He is 28. He first broke on to the crypto scene in 2013 when he wrote a white paper that led to the birth of the second most traded cryptocurrency in the world: ethereum. His net worth today is in excess of $800 million.

He made it to the Forbes 30 under 30 list when he was 23. And TIME Magazine's recent cover story calls him, "The Prince of Crypto."

But the Russia-born Canadian computer programmer Vitalik Buterin hasn't achieved what he really set out to do -- make ethereum great.

“I would rather Ethereum offend some people than turn into something that stands for nothing," Buterin told Time Magazine in a recent interview.

Buterin says the biggest divide between him and his fellow crypto crusaders at Ethereum is often, "that a lot of these people cared about making money. For me, that was totally not my goal."

Buterin has wanted ethereum to go beyond people's accepted imagination and become the token that enables fairer voting systems, urban planning, universal basic income and other public-works projects.

He is not a typical capitalist even though is one of the youngest crypto millionaires.

"If we don’t exercise our voice, the only things that get built are the things that are immediately profitable. And those are often far from what’s actually the best for the world," Buterin added.

He Goes After the Bored Ape NFT

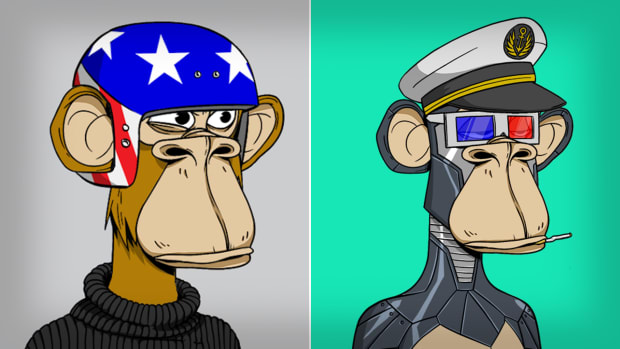

And he's also not a fan of the Bored Ape Yacht Club NFTs, or non-fungible tokens. "The peril is you have these $3 million monkeys and it becomes a different kind of gambling," he said referring to the Bored Ape Yacht Club NFT that has captured modern day spotlight.

ApeCoin, the token linked to the Bored Ape Yacht Club NFT had rough debut this week.

The token, which was airdropped to the Bored Ape NFT owners, saw its price tumble from a high of $39.40 to $7.75 the first day according to data firm CoinGecko. It was trading at $13.26 at last check.

The Bored Ape Yacht Club is an NFT collection of 10,000 simian avatars created by Yuga Labs. Celebrities like Paris Hilton, Jimmy Fallon and Eminem all have their own special apes.

"One silver lining of the situation in the last three weeks is that it has reminded a lot of people in the crypto space that ultimately the goal of crypto is not to play games with million-dollar pictures of monkeys, it’s to do things that accomplish meaningful effects in the real world,” Buterin added while talking about Russia's invasion of Ukraine.

Bored Ape Yacht Club

Russia's invasion of Ukraine has put bitcoin and other cryptocurrencies centerstage as people look for ways to donate funds.

Cryptocurrency is synonymous with volatility. Veterans in the financial world consider it a volatile asset. In addition to being a risky asset, cryptocurrency has also become the target of scams.

Crypto scammers ripped off over $7.7 billion worth of cryptocurrency in 2021, up 81% from a year ago, according to a new report.

One scam, Finiko, a Ponzi scheme primarily targeting Russian speakers throughout Eastern Europe, netted more than $1.1 billion from victims, the blockchain analysis firm, Chainalysis said.

Money laundering activity linked to ethereum and wrapped ethereum in the NFT marketplace also “jumped significantly,” surpassing $1 million, CNBC reported last month. In the fourth quarter, that number rose to nearly $1.4 million.

Here is TheStreet's guide on how to spot crypto scams.