The wealthiest 1 per cent would get an average tax cut of £1m if the inheritance tax is scrapped, the Institute for Fiscal Studies has said.

According to an IFS report, the cost of abolishing inheritance tax would be £7bn, with the wealthiest benefitting from an average tax cut of around £1.1m.

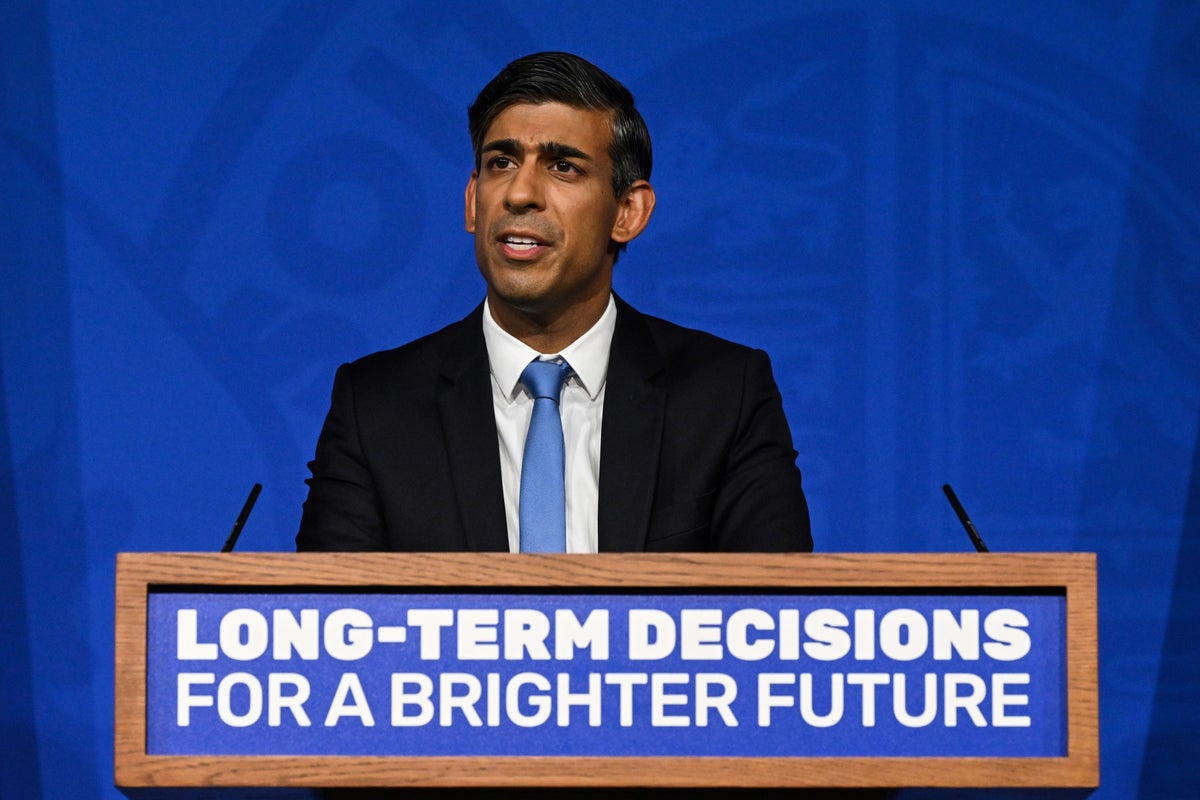

The findings come as Rishi Sunak is understood to be considering a cut to inheritance tax as he seeks to woo voters ahead of the general election.

The prime minister is planning to phase out the levy by reducing the 40 per cent inheritance tax rate in the budget in March, while setting out a pathway to abolish it completely in future years, the Sunday Times reported.

According to the most recent HMRC statistics, less than four per cent of estates paid inheritance tax in 2020–21. However, the rapid growth in wealth among older individuals means this number is set to rise to over seven per cent by 2032–33.

The statistics also show one in eight people will have inheritance tax due either on their death or their partner’s death by 2032–33.

The IFS projected inheritance tax revenues will grow from £7bn to £15bn in a decade’s time as more people pay the tax, meaning scrapping it would have financial implications.

There has been pressure within the Tory party to change or scrap IHT, with former prime minister Liz Truss among those calling for it to be axed. But Labour questioned how such a move would be paid for, and whether it would be fair.

Labour’s shadow Treasury chief secretary Darren Jones criticised the proposals for the tax to be axed, calling it an “unfunded tax cut.”

He said: “A year ago Liz Truss trashed the economy with unfunded tax cuts.

“Now Rishi Sunak is doing what Liz Truss wants.

“Abolishing inheritance tax – which 96 per cent of people never pay – is an unfunded tax cut of £7.2bn per year.”

David Sturrock, a Senior Research Economist at IFS, said: “As inheritances grow in size, it’s increasingly important that we address problems in the current system. The government should abolish the special treatment given to business assets, certain types of shares, agricultural assets, pensions and homes passed to direct descendants.

“These exemptions and reliefs open up channels to avoid inheritance tax. This is costly, unfair and distorts economic decisions. Reforming them could raise as much as £4.5bn in additional revenue.”

Meanwhile, Mark Franks, Director of Welfare at the Nuffield Foundation, said cutting inheritance tax would raise the national debt.

He said: “Inheritance tax is paid after death and by only a small proportion of the population, who are largely the wealthiest members of society. Like all taxes, it supports vital public services.

“Abolishing it or scaling it back would mean either cutting such services, raising other taxes or increasing the national debt. Yet, the current design of inheritance tax compromises both confidence in it and its ability to generate revenue effectively. Through practical reforms, it is possible to craft a more just and efficient system.”