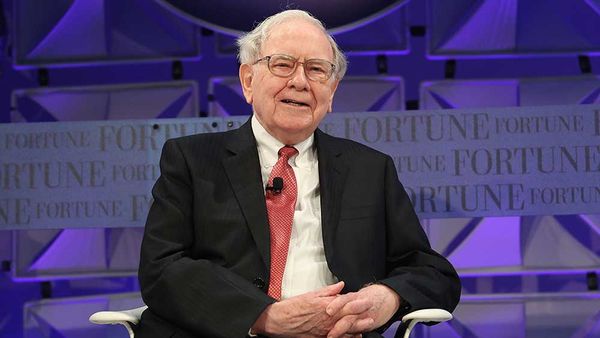

Warren Buffett added more Occidental Petroleum stock to his Berkshire Hathaway portfolio in recent days, as U.S. oil prices skidded to 15-year lows and energy stocks sold off.

Buffett has not been deterred from purchasing OXY shares even as concern about the SVB Financial crash spilled into the oil market this week, sending U.S. oil prices to their lowest level since late 2021 with energy stocks veering lower.

Berkshire Hathaway purchased around 8 million shares of Occidental Petroleum this week, according to a regulatory filing late Wednesday. After the purchases, Buffett now has a 23% stake in the Houston-based energy stock, around 208 million shares.

Warren Buffett made his OXY share buys between Monday and Wednesday at prices ranging from $56-$61 per share. Berkshire Hathaway bought around six million shares of Occidental Petroleum stock earlier in the month. Through the latter half of 2022 Buffett was on an OXY shares buying spree, with the billionaire investor targeting shares in the $57-$61.5 price range.

On Wednesday, U.S. oil futures settled down 5.2% at $67.61 per barrel, prices not seen since December 2021. Energy stocks broadly sold off as the failure of SVB Financial late last week and Signature Bank of New York on Sunday triggered worries other financial institutions could crash.

Occidental Petroleum closed 3.4% lower, at 56.80, on Wednesday. Buffett purchased 1.5 million shares of Occidental Wednesday at prices ranging from $56.66-$57.15.

OXY shares advanced 3.9% to 59.02 Thursday during market trade. Chevron, another Buffett favorite, edged up 0.3% Thursday after ending Wednesday down 4.3%. Berkshire Hathaway owns $27 billion in Chevron stock.

Please follow Kit Norton on Twitter @KitNorton for more coverage.