Russia’s invasion of Ukraine and looming global fuel supply disruption has raised the urgent question: Is this really the right time to close and demolish New Zealand’s only oil refinery?

In less than a month’s time, New Zealand will stop producing its own transport fuels. The petrol, diesel, aviation and shipping fuels which are now made at Marsden Point – about 70 percent of needs – will now be imported. The plan is that by April 1, the country’s only oil refinery, at Northland’s Marsden Point, will have shut down and will start being dismantled.

The company operating the plant, Refining NZ, will change its name to Channel Infrastructure NZ and change its business model entirely. It will no longer turn crude oil into usable fuels targeted at New Zealand fuel requirements; instead it will receive and store imported fuels and push some of them down its pipe to Auckland.

The company and its big oil company shareholders say it's no longer economic to run a refinery in New Zealand.

The timing is unfortunate. There have been a few periods in the almost 60 years since then Prime Minister Keith Holyoake opened the refinery in May 1964 when New Zealand has been grateful for the security of fuel supply that a domestic producer provides – like when the 1973 Arab–Israeli War sparked the first oil shock, for example.

This week’s invasion of Ukraine by Russia, the world’s second largest oil producer, looks like being another critical time for international oil and fuel supplies.

New Zealanders who went to bed on Wednesday with news of the initial Russian aerial bombardment and troop movements, woke on Thursday to surging oil prices and British Prime Minister Boris Johnson urging partners to “end Europe’s collective dependence on Russian oil and gas that has served to empower [Russian President Vladimir] Putin for too long”.

Ukraine’s Ambassador to the UK called for people to stop buying Russian oil and gas, although Western governments have said they won't be imposing sanctions on energy exports.

Still, the situation is far from stable, as a Bloomberg report makes clear.

"Russia’s invasion of Ukraine has spooked a global oil market that was already perilously tight due to the inability of supply to keep up with the demand recovery from the pandemic," the report said. "Biden said the US is working with other major consuming nations on a coordinated reserves release. Any such sales would need to be very large to have a major impact on prices."

It's impossible to know how important having a domestic refinery might prove to be for New Zealand's fuel security in the future, but what we do know is the Australian government stepped in last year as it saw domestic oil refinery operators closing down. The support package, which lasts until 2030, provides a "fuel security service payment" for the two remaining refinery operators when global refining margins are low and therefore their profitability is at risk.

The measure will cost up to $2 billion to 2030 "in a worst-case scenario" where both refineries are paid at the highest rate for the entire nine years, an ABC News report said.

"Fuel is what keeps us and the economy moving. That is why we are backing our refineries," Energy Minister Angus Taylor said. "Supporting our refineries will ensure we have the sovereign capability needed to prepare for any event, protect families and businesses from higher prices at the bowser [pump], and keep Australia moving as we secure our recovery from Covid-19."

New Zealand's Energy Minister Megan Woods considered a similar move to support Marsden Point, noting "the consequences of a major fuel import disruption would be serious and this risk warrants careful consideration."

However in the end Woods decided against any subsidy.

"There does not appear to be a clear case for maintaining refinery operations for fuel security reasons, except to address an exceptional 'no fuel imports' scenario," the minister said in a Cabinet paper titled "Fuel supply resilience without a domestic oil refinery" released in November last year.

"Industry and independent expert advice is that a refined fuel import supply chain can provide more supply source diversity (from multiple refineries in different regions), and is more resilient to most credible fuel disruption scenarios," Woods said.

"I do not propose subsidising the refinery to keep it operating for five or 10 years because I consider the fuel import risk to be small, and I propose instead to progress options to ensure New Zealand has adequate fuel stocks in-country to offset any fuel import risk."

Emergency capability

The big problem for New Zealand - and its refinery - is the disconnect between the oil we pump out of the ground in Taranaki and the oil Marsden Point is set up to refine. The former is so-called ‘light’ and ‘sweet’ crude, the latter is a heavier variety.

Our own oil is mostly exported - it's high quality and therefore gets good prices on the international market. The crude for the refinery is mostly imported, although sometimes New Zealand crude is mixed in.

Which is kind of awkward in terms of security of supply. If crude production or shipping was significantly disrupted, it wouldn't matter whether we were importing crude or refined fuel - we would be in trouble.

But couldn't our oil be useful at all in that scenario?

The Worldometer global statistics website suggests that, in 2016 at least, New Zealand held 64.1 million barrels of proven oil reserves, ranking 75th in the world.

"The country has proven reserves equivalent to 1.1 times its annual consumption," the site says. "This means that, without imports, there would be about 1 year of oil left (at current consumption levels and excluding unproven reserves)."

Which could be kind of handy.

Where it gets murky is whether in an emergency, Marsden Point could actually be adapted to process local crude oil.

The narrative from Refining NZ is 'No'.

"The Marsden Point refinery cannot produce fuels solely from light crude oils like those produced in Taranaki without significant reconfiguration that would take some years to plan and implement," a spokesperson said in response to a question.

The word "solely" may be important here. Newsroom understands from an expert close to Refining NZ that it might be possible to produce transport fuels at Marsden Point not with only Taranaki oil, but where our crude made up a good percentage of the raw material. Local crude already goes through the machines, though not in big quantities.

It might not be efficient, it might not be economic, but it could possibly keep our ambulances running, our food delivery trucks stocking our supermarkets, and other essential services on the road or in the air.

Simon Terry is executive director of the Sustainability Council of NZ, a long-time researcher and commentator on energy, climate change and pricing issues, and the author of a commentary piece on the refinery closure published in Newsroom last year. In the article he argued it would cost government, consumers or the oil companies just one cent a litre to insure against the breakdown of essential services should oil imports be cut for an extended period.

"If international oil supplies were cut now, New Zealand produces enough crude oil to meet around 20 percent of its demand and the local refinery could keep essential services in operation indefinitely." – Simon Terry, Sustainability Council of NZ

"The absence of such an insurance payment, similar to that Australia is making to its refineries... would expose New Zealand to a new type of risk with huge costs at a time when geopolitical tensions are increasing."

That commentary piece was written in July last year. What does Simon Terry think now, given the Russian invasion of Ukraine, Newsroom asked.

Terry says he's been trying for some time to get specifics from Refining NZ or the Government about how the plant might operate using Taranaki's lighter crude.

The information he has suggests "if the refinery were kept open, we could definitely use it to make diesel from Taranaki's lighter crude, and so keep essential services running, Terry says.

"If international oil supplies were cut now, New Zealand produces enough crude oil to meet around 20 percent of its demand and the local refinery could keep essential services in operation indefinitely.

"But what Refining NZ needs to do is front up with is the technical information that will tell us how much could be produced by making simple operational changes, and how much depends on physical changes to the plant."

Terry isn't the only one concerned. In August last year, as Refining NZ shareholders prepared to vote on the closure proposal (more than 90 percent accepted the company's recommendation to go import only), an Australian analyst warned New Zealand was being "naive" about the dangers of shutting down its only oil refinery.

Dr John Coyne, head of the Northern Australia Strategic Policy Centre told RNZ reporter Phil Pennington the Government was "buying into a very dated view of globalisation, and certainly hasn't learned the lessons from Covid-19, around secure supply chains and national resilience".

The pandemic disproved assumptions that global supply chains could readily deliver, whether it was vaccines or oil, he said.

"If you listen to the oil companies, they'll tell you all the risk is under control," but the reality is conflicts can escalate quickly, trade splits are deepening and one natural disaster can pile on top of another, he said.

"If the oil refinery in New Zealand closes, you are totally reliant on oil companies doing the right things ... a really dangerous proposition."

NZ exposure to Russian oil

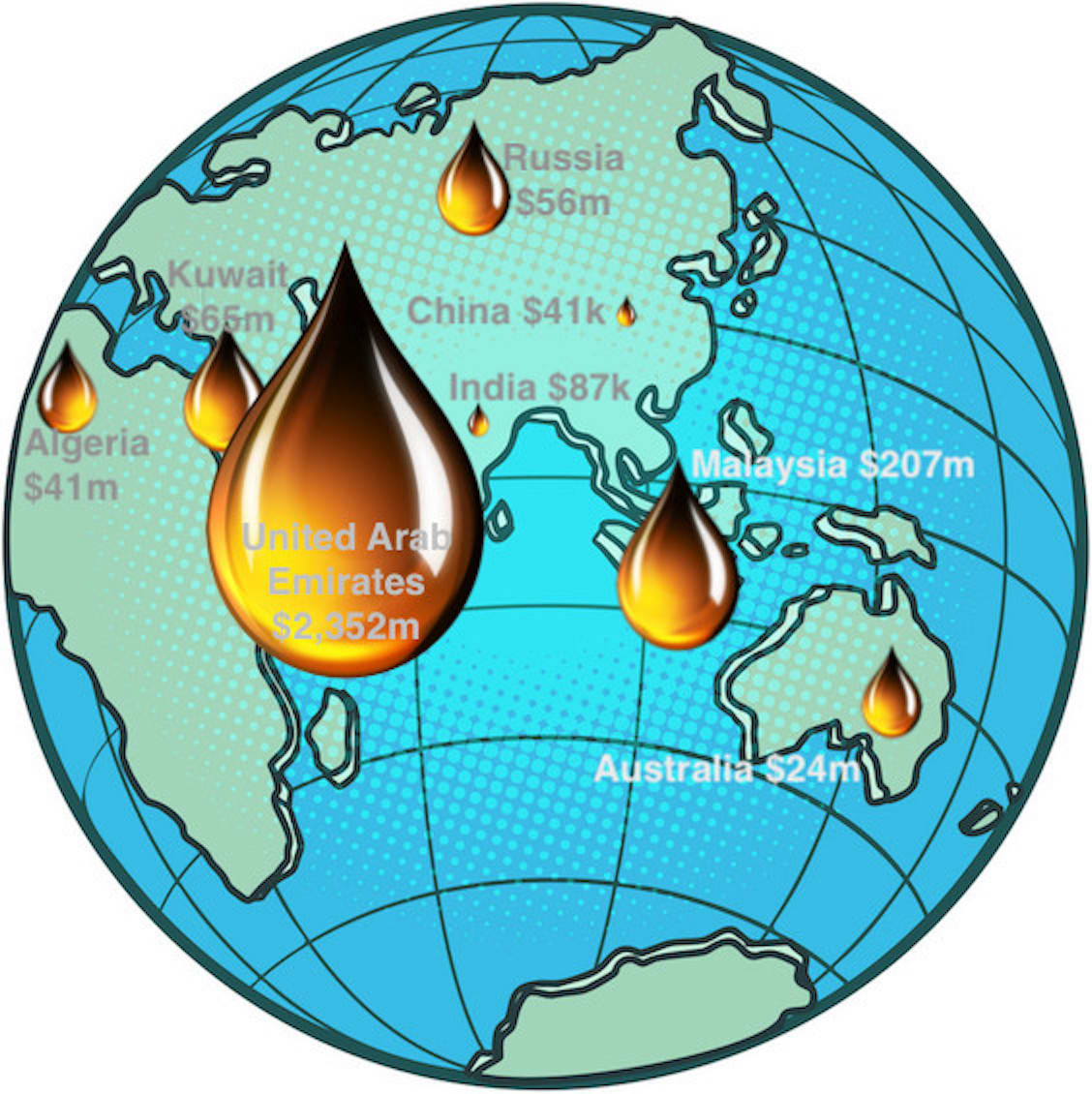

How much New Zealand relies on Russian oil is hard to gauge. In 2021, we imported approximately 2 percent of our crude oil from Russia, according to Statistics NZ, down from 14 percent in 2019. Our official statistics show virtually no refined petroleum imports from Russia – and the Government and oil companies stressed this in answers to questions from Newsroom.

But those figures may be disingenuous. The vast majority of New Zealand's fuel imports come via third country refineries, mostly in Southeast Asia. Our biggest suppliers in 2021 were in Korea (53 percent of total imports) and Singapore (31 percent).

What Stats NZ figures can’t show – and what oil companies and Government couldn't tell Newsroom – is how much of the crude oil that supplies those Korean, Singaporean and other refineries comes from Russia. But given Russia's status as the second largest producer in the world, after Saudi Arabia, it would be fair to assume it might be quite a lot.

It's also possible New Zealand oil companies don't know the provenance of the refined fuel they buy.

Z Energy, set to be purchased by Australian oil giant Ampol, has been pushing hard for the closure of Marsden Point to allow it to buy cheaper fuel and not be exposed to the risk of owning a refinery.

The company's supply general manager Julian Hughes says: "We are currently working with our new suppliers to understand how they source their supply."

The case for closure

The arguments for closing the Marsden Point refinery are financial. The major oil company shareholders BP, Mobil and Z Energy want it shut to save them money. Buying fuel from big overseas refineries is cheaper and less risky than owning a local refinery that needs propping up when margins are low.

The oil companies say moving to a 100 percent import model actually provides more supply source security and diversity than the mixed import/refining model we have at the moment, because it allows them to source fuel from anywhere in the world, rather than being forced to buy a certain amount locally, no matter what the price.

Meanwhile Refining NZ argues Marsden Point is old and small and can’t compete with bigger, newer refineries overseas.

The risk to non-oil-company shareholders, from big institutions to small retail shareholders, is poor profitability, Refining NZ said in its closure proposal last year. The company pointed to the low margins and Covid-induced slump in volumes over the last couple of years.

Exceptional circumstances

The Government agreed with the decision. In a Cabinet paper entitled “Fuel supply resilience without a domestic oil refinery”, Energy Minister Megan Woods looked at the option of government support for Refining NZ to help keep it running for 5-10 years as New Zealand transitions away from fossil fuels.

The proposal was the Government would underwrite Refining NZ profitability during tough times, with the understanding the company would pay the taxpayer back if and when margins recovered and earnings rose.

“This could avoid potential negative impacts on fuel security and buy time to progress options that would enable skilled workers at the refinery to help kick-start a biofuels industry,” Megan Woods said in the fuel supply resilience paper, released in November 2021.

“It would also allow time to investigate whether any parts of the Marsden Point refinery could be repurposed for sustainable biofuels production at lower cost than building new production plant. My focus has been fuel security but other considerations, including the regional economy, are important.”

The Australian government has done a similar thing, announcing in July last year a “fuel security service payment” of up to A$2.3 billion to keep the country’s two remaining refineries open. .

In the end, however, Woods decided against the subsidy option. Although there was a risk to New Zealand that at some stage in the future, before we had alternative fuel options, something bad would happen which would stop all fuel coming into the country, she didn’t believe the risk was high enough to merit intervention.

“I consider the fuel impact risk to be small,” Woods said. “It is also unclear whether or how existing refinery assets could be used or repurposed for sustainable fuels production, at what cost, and in what timeframe.” So the question remains, is the situation with Russia’s invasion of Ukraine enough to cause a re-think - or even a postponement - of the Marsden Point closure decision.

The present plan is for deconstruction of the plant to start soon after it stops production.

Simon Terry is worried.

"New Zealand has some of the longest supply lines for fuel delivery and yet it keeps far lower reserves of fuel than other developed countries,” he told Newsroom.

"The impact on global oil markets from the Russian invasion is a reminder of how quickly and radically the world can change.

Countries that take security of supply seriously keep serious reserves - European nations generally hold 90 days, and the US holds years of supply.

If you have crude oil of your own, you can spend less on storing reserves - but only if you have a refinery to process it. New Zealand's one is planned to be scrapped in two months."

No worries from Govt and oil companies Megan Woods didn’t respond to Newsroom’s direct questions about the refinery, but issued a general press statement saying Russia’s invasion of the Ukraine “won’t affect New Zealand’s fuel supply”.

“New Zealand does not purchase any oil or oil products from Russia so would not be directly affected if Russian oil supply is curtailed,” she said, although that statement doesn’t address the very real risk that New Zealand is in fact exposed indirectly to Russian crude oil via the Southeast Asian refineries that supply us with fuel.

We just don’t know it.

“The International Energy Agency (IEA) has assessed that world oil production capacity is more than sufficient to meet demand due to any disruption that may arise from the situation in the Ukraine,” Woods says.

Major oil companies did reply to Newsroom, although their statements regarding security of supply were - perhaps unsurprisingly given the uncertainty in the global market post the invasion - long on assurance and short on detail.

“BP is well placed to ensure we continue to provide supply security for all our customers throughout New Zealand,” a statement attributed only to a ‘BP spokesman’ said. “We have a dedicated local supply team and are experts in reliably sourcing quality product from international refineries and terminals for our nationwide terminal infrastructure.”

Mobil gave a somewhat fuller statement attributed to lead country manager Andrew McNaught, albeit with some preliminary gushing, and some assurances around timely shipping which might make long-suffering importers and customers in other sectors smile.

“Mobil is proud to have been delivering a safe, secure, and competitive supply of high-quality fuels to Aotearoa New Zealand for over 125 years, and will continue to do so as the country transitions to an import-only model of fuel supply,” McNaught said.

"The transition of Refining NZ’s refinery at Marsden Point to an import-only terminal will support Aotearoa’s fuel security, as it will provide fuel importers in Aotearoa with more options to source fuels, from multiple refineries in multiple countries.

“Other benefits include the reduced risk of a 'single point of failure' – Aotearoa will see more frequent ship deliveries and more product ships in the country’s domestic waters, or in transit, with greater flexibility to redirect ships to any port where product is required.”

Meanwhile Z Energy’s Julian Hughes said the company was working with new refined fuel suppliers to understand how they source their supply.

Although he didn’t give details of where fuel arriving in New Zealand via Southeast Asian refineries was originally from, he says the amount of crude from Russia is less than it has been in the past.

“We have bought Russian crudes in the past and while at times this has accounted for up to 10-20 percent of our crude imports, we haven’t purchased this grade for over six months. We can confirm our last two cargoes before we exit refining are already on their way to New Zealand and do not comprise any Russian crudes.”

Hughes says the situation in Ukraine “reinforces our position that moving to an import-only model will allow New Zealand to source refined product from larger and more efficient overseas refineries”.

“Z believes supply will be maintained, if not enhanced under an import-only model, with more fuel held in tanks onshore and on the water. That fuel can be sent exactly where it is needed and will be ready for immediate use on arrival, rather than having to be refined and moved around the country.”

The irony of higher refining margins

Edward Miller is researcher and policy analyst for First Union which represents workers at Marsden Point. His main concerns are for the loss of almost 300 jobs at the plant and the 7 percent of the Northland’s GDP the refinery represents. But he feels strongly enough about fuel security to have gone to Wellington to meet with Megan Woods last year and followed up with a letter a month ago.

Miller says it has been figures from Refining NZ own investor materials which lead to the conclusion a levy on fuel of 1 cent a litre, or a subsidy from Government of the same amount, could keep the refinery open and insure against supply risks.

Over the past decade this would have averaged only $33 million-$38 million, he says.

“It would be nice to say Australia would bail us out if we had problems with fuel supplies, but states don't do that when it comes down to national interest.

“We said to Government it’s not just the pandemic. What happens if a good chunk of the international shipping workforce gets Omicron and large numbers have to isolate.

“And what else is out there? How do we weight up the potential costs to the country against the financial benefits of losing the refinery?”

Miller says it’s ironic that the decision to close Marsden Point was justified using the low refining margins from the early days of the pandemic. These margins are recovering and could go higher.

“I think it’s quite likely that global refining margins could rise as a result of the Russian invasion. The rise in margins over the past two quarters seems to have aligned closely with supply constraints (however there are quite a few different factors in the mix).”

Put simply, when crude prices rally, refining margins tend to move in the same direction, he says.

“If sanctions target the energy industry in particular then this would likely push crude prices even further, giving refiners space to further increase margins.”

The problem with emergency stocks

Meanwhile, the debate is heating up about whether if we don’t have a refinery, New Zealand needs more fuel stockpiled for emergencies, and whether the Government should mandate minimum stock levels.

Consultation on the issue closes this Monday, February 28.

“Covid has made us rethink these things. We no longer want ‘just in time’, now we want ‘just in case’.” – Stuart Smith, National's energy spokesperson

The preferred option, according to the Ministry of Business Innovation and Employment, is for New Zealand to hold 28 days of fuel cover for diesel, and 24 days for petrol and jet fuel.

Options include Government procuring stock, requiring oil companies or fuel wholesale suppliers to hold minimum stocks, and/or establishing a stockholding agency for managing the minimum stockholding obligations of fuel industry participants and the Government, MBIE says.

Stuart Smith, the National Party’s energy spokesperson, is worried much of the planning around emergency stockpiles has in the past involved contracts for oil being held overseas.

“We have low storage, supplemented with agreements for storage offshore. We need assurance there are adequate supplies and the supplies we have are secure and we won’t be trumped by some other country’s interests,” Smith says.

“Things changed in last few days and we need assurances from the Government on their thinking.

“I don’t think we should be panicking but it's time to be pulling our contracts out of the drawer and making sure what we’ve got is in the country’s best interest.

“Covid has made us rethink these things. We no longer want ‘just in time’, now we want ‘just in case’.”