Walmart’s potential aggressive push into the TV industry made headlines earlier this week as reports suggested the massive retailer could be in talks of buying Vizio for $2B.

It’s not so farfetched as it might seem from the outside looking in. Walmart, no stranger to TV designs as witnessed in its relatively lackluster Onn brand, has quite the incentive to deliver TVs at an affordable price point as the market could prove lucrative if approached correctly.

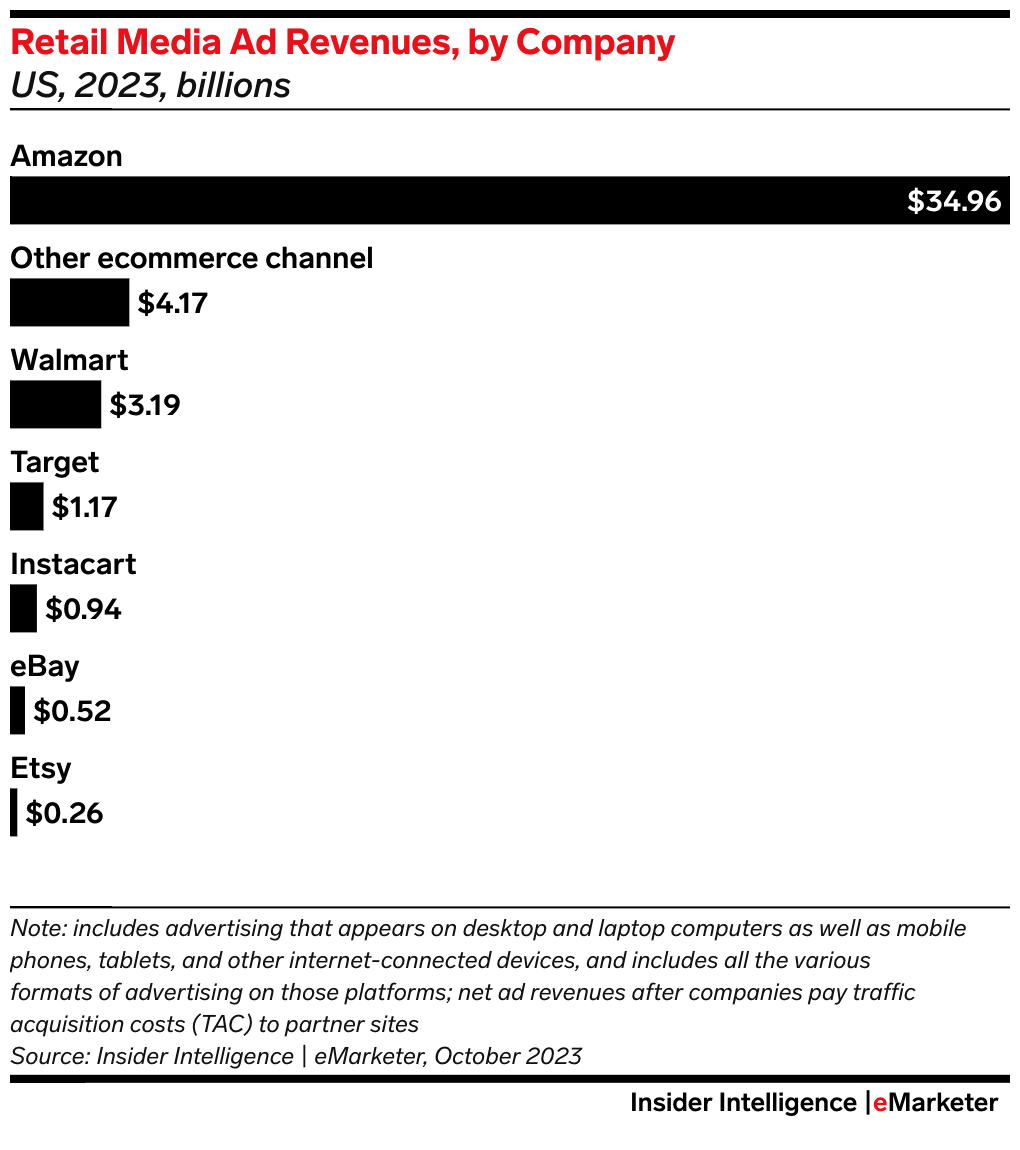

On the other hand, while teaming up with Vizio is certainly a gamble — quite the expensive one at that — the optics seem more so focused on other areas where Walmart can leverage the Vizio branding for other purposes, most notable of all being advertising. Walmart’s ads business has ballooned over the past year, with Inside Intelligence claiming it saw over $3B in 2023 alone.

Is Vizio’s buyout a natural foil to Amazon Fire TV and Roku, or could it be just another way to bleed Walmart mindshare and its products into homes worldwide? There’s some good and some potentially bad aspects behind Walmart’s supposed $2B deal, so let’s break down how it could shake up the TV industry and if it will ultimately be rewarding for consumers — or a total nightmare.

Walmart’s $2B Vizio deal — the good

Walmart’s Onn brand TVs, which typically retail for around $100 to $500, aren’t exactly the most ideal displays on the market. Although cheap, these TVs have arguably the lowest quality and performance baked in, with little to show for other necessities like audio and gaming enhancements.

Data sets provided in our own review of a 50-in 4K Roku Onn TV prove an incredibly lackluster narrative across its color volume (96.7% sRGB), gaming potential (32.1ms input lag), and contrast levels. At least its pricing matches with the value, but even then there’s better TVs out there to buy at its price point — Vizio TVs included.

While not quite at the level of either Hisense or TCL, Vizio still provides some remarkable sets at incredible price points. And the firm is continuously improving upon its underlying operating system (OS), as seen with the speed boost update it garnered this past December.

With a $2B cash injection, Vizio could leverage that capital for some serious gains. Vizio’s R&D could cook up major rival TV models against not just both Amazon Fire TV and Roku ... but also maybe even Hisense and TCL as well.

With a $2B cash injection, Vizio could leverage that capital for some serious gains. Vizio’s R&D could cook up major rival TV models against not just both Amazon Fire TV and Roku, as mentioned in the initial report published via the Wall Street Journal, but also maybe even Hisense and TCL as well.

Although there was only one series of it, Vizio’s OLED TV went relatively under the radar due in large part to its name. There's no guarantee we'd ever see another Vizio-branded OLED, however a potential $2B check could make it a reality.

Right now, there’s really no indication as to where Walmart might take the Vizio brand in terms of its display innovation, but hopefully Walmart uses the brand to prop up its own TV sales with some really interesting new models.

Though, then again, maybe it’s not so sunshine and rainbows after all.

Walmart’s $2B Vizio deal — the bad

In the more negative camp, which to many seems to be the most prime reality, Walmart’s potential $2B investment into Vizio is just another commercial ploy, one to prop up its ever-thriving Connect ads business. This not only pertains to both shoppable ads as seen on the TV at home and in stores, but likewise for the potentially far more lucrative data corralled within Vizio’s consumer base.

Called Retail Media Networks (RMNs), retailer ads businesses have thrived over the past several years as seen in mega corporations like Google and Apple. Walmart’s Connect obviously can’t hit the same heights as presented by these two names, nor even that of Amazon’s incredible dominance in this sector either, but retail media is a potential goldmine for Walmart — a goldmine that Coresight Research claims could be a $60B opportunity in 2024.

Walmart’s ads business has been growing by the billions over the past few years, with 2023 raking in over $3B and 2024 looking to capture $4B and more, according to Statista. Through Vizio, Walmart could leverage the platform to sell even more ads across TV screens that could potentially even rival small sectors within its own conventional retail business.

That’s not even accounting for the other untapped goldmine in the equation: data monetization. Vizio currently wields an 18M strong user base, making it a platform ripe for monetization — a business sector that Coresight Research claims could net $1M-$5M per every $1B earned in revenue.

If Walmart were granted the keys to Vizio’s kingdom, it could mean a whole lot more ads served to its millions of users.

In other words, if Walmart were granted the keys to Vizio’s kingdom, it could mean a whole lot more ads served to its millions of users. And, on top of that, said users’ data will most assuredly be leveraged to service these ads and better process the kinds of products Walmart puts at the forefront of its retail business.

But, with all of that being said, who’s to say the deal even goes through?

Walmart’s $2B Vizio deal — it may not even happen

The purported $2B deal that sees Walmart eyeing Vizio might not even come to fruition. The deal — if it's ever publicly acknowledged by both companies — all comes down to Vizio CEO William Wang, an executive wielding majority voting rights within the business and also founded the TV manufacturer back in 2002.

If the deal is finalized with Walmart as its new owner, it’s unclear what his role would be going forward. Additionally, Walmart might not be the only shark out there battling the tides of the TV industry seas.

Best Buy, too, has its own TV brand, called Insignia. Similar to Walmart, these TVs aren’t exactly the most ideal displays on the market, but through Vizio, it could bring about some serious change with the right capital injection. Best Buy scooping up Vizio and rebranding its own internal TVs with even better internals might give it a sweet push for 2024, especially given Best Buy’s commitment to value offerings — not unlike Walmart itself.

It all remains to be seen, and who knows? Maybe Vizio doesn’t even sell and remains its own entity entirely. We’ll just have to wait and see where this TV industry is headed as 2024 blazes on.