New York-based Warner Bros. Discovery, Inc. (WBD) operates as a media and entertainment company worldwide. With a market cap of $70.8 billion, the company offers a complete portfolio of content, brands, and franchises across television, film, streaming, and gaming.

Shares of this leading global media and entertainment company have substantially outperformed the broader market over the past year. WBD has gained 175.5% over this time frame, while the broader S&P 500 Index ($SPX) has rallied nearly 13.9%. However, in 2026, WBD stock is down 2%, compared to the SPX’s 1.5% rise on a YTD basis.

Zooming in further, WBD’s outperformance is also apparent compared to Invesco Leisure and Entertainment ETF (PEJ). The exchange-traded fund has gained about 12.4% over the past year. However, the ETF’s 1% dip on a YTD basis outshines the stock’s losses over the same time frame.

Warner Bros. Discovery shares are outperforming due to a revised, all-cash acquisition bid from Netflix, Inc. (NFLX) on Jan. 20. The $82.7 billion deal, which includes WBD's studio and streaming assets, aims to provide greater value certainty and accelerate a shareholder vote.

On Nov. 6, 2025, WBD shares closed down by 1.5% after reporting its Q3 results. Its loss of $0.06 per share did not meet Wall Street expectations of $0.04 per share. The company’s revenue was $9 billion, falling short of Wall Street forecasts of $9.2 billion.

For the current fiscal year, ended in December 2025, analysts expect WBD’s EPS to grow 114.7% to $0.68 on a diluted basis. The company’s earnings surprise history is disappointing. It missed the consensus estimate in three of the last four quarters while beating the forecast on another occasion.

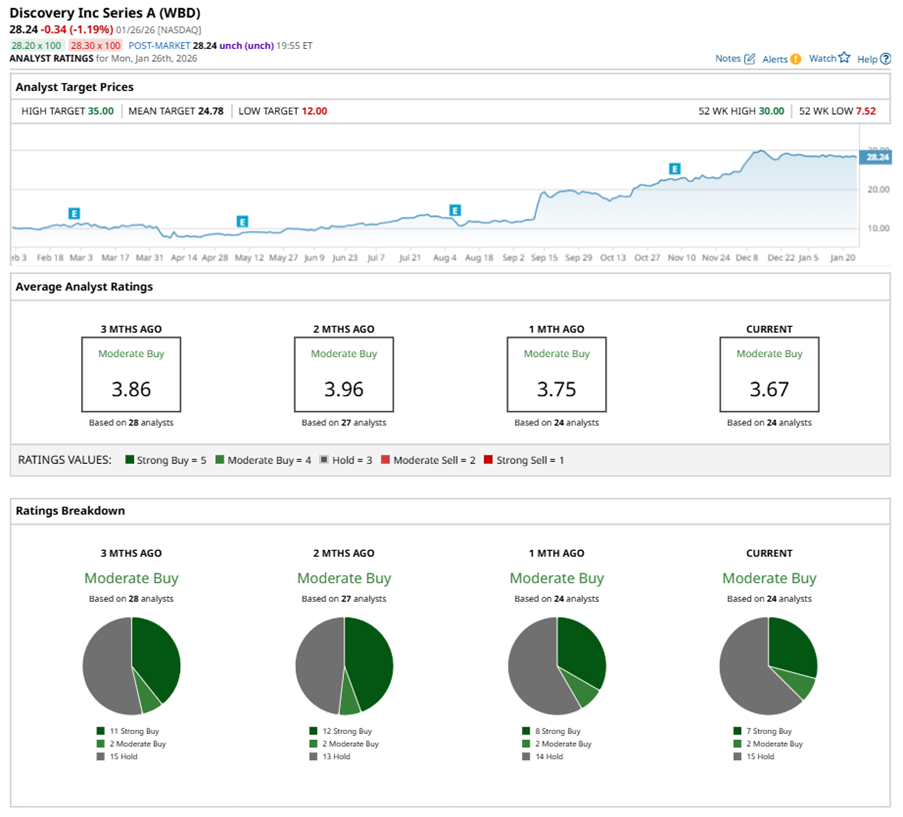

Among the 24 analysts covering WBD stock, the consensus is a “Moderate Buy.” That’s based on seven “Strong Buy” ratings, two “Moderate Buys,” and 15 “Holds.”

This configuration is less bullish than a month ago, with eight analysts suggesting a “Strong Buy.”

On Jan. 15, Benchmark kept a “Buy” rating on WBD and raised the price target to $32, implying a potential upside of 13.3% from current levels.

While WBD currently trades above its mean price target of $24.78, the Street-high price target of $35 suggests a 23.9% upside potential.