Despite reporting a profit for its direct-to-consumer business, Warner Bros. Discovery reported a big loss as it took huge write-downs in the first quarter.

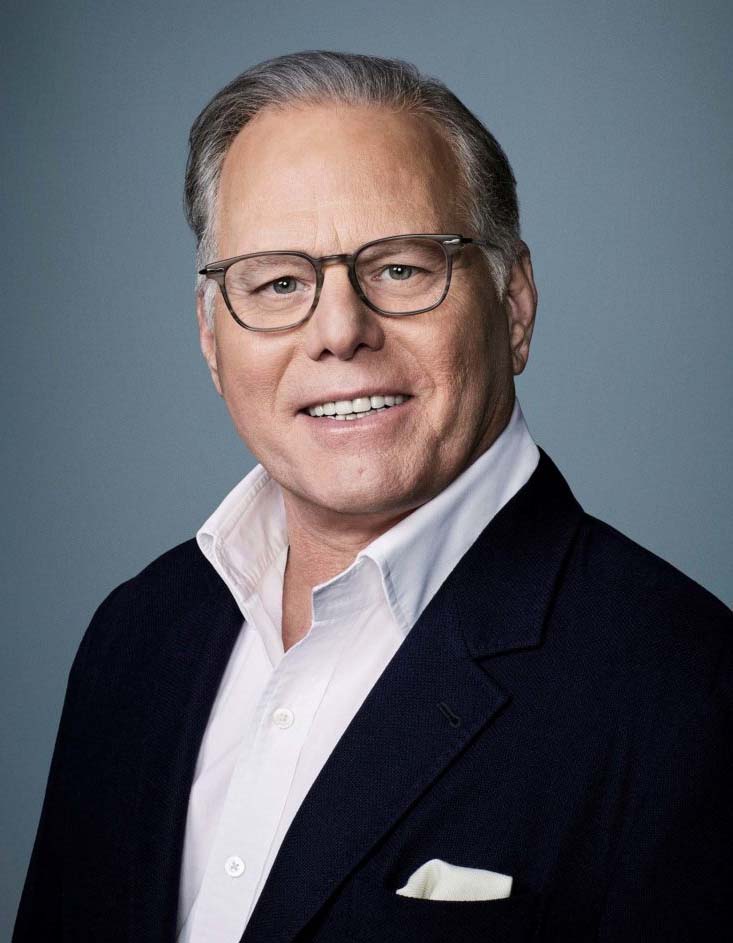

On the company’s call with investors, CEO David Zaslav said the company continues to negotiate with the NBA, and hopes for an outcome that’s good for both sides. He noted that WBD has a right to match any third-party offer for NBA rights. The company has “strategies in place for the various potential outcomes,” Zaslav said.

Warner Bros. Discovery added almost 2 million direct-to-consumer subscribers in the quarter, giving it 99.6 million. The company added 700,000 domestic subscribers for a total of 52.7 million.

Also Read: Disney and Warner Set to Bundle Disney Plus, Max and Hulu Starting This Summer

WBD continued to report earnings for its direct-to-consumer business, with adjusted EBITDA up 72% to $86 million.

DTC revenues were flat at $2.5 billion. Advertising revenue rose 70% to $175 million, benefiting from the launch of B/R sports in October. Distribution revenue increased 1% to $2.2 billion.

“This is a pivotal and critical year for Max,” Zaslav said on the call.

He noted that Max has begun its international rollout. It’s now in 39 international territories, mostly in Latin America and over the next several weeks Max will be launched in 25 additional markets across Europe.

One of those markets is France, where the launch will take place before the start of the Paris Summer Olympics.

“Max will be the only place where viewers across Europe will be able to watch every part of the Olympic Games,” Zaslav said.

Zaslav said the company aims to have $1 billion in DTC EBITDA by 2025.

Overall, Warner Bros Discovery lost $996 million, or 40 cents a share in the first quarter, compared to a 1.1 billion loss, or 44 cents a share, a year ago.

The loss included $1.9 billion in pretax acquisition-related amortization of intangibles, content fair value step-up and restructuring expenses.

First-quarter adjusted earnings before interest taxes and depreciation was $2.1 billion, down 20% from a year ago.

Revenues fell to to $9.96 billion, down 7%.

The financial results were below Wall Street expectations and WBD stock was lower in premarket trading.

Adjusted EBITDA at the company’s networks segment — which includes its cable networks — fell 8% to $2.1 billion.

Revenue was down 8% to $5.1 billion. Distribution revenue was down 7% to $2.7. Advertising revenue fell 11% to $2 billion.

“We are pleased with our progress in the first quarter as evidenced by strong results in important KPIs,“ Zaslav said. “We delivered meaningful growth in our streaming business with a nice acceleration in ad sales, generating nearly $90 million in positive EBITDA for the quarter.

“We continue to make bold moves to transform our company for the future as we position ourselves to take full advantage of the opportunities ahead," he said.