Forty-two months after a chance golf coupling led to smaller linear media company Discovery Inc. trying to swallow AT&T's much-larger WarnerMedia, the consequences have been laid bare.

Debt-strapped Warner Bros. Discovery's stock fell nearly 9% Thursday to another all-time low, following the troubled media company's disclosure Wednesday that it took a $9.1 billion goodwill impairment charge on its linear TV networks in the second quarter. Simply put, WBD's cable channels' book value didn't match their market value.

Warner stock has lost nearly 40% of its value since the beginning of 2024. Unless it can be reversed by an unlikely legal gambit, it's about to lose its most vital linear programming asset, NBA basketball. And although Warner Bros. Discovery added 3.6 million subscribers in Q2, direct-to-consumer operations swung to a $107 million loss vs. an $86 million profit in Q1.

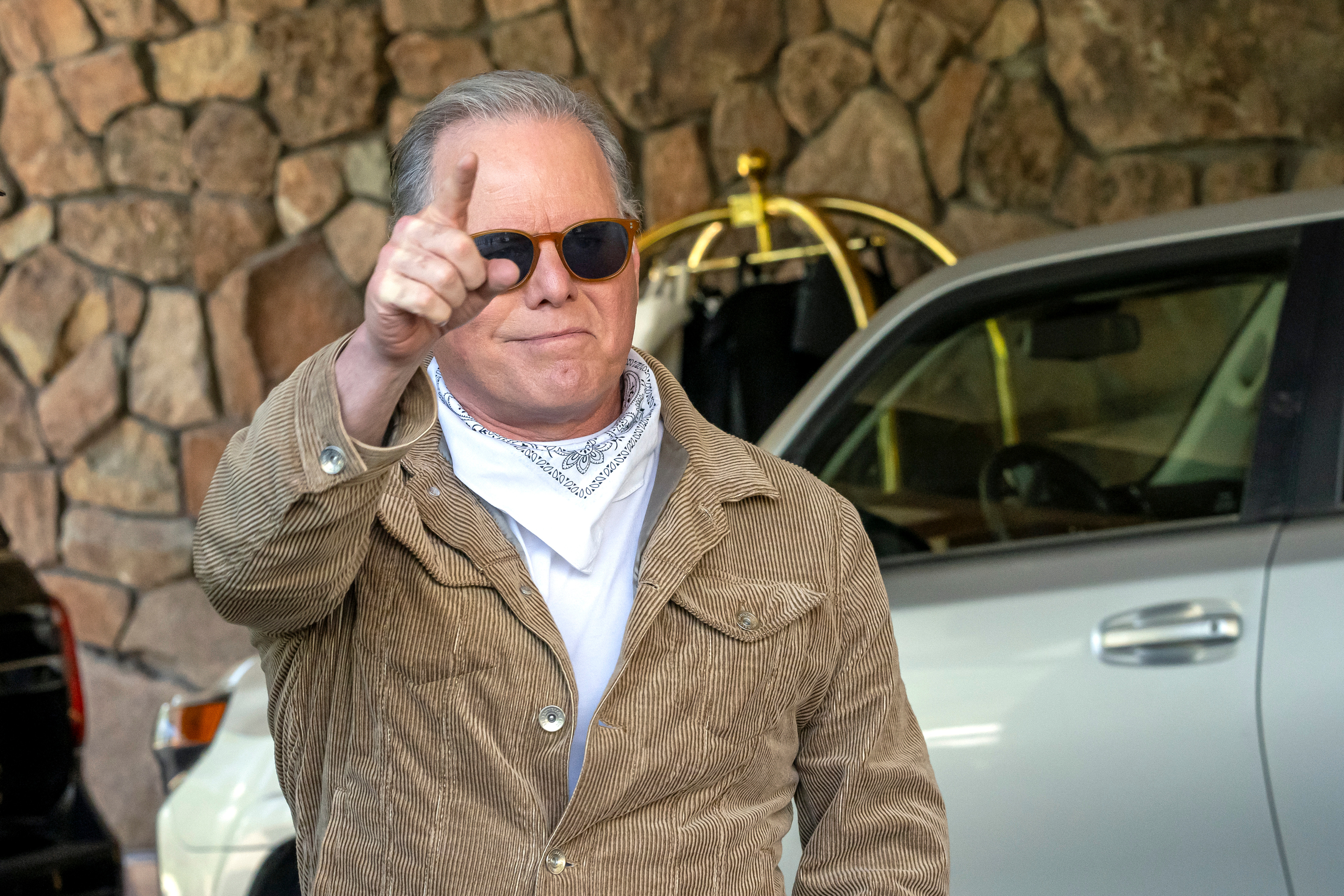

“Am I disappointed that the trends in the linear business haven’t been a little better?“ Warner CEO David Zaslav said on Wednesday’s earnings call. “There has been talk about recovery a year, a year-and-a-half ago. It hasn’t really happened. It is what it is. We’re managing this as best we can.”

Equity analysts seem to be losing faith.

"Unfortunately, the stock performance is a clear indication that investors see little optimism that the tides may soon start to turn," wrote MoffettNathanson's Robert Fishman in a note to investors.

With eight consecutive quarters of double-digit declines for WBD linear advertising revenue, Fishman noted: "We find it unlikely that trends will reverse anytime soon. The appetite of advertisers to spend on linear cable networks outside of sports (and to a lesser extent, news) has simply gone away as eyeballs exit the ecosystem and digital alternatives grow in sophistication and reach."

Despite the Q2 setback in profitability, Fishman said direct-to-consumer might present a more compelling story, especially given the strong subscriber growth. “That said, the DTC segment includes the headwinds of a dwindling HBO linear that likely contributes a large share of its profits,” he wrote.

Coming “on the heels of significant underperformance over the last two years,” BofA Securities analyst Jessica Reif Erlich suggested some radical steps.

"In our view, 2Q results validate our thesis that exploring strategic alternatives for the company could be a way to potentially unlock shareholders’ value,” she said. She advised Warner to look at “asset sales or mergers could still be utilized to create shareholder value.”