The stock picks of one of the most well-known financial media personalities will be the theme of an ETF that tracks his stock picks — for better or worse.

Short Cramer And Long Cramer: After previously taking on Cathie Wood, Matthew Tuttle has a new target in his sights. Tuttle Capital Management filed two new ETFs on Wednesday that will track the stock recommendations of television personality Jim Cramer.

The ETFs are the Inverse Cramer ETF with ticker SJIM and the Long Cramer ETF with ticker LJIM, representing short Cramer and long Cramer.

The Inverse Cramer ETF will bet against Cramer's stock recommendations.

“The fund is an actively managed exchange traded fund that seeks to achieve its investment objective by engaging in transactions designed to perform the opposite of the return of the investments recommended by television personality Jim Cramer,” the prospectus reads.

How The ETFs Will Work: The fund will invest at least 80% in investments mentioned by Cramer.

“The fund’s adviser monitors Cramer’s stock selection and overall recommendations throughout the trading day as publicly announced on Twitter or his television programs broadcast on CNBC, and sells those recommendations short or enters into derivatives transactions such as futures, options or swaps that produce a negative correlation to those recommendation.”

The ETF will go long on stocks or ETFs on which Cramer is negative. The fund can also enter positions on index ETFs and inverse index ETFs representing Cramer's overall market view.

The Long Cramer ETF will invest in stocks and ETFs related to positions on which Cramer is positive.

The actively managed ETFs are expected to have high turnover of positions in the funds.

The funds will exit positions when Cramer announces a planned exit or change in sentiment. Positions will also be exited at the adviser’s discretion if no position on the stock or ETF has been relayed for over a week by Cramer.

A portfolio of around 20 to 25 securities with equally weight will be the target.

Related Link: If You Invested $1,000 In The Short Cathie Wood ETF AT IPO, Here's How Much You'd Have Now

Why It’s Important: The new ETFs come from Tuttle Capital Management, led by Tuttle, who previously released an ETF that took on well-known ETF investor Wood.

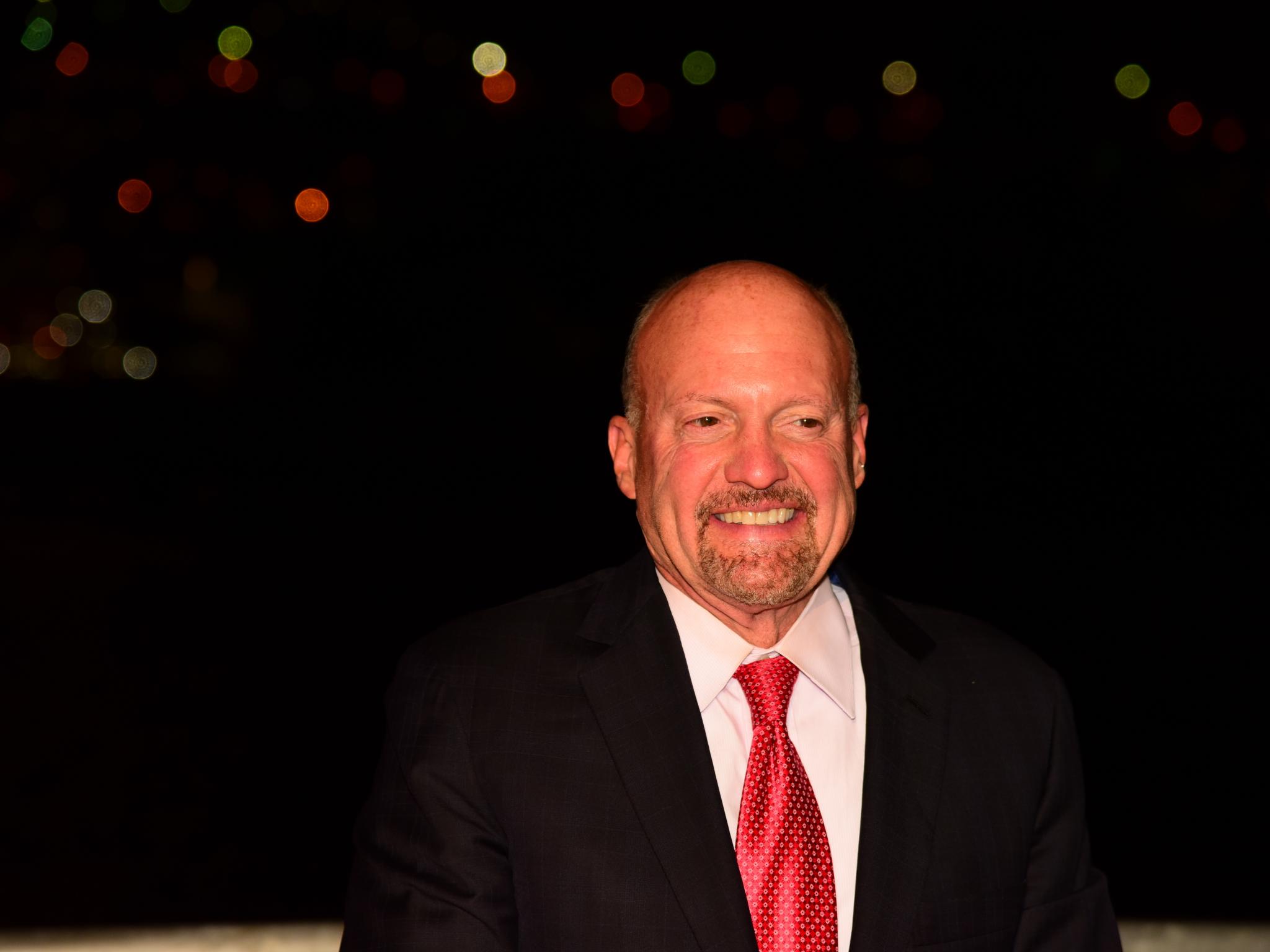

Cramer is a well-known television personality on CNBC and the host of “Mad Money” on the channel. Cramer is also the founder of TheStreet, a financial media company. The television host is a former hedge fund manager.

Social media has often joked that a recommendation of a stock by Cramer is a death kiss and vice versa, with the stocks he goes negative on being a potential bottom call.

ETF Shorting Ark Gains In 2022: Tuttle launched the Tuttle Capital Short Innovation ETF, now known as AXS Short Innovation Daily ETF (NASDAQ:SARK), in November 2021.

The ETF bets against the performance of the Ark Innovation ETF (NYSE:ARKK), led by Ark Invest and Wood.

“This distinctive exposure allows investors to potentially profit from a decline in a portfolio of companies involved in disruptive industries such as electric vehicles, next-gen internet, genomics and fintech,” Tuttle Capital Management said at the time.

The AXS Short Innovation Daily ETF is up 60% year-to-date in 2022 and has done well in a market that has seen many of Wood's favorites struggle.

Photo via Shutterstock.