudent investors begin taking profits and exiting their positions to lock in their gains. The earlier they bought in, the more they stand to make. Less prudent investors hold their positions or continue buying based on encouragement from other traders and the fear of missing out on additional gains should the stock’s price continue to skyrocket. The stock hits its peak and begins to drop in price relatively rapidly, decimating the gains of those who remain invested. Capitulation occurs as more traders liquidate their positions to minimize their losses.

Are meme stocks good investments?

Meme stocks aren’t necessarily good or bad investments. The premise of most meme stocks is that they are undervalued and over-shorted despite decent fundamentals, but this premise fails to take their fading cultural, societal, and technological relevance into account. Large, institutional investors tend to be focused on the future value of securities, which is why they tend to short (bet against) stocks with seemingly bleak outlooks.

Additionally, meme stocks are notoriously volatile, and timing their ups and downs can be very difficult. High volatility can translate to sizeable short-term gains, which makes them attractive to active traders. For more casual, long-term investors, however, meme stocks probably aren’t the best portfolio fodder, as their price increases don’t tend to last long, and their risk tends to outweigh their upside potentiaal.

For active, risk-tolerant traders who enjoy examining technical indicators and have plenty of time to watch the market and react quickly to new data, meme-stock trading can produce significant gains. That being said, past performance is never a guarantee of future results, so any traders considering betting big on the next WSB meme stock phenomenon should tread carefully.

What meme stocks are trending now?

Traders interested in meme stocks who want to keep tabs on what’s popular on r/WallStreetBets can examine ApeWisdom’s list of WSB’s current favorite tickers.