Britons struggling to heat their homes and feed their children because of the cost of living crisis have urged new prime minister Liz Truss to act now.

Leading health experts have warned that millions of households in the UK are facing a “significant humanitarian crisis” due to soaring energy bill costs and say more people will die this winter because they can’t afford to heat their homes.

In her victory speech, Ms Truss pledged to “deliver a bold plan to cut taxes and grow our economy” as well as “dealing with people’s energy bills”.

Truss’s ascent to the top job comes in the face of double-digit inflation and an economy heading into a potentially lengthy recession.

Have you been affected by the cost of living crisis? If so email chiara.giordano@independent.co.uk

As the forecasts paint an increasingly grim picture, people are reducing the amount they eat, abandoning their studies and closing their businesses as reality takes hold.

One man, 61, told The Independent he could afford to eat only one meal a day, while a student said she feared she might not be able to afford to finish her studies, but would “rather freeze and not eat than not pay my tuition”.

And a cafe owner in Leicester, who barely scraped through the coronavirus pandemic, warned that she faced closing her business because her annual electricity bill had risen to £55,000.

These are their stories:

‘I’m down to one meal a day’

Graeme Hubbard, 61, is having to manage on one meal a day because his universal credit payments only just cover his rent and energy costs.

“I get £250 a month [after housing costs] and that’s why I’ve had to look at what I’m paying out. Credit bills, phone bills, TV, food – I’ve had to sacrifice quite a lot at the moment,” he told The Independent.

There was a five-week delay while he was switched to universal credit payments after he lost his welding job during the pandemic, so he was forced to take out a loan to cover the delay, putting him £1,000 in debt.

He said: “I’m down to one meal a day now. I buy the yellow-label products in Asda and I get cheap cuts of meat, like bacon, and tins of haricot beans and lentils. I try to eat healthy for that meal, so no sugar or sweeteners – just plain fresh veg, some meat and some salads.

“I’ve crashed in weight from around 160 pounds to around 125. My diabetes has actually improved because I’ve cut out processed food, but I’ve got to go hungry for 23 hours of the day.”

‘I’d rather freeze and not eat than not pay my tuition next month’

Tana Randle is about to start a master’s degree at Royal Holloway, University of London. But the 21-year-old is not completely sure she will be able to finish it.

She is from a low-income family, estranged from her parents and relies on a zero-hours contract job that brings in between £100 and £400 a month. More support with soaring energy bills and a cap on rental prices would give her more security. In the meantime, she is worried there could be stark decisions down the line.

“I’d much rather freeze and not eat than not pay my tuition next month,” the classical art and archaeology student toldThe Independent.

“If it comes to it, I’ll just have to drop out of my master’s and find a full-time job. I don’t want to do that,” she said.

Soaring rents and energy bills are a worry and are something she believes there needs to be more help with.

‘My cafe’s electricity bill has gone from £10,000 to £55,000’

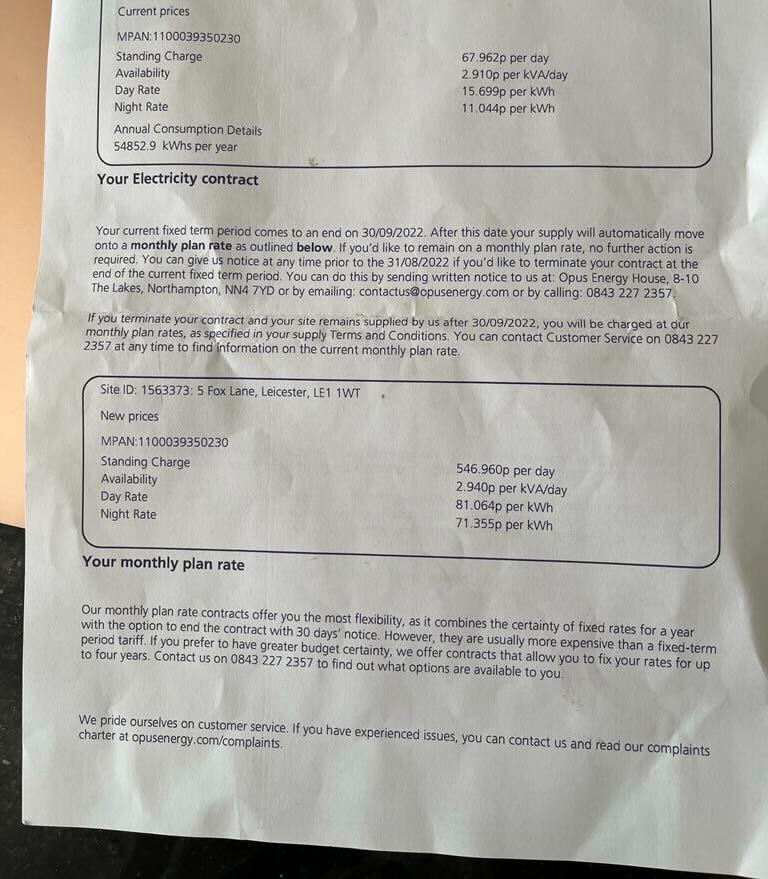

Janet Gillbanks is facing the prospect of closing her cafe in Leicester only two years after it opened.

The cafe barely survived the pandemic, but soaring energy costs will see her electricity bill go from £10,000 a year to more than £55,000, putting the shop and its seven employees at risk.

“We haven’t got a prayer,” Ms Gillbanks said. “It’s madness.

“You can’t make that money on cups of coffee; you can’t charge £10 for a cup of coffee – we’re in a mess,” she added. “We don’t know what to do; we don’t know where to turn.”

Correspondence with Ms Gillbanks’ energy supplier shows her standard rate – the fixed amount paid regardless of energy use – will rise from 67p a day to £5.50 this autumn.

She said cuts to electricity by using the dishwasher at a lower temperature and decommissioning the cafe’s walk-in fridge could save only £5,000 at best.

“It’s heartbreaking,” she said.

Ms Gillbanks said that, although the government helped keep businesses going through Covid, they needed more help now.

‘I’ve only got a finite amount of money’

By his own admission, Terry Cope will not be one of the worst affected by the astronomical rise in energy bills this October.

But the fact that the retired operations director will be pushed into fuel poverty in a few weeks’ time highlights just how far-reaching the cost of living crisis is.

The father of three, from Leicester, said his gas and electricity costs were set to rise to £5,200 a year, meaning 31 per cent of his combined state and small work pension would be spent on bills.

“I’m quite anxious about it,” he said of the looming price hike. “I’ve always had a good income in the past, but it is concerning. I’ve got a finite amount of money now.”

He said his “thrifty” family never spent lavishly, rarely going out for meals, but they would now have to scale back on those small pleasures.

Mr Cope said he believed the financial assistance announced by the government so far did not go far enough and called for another windfall tax on oil and gas giants.

‘I’m hiding snacks from my children as prices soar’

Mother of two Faith Agnwet started to hide snacks from her children when food prices started to soar, but now she’s cutting back altogether.

Transport costs are also a strain and she will be £60 worse off each month when her five-year-old son goes back to school. She feels there is a lack of help available for the journey.

“We are in a Catch 22 [situation],” she said. “We have to think ‘if I spend money on this in terms of food, I won’t have enough for transport’.”

As someone who receives universal credit, Ms Agnwet is eligible for £650 in cost of living support, but she believes there needs to be a clearer timetable for when further financial support will be available.

‘I’m turning my boiler off every day’

Melissa, a single parent with three children, is turning on her boiler only when she really needs it.

“I had a prepay meter fitted – the other day I looked at it and it told me that I was using £19.22 an hour. I started panicking, so I just turned my boiler off.”

She has a 14-year-old autistic son, Fraizer, who has sensory issues and ADHD, and needs to pay for energy to power the sensory lights he needs. Due to his sensitivities, he changes his clothes frequently, so she is constantly washing items.

“I can’t afford to save for Christmas. I don’t know what’s going to happen for Christmas presents, because all my savings are going on food and utilities,” she said.

“Even just to do a basic shop for me is £70 to £100 a week, which I don’t have. I’ve been topping up my shopping money with savings. Bleach used to be 39p – it’s now 70p. All those little amounts add up in the end.

“I don’t think the government has thought about the fact that families with disabled children can’t afford the huge increases in energy costs.”

‘I’m too scared to turn on the TV’

Paul Harris and his wife were already under financial pressure before bills started to rise after he was left unable to work because of depression and anxiety disorder caused by work-related stress.

But the former property manager said soaring energy costs had “amplified” the couple’s money concerns and his struggle with mental health.

The 42-year-old, who lives in a rental property in Bedfordshire, said he was now “too scared to turn on the TV” and they were considering doing jigsaw puzzles instead to save on electricity.

He told The Independent: “We’ve gone from two salaries to one, which has been a struggle. We’ve been under pressure for a while.

“It puts a lot of pressure on my wife, especially being the sole earner and since she is self-employed.

“That sort of pressure makes me feel like I’m a burden because I can’t contribute, so that makes my mental health worse.”

Mr Harris said the couple were “holding their breath” to see what action the next prime minister would take. But he said he believed the government should do more to help those on benefits by raising them.

Bill calculations ‘too scary’

Bookshop owner Emma Corfield-Walters said her bills had risen so much she was too scared to calculate the exact cost.

The 43-year-old has been the owner of Book-ish in Crickhowell, Wales, since she founded the independent bookshop 12 years ago.

She tweeted that she would need to sell 211 paperbacks at £8.99 just to pay this month’s electricity bill. Most of her sales this week have come from Twitter users buying books in solidarity.

Ms Corfield-Walters said her fixed energy charge was £1,500, which “has pretty much tripled” but she still did not know how much her energy bills would increase once winter began.

“I haven’t done the sums because I find it too scary at the moment,” she said.

“It’s a hugely anxious time for everybody. My team of 20, it’s affecting them, their anxiety and their mental health.”

Additional reporting by Zoe Tidman, Thomas Kingsley, Matt Mathers, Holly Bancroft and Maryam Zakir-Hussain