The main theme for investors right now is how the surge in bond rates made stocks less attractive. This had the S&P 500 (SPY) heading lower which compelled me to write recent commentaries about a term we should all get used to: Rate Normalization.

I am not the only investor fixated on this topic. Howard Marks, the famed money manager from OakTree, believes this theme has multi year effects on the investment landscape. That is a topic we need to dig into further today.

Spoiler Alert: It does darken the appeal of stock investing going forward. The good news is that those aware of the Sea Change can chart a course to outperformance. And that is exactly we will discuss below in today’s Reitmeister Total Return commentary.

Market Commentary

The simplified version of the current investment chain reaction goes like this:

Bond Rates Up > Stocks Down

However, that is just the current dynamic. That is why Howard Marks has gone in depth on the topic in his latest letter to investors: Further Thoughts on Sea Change.

It’s a lengthy read. So let me boil it down for you by expanding on the above chain reaction:

Bond Rates Up > Lower Corporate Borrowing > Slower Economic/Earnings Growth > Stocks Less Attractive > Bonds More Attractive

Why are stocks less attractive?

Because earnings growth is the main catalyst for stock price appreciation. Meaning that once stocks become fully valued in terms of PE...then really the only thing that makes sense to move prices higher is earnings growth. If that is muted...so too is upside potential.

Further, if bond yields are higher, then investors have a very attractive, lower risk alternative to achieve decent rates of return. This dynamic has already been set into motion given the dramatic rise in rates since the spring and accelerated the past couple months.

Note that stocks being less attractive does not equal unattractive. And does not mean bearish.

In essence, it says that investors need to throw out the playbook from the last 40 years as interest rates drop from historically high levels in the early 1980’s to artificially low levels between the Great Recession and Covid crisis. (See chart below).

Once 10 year Treasury rates got under 2%, the playbook was all about TINA: There Is No Alternative...to buying stocks.

Meaning with interest rates at historic lows, then at some point rates would move higher...which hurts bond prices...making bonds a very unattractive investment.

This shifted most asset allocation models to very high percentages in stocks. This helps explain the longest bull market in history from the end of the Great Recession through Covid (but not unfair to say the 3 week bear market in March 2020 barely counts as stocks continued to rise to new heights through the end of 2021).

Again, Howard Marks is saying that the normalization of rates will make bonds more attractive once again and thus stocks less attractive. Yet he goes on to say that those with a superior method of stock selection, especially with an eye towards value, will have a decided edge in the stock market.

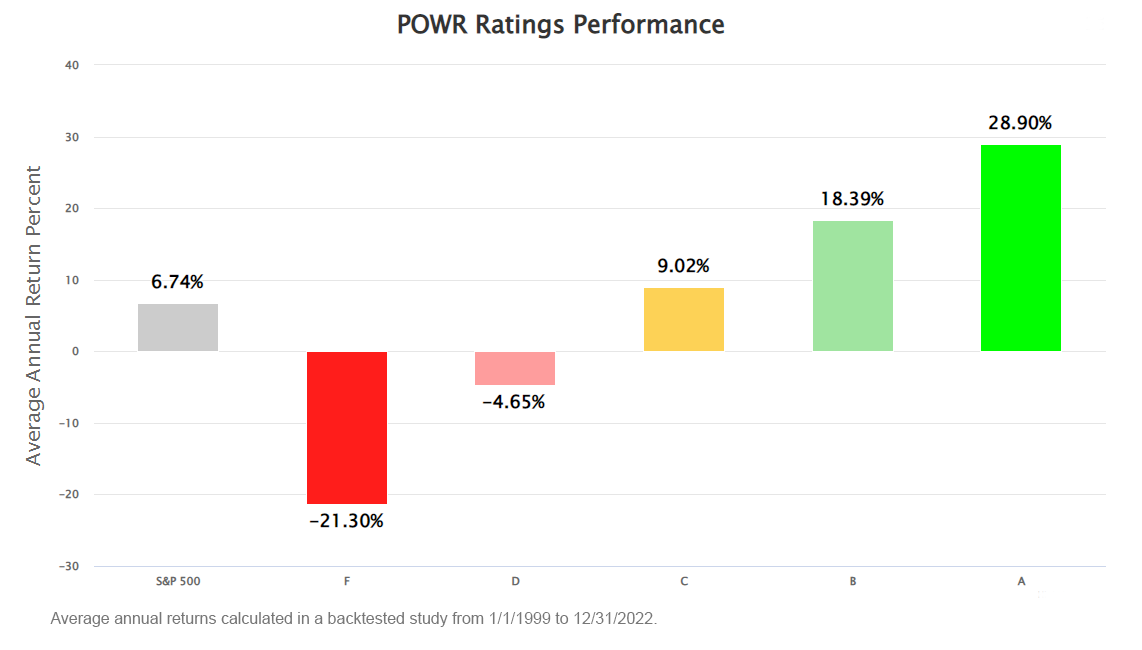

You know what I am going to say next...that our POWR Ratings model focusing on 118 factors that point to stocks to outperform is a decided advantage in our favor. On top of that there is most certainly a value bias in our approach given that 31 of the factors are in the value camp.

Once again, do not take this as a bearish statement from Marks. It is a fair and accurate assessment of the new landscape...which is more akin to historical investment landscapes where higher bond interest rates are an attractive alternative to stocks.

This also explains why I have added bond investments to my newsletter portfolio for the first time since I started doing newsletters back in 1998. On top of that is an strategic allocation to stocks packed to the brim with the outperforming characteristics of the POWR Ratings. That was certainly beneficial today as our portfolio generated a solid return even as the S&P 500 was modestly in the red.

Price Action & Trading Plan

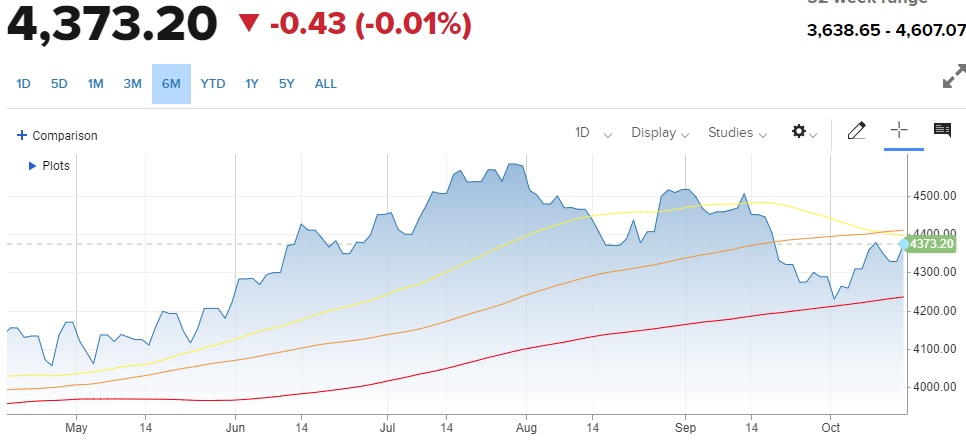

Moving Averages: 50 Day (yellow), 100 Day (orange), 200 Day (red)

It appears that stocks found ample support as we approached the 200 day moving average at the start of October. From there the market has bounced around 4% from recent lows and not taking a run at both the 50 and 100 day moving averages.

Hard to call it overly bullish. Nor is it super bearish. Instead it is rather volatile as the big up and down swings make it hard to feel comfortable in the current environment.

Yet given that the economy is still growing (most estimates north of 3% for Q3) and employment still solid, then much easier to appreciate the long term picture leans bullish.

In the short term we are enduring the realignment to this new world order thanks to higher rates. This may lead to a few more painful periods for stock investors before things settle in. Yet all in all, when you appreciate the fundamental and technical picture, it is still appropriate to be fully invested at this time for whenever the next leg higher ensues.

The key is where to invest. The above conversation helps to strategize that plan. And the section below provides more specifics on the best ETF and stock investments for the time ahead.

What To Do Next?

Discover my current portfolio of 7 stocks packed to the brim with the outperforming benefits found in our POWR Ratings model.

Plus I have added 5 ETFs that are all in sectors well positioned to outpace the market in the weeks and months ahead.

This is all based on my 43 years of investing experience seeing bull markets...bear markets...and everything between.

If you are curious to learn more, and want to see these 12 hand selected trades, then please click the link below to get started now.

Steve Reitmeister’s Trading Plan & Top Picks >

Wishing you a world of investment success!

SPY shares fell $0.27 (-0.06%) in after-hours trading Tuesday. Year-to-date, SPY has gained 15.28%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Steve Reitmeister

Steve is better known to the StockNews audience as “Reity”. Not only is he the CEO of the firm, but he also shares his 40 years of investment experience in the Reitmeister Total Return portfolio. Learn more about Reity’s background, along with links to his most recent articles and stock picks.

Warning: Investors Prepare for “Sea Change” StockNews.com