/Waters%20Corp_%20phone%20logo%20and%20site-by%20T_Schneider%20via%20Shutterstock.jpg)

Waters Corporation (WAT) is a leading scientific instruments company that designs, manufactures, and markets advanced analytical technologies, including high-performance liquid chromatography, mass spectrometry, thermal analysis, rheometry, and related software and consumables used in laboratory research, quality assurance, and industrial applications across life sciences, pharmaceutical, food safety, environmental, and academic sectors. Headquartered in Milford, Massachusetts, Waters has built a global presence with facilities and customers around the world. The company has a market cap of $23.4 billion.

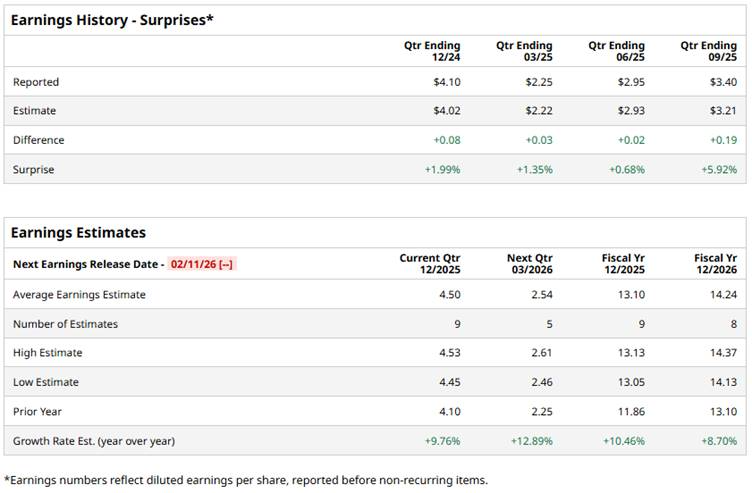

It is expected to announce its fiscal Q4 earnings report soon. Ahead of this event, analysts expect this healthcare company to report a profit of $4.50 per share, up 9.8% from $4.10 per share in the year-ago quarter. The company has a promising trajectory of consistently beating Wall Street’s bottom-line estimates in each of the last four quarters.

For fiscal 2025, analysts expect WAT to report a profit of $13.10 per share, representing a 10.5% increase from $11.86 per share in fiscal 2024. Furthermore, its EPS is expected to grow 8.7% year-over-year to $14.24 in fiscal 2026.

Shares of the company have underperformed the S&P 500 Index’s ($SPX) 18.6% return over the past 52 weeks, and the State Street Health Care Select Sector SPDR ETF’s (XLV) 12.8% uptick with its shares down 2.9% over the same time frame.

Waters Corporation’s stock faced downward pressure largely due to investor concerns around its $17.5 billion merger with Becton Dickinson’s Biosciences & Diagnostic Solutions business. The strategic deal, while aimed at expanding Waters’ market and long-term growth prospects, sparked sell-offs because shareholders were worried about dilution of existing stock, increased debt, and integration risks, which led to sharp share price drops after the announcement.

Additionally, some concerns about the organic growth pace in Waters’ core business contributed to share price declines over the past year.

Wall Street analysts are cautiously optimistic about the stock, with an overall “Moderate Buy” rating. Among 17 analysts covering WAT, eight recommend “Strong Buy,” and nine suggest “Hold.” The mean price target for WAT is $419.44, indicating a 6.7% upside from the current levels.