What Are Housing Starts?

Housing starts are a monthly measure of the construction of new, privately owned homes across the U.S. They are part of a report on surveys conducted and compiled by the U.S. Census Bureau and the U.S. Department of Housing and Urban Development (HUD) to highlight housing activity. Other important types of data in the New Residential Construction report include building permits and housing completions.

After local, county and state governments approve and issue building permits—be it for single-family or multifamily units—contractors typically begin construction on new homes, and those become housing starts. The Census Bureau and HUD release data on single-family homes and buildings with multiple units, and it also includes new construction in areas where building permits are not required. The data, however, do not include publicly owned, or government-built, housing.

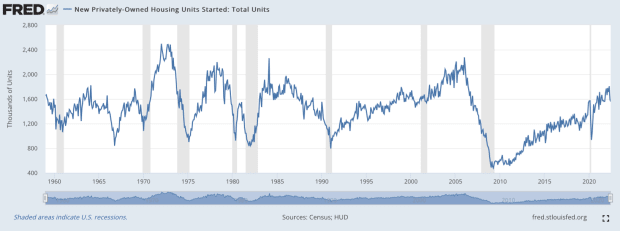

Housing starts are among the oldest data collected on the construction of new homes, going back to 1959. The collection period for the data lasts from the first day after the reporting month until the seventh working day. For example, for January housing starts, the survey collection would begin on February 1.

Why Are Housing Starts Important?

Housing accounts for a significant portion of investment spending by American households and overall economic activity. In a strengthening economy, Americans feel they have more income to spend and are likely to make purchases on new homes, and they are less likely to do so under a weakening one. U.S. government data, as of 2021, pointed out that at the individual level, about 65 percent of occupied housing units are owner occupied.

As such, housing has a significant impact on other industries, including labor, construction, raw materials, banking, and real estate. Data on housing starts allow manufacturers to plan production, insurers to adjust their rates, and banks to allocate funds for mortgages. When a property developer eyes green spaces to build a housing community, it’ll turn to lenders to help finance construction, and then list homes up for sale with realtors.

New homeowners aren’t likely to pay for a new home in full, but they’ll make a down payment and take out a mortgage to pay for the remainder. Homes require lumber and cement for the foundation, and copper tubes for plumbing, all of which must be built or installed by tradespeople. Housing starts offer a view into the state of economic activity and Americans’ wealth.

Are Housing Starts a Leading Indicator?

Housing starts are viewed as a leading indicator of the economy. Government agencies and the Federal Reserve use data on “privately owned housing units authorized by building permits” in evaluating the condition of the economy. A period of decline in housing starts could suggest that the economy might be headed into recession, while a steady increase could mean that the economy is on track for growth.

Housing starts are sensitive to changes in interest rates. When the Fed tightens monetary policy,mortgage rates rise, which can suppress demand for homes. Developers can become wary of constructing new homes, leading to fewer building permits and housing starts. Lower rates, on the other hand, encourage consumers to take out loans and buy new homes.

Below is a graph of housing starts between January 1959 and June 2022:

When Are Housing Starts Released?

Housing starts are released around the middle of each month, on the 12th working day, at 8:30 a.m. ET by the Census Bureau and HUD. The formal title of the press release is Monthly New Residential Construction, followed by reporting month. The two agencies also release data on a quarterly and annual basis, and previously released data is sometimes revised and updated.

Upcoming Release Dates for Housing Starts

How Do Financial Markets React to Housing Starts?

Investors and analysts compare the latest report to previous data, be it monthly, quarterly or yearly, and some tend to focus on housing starts for single-family residences. Increases in housing starts can bode well for shares of property developers, construction materials manufacturers, home repair and furnishing retailers, and mortgage providers.

Still, sharp increases might cause some to worry about a sudden pick-up in inflation and a stronger pace in economic growth, and that could lead to lower bond prices. Monthly decreases in housing starts, on the other hand, might be a negative for stocks and ease bond investors’ concerns about inflationary pressures.

Investors and analysts may also combine new home sales and previously owned home sales data with housing starts for an overall analysis on housing since the home sales data reflect housing prices. Home purchases are considered an important part of the U.S. economy and represent families’ and individuals’ long-term financial obligation.