/Waters%20Corp_%20phone%20logo%20and%20site-by%20T_Schneider%20via%20Shutterstock.jpg)

Waters Corporation (WAT), headquartered in Milford, Massachusetts, offers analytical workflow solutions. Valued at $22.5 billion by market cap, the company designs, manufactures, sells, and services high and ultra-performance liquid chromatography, as well as mass spectrometry (MS) technology systems, and support products, including chromatography columns, other consumable products, and post-warranty service plans.

Shares of this global analytical instrumentation leader have underperformed the broader market over the past year. WAT has gained 14.5% over this time frame, while the broader S&P 500 Index ($SPX) has rallied nearly 17.6%. However, in 2025, WAT stock is up 2.2%, surpassing SPX’s 1.7% rise on a YTD basis.

Narrowing the focus, WAT’s outperformance is apparent compared to the Health Care Select Sector SPDR Fund (XLV). The exchange-traded fund has declined marginally over the past year. However, the ETF’s 7.3% gains on a YTD basis outshine the stock’s returns over the same time frame.

WAT has faced challenges from foreign exchange fluctuations, lower sales volume, and inflationary pressures, which have contributed to its underperformance.

On Feb. 12, WAT shares closed down more than 5% after reporting its Q4 results. Its adjusted EPS of $4.10 surpassed Wall Street expectations of $4.02. The company’s revenue was $872.7 million, topping Wall Street forecasts of $857.1 million. WAT expects full-year adjusted EPS to be between $12.70 and $13.

For fiscal 2025, ending in December, analysts expect WAT’s EPS to grow 8.4% to $12.86 on a diluted basis. The company’s earnings surprise history is impressive. It beat the consensus estimate in each of the last four quarters.

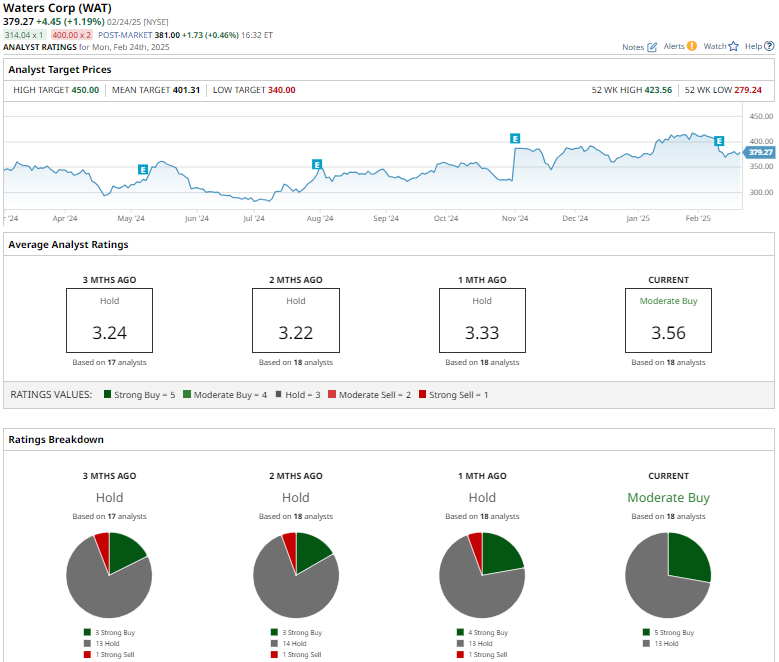

Among the 18 analysts covering WAT stock, the consensus is a “Moderate Buy.” That’s based on five “Strong Buy” ratings, and 13 “Holds.”

This configuration is more bullish than a month ago, with an overall “Hold” rating, consisting four analysts suggesting a “Strong Buy,” and one analyst recommending a “Strong Sell.”

On Feb. 18, Jefferies Financial Group Inc. (JEF) analyst Tycho Peterson reaffirmed a “Buy” rating on WAT with a price target of $435, implying a potential upside of 14.7% from current levels.

The mean price target of $401.31 represents a 5.8% premium to WAT’s current price levels. The Street-high price target of $450 suggests an upside potential of 18.6%.