Warner Bros. Discovery said it is having a good upfront and is making plans to add live sports and news to its streaming Max platform.

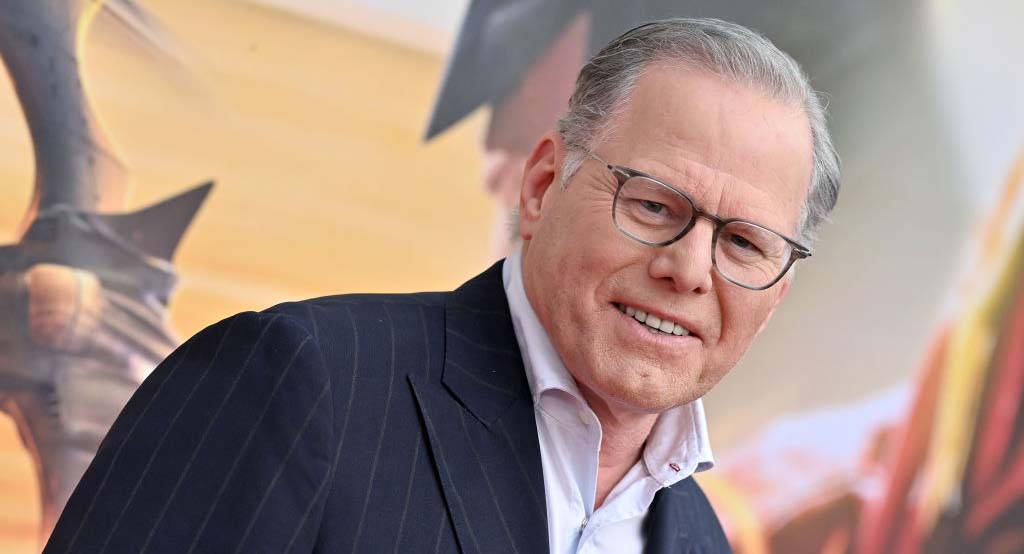

“We’ve nearly completed the U.S. upfront and our volume is up and our price levels are consistent with the prior year, a very good result in a tough market,” WBD CEO David Zaslav said during the company’s second-quarter earnings call Thursday.

Chief financial officer Gunnar Wiedenfels added that WBD’s upfront volume is expected to be up, with pricing consistent with the prior year.

Also Read: Fox Wraps Upfront With Gains In Sports, News, Tubi

Direct-to-consumer ad volume was up 50 “in a marketplace in which CPMs were position to drive scale for us, as much as for the broader market,” Wiedenfels said.

LIke most other media companies WBD had been expecting the ad market to strengthen in the second have, but a meaningful recovery hasn’t materialized.

“We haven’t seen it and we’ve need to figure out how to make up for that,” Zaslav said.

But Zaslav said he was largely encouraged by the upfront, where buyers had been pushing for price rollbacks.

“We’re seeing mid-single increases on the sports side. We got price increases on some of our affinity networks,“ he said. “Some of these networks are really important to advertisers and we’re still doing a lot of original content, which makes us unique.”

While some of WBD’s smaller networks were slightly down, Zaslav called Max the star.

He noted that Max was offering advertisers their first chance to get in front of some of the highest-quality shows on television, like Succession. The environment is very uncluttered, with one spot in front of new shows and limited spots for older HBO content.

“We’re seeing really good pricing,” but Max’s ad tier isn’t yet big enough to replace dollars lost by the company’s linear networks on a one-to-one basis, he said.

“We can’t predict what’s going to go on with the linear business,” he said, adding that “viewership on our platforms is actually quite strong. It’s just that they’re olds. There’s a load of people still loving and watching our content.”

Zaslav noted that a lot of the content that started on its linear networks is now available to stream.

”Most of our content is going over to Max,“ he said. “So they’re watching Diners, Drive-Ins and Dives and we’re monetizing it again with our subscribers on our ad tier.”

Zaslav also said WBD has been working on a strategy to bring live news and sports to its streaming platform.

“We still have a lot of work to do, but news and sports are important, they’re differentiators, they're compelling, and they make these platforms come alive,” he said.

Most of WBD’s sports deals include digital rights, so it won’t cost the company more to stream them on Max, he said.

“We think it's a real asset, all the sports rights we have,” Zaslav told analysts on the call. “We have a real strategic plan that we’re finalizing and we’ll take it to you guys and be very clear about exactly how we’re going to use news and sports on our platforms to build value for the future.”

JB Perrette, CEO of global streaming and games for WBD, said that in Europe, some sports programming is carried on tiers that carry incremental prices, while other content appears alongside entertainment programming.

“Generally, our view is sports is a premium offering with a very focused and passionate fan base,” Perrette said. “Generally, we’ll need to find incremental value to get out of it. And so exactly how that comes to market, we will have more to say later in the year.”