Warner Bros. Discovery continued to cut its losses in the fourth quarter, but not enough to meet Wall Street expectations.

Media companies have been struggling to reduce the losses they’ve incurred by jumping to the streaming business to compete with Netflix.

Warner Bros. Discovery reduced its direct-to-consumer losses to $55 million in the fourth quarter from $217 million a year ago on an adjusted earnings before interest, taxes, depreciation and amortization (EBITDA) basis.

Revenue for the DTC business rose 4% to $2.5 billion. Distribution revenue rose 4% to $2.2 billion and advertising revenue increased 51% to $186 million as the company added subscribers to the ad-supported version of Max.

The company said it had 97.7 million global direct-to-consumers, up from 95.9 million at the end of the third quarter and 96.9 million a year ago.

The total includes 1.3 million subscribers added when WBD acquired Turkish streaming service BluTV. Excluding BluTV and TNT Sports Chile, the company had 500,000 more subscribers than it had at the end of the third quarter.

The company lost 400,000 domestic subscribers to its Max and Discovery Plus services in the fourth quarter, finishing with 52 million. A year ago, there were 54.6 million domestic subscribers.

Global average revenue per subscriber rose (ARPU) to $7.94 per month from $7.88 in the third quarter and $7.42 a year ago.

Domestic ARPU was $11.65, up from $11.29 in the third quarter and $10.83 a year ago.

For the full year, the company said its DTC business had earnings before interest, taxes, depreciation and amortization (EBITDA) of $103 million, compared to a $1.6 billion loss in 2022.

Overall, Warner Bros. Discovery’s net loss was $400 million, or 16 cents a share in the fourth quarter, compared to a loss of $2.1 billion, or 86 cents a share, a year ago.

The result includes $1.7 billion of pretax amortization and $75 million in restructuring expenses.

Revenue fell 7% to $10.3 billion.

EBITDA was down 5% to $2.5 billion, but cash from operating activities increased 26% to $3.6 billion.

The results were below expectations and WBD’s stock price was down 10% in mid-day trading Friday.

Falloff at Cable Nets, Advertising

While the company’s streaming business improved, its traditional cable network business saw EBITDA drop 11% to $2.2 billion.

Advertising revenue was down 12% to $1.9 billion. The company blamed audience declines, a soft ad market and the decision to exit the AT&T SportsNet business, which accounted for 1 percentage point of the decline.

Distribution revenue fell 4% to $2.8 billion because of a drop in subscribers and the decision to leave the regional sports business.

At the company’s studios segment, adjusted EBITDA fell 29% to $543 million. Revenue fell 17% to $3.2 billion. The company said TV revenue “declined significantly” because of the strikes by the Writers Guild of America and SAG-AFTRA.

Warner Bros. Discovery finished 2023 with a net loss of $3.1 billion on revenues of $41.3 billion.

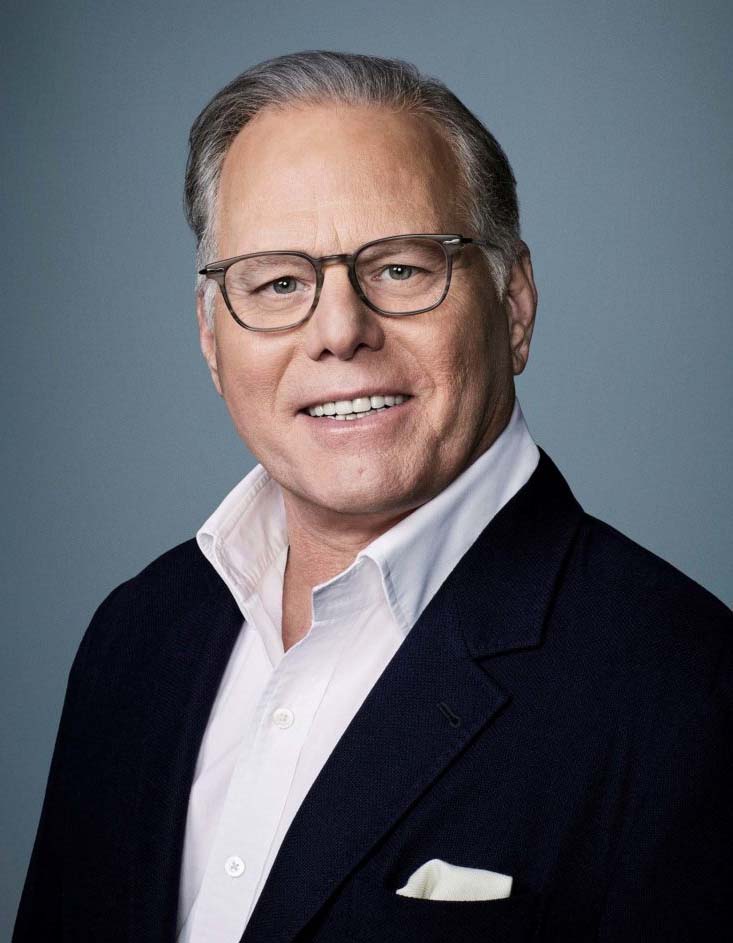

“After executing against our strategic plan to reposition the company, we are now on solid footing with a clear pathway to growth,” CEO David Zaslav said.

“We have an attack plan for 2024 that includes the rollout of Max in key international markets, a more robust creative pipeline across our film and TV studios and further progress against our long-range financial goals, and are confident in our ability to drive sustained operating momentum and enhanced shareholder value,” Zaslav said.