The macroeconomic picture -- geopolitical tensions, higher interest rates and sticky inflation -- has left investors scratching their heads.

While we hear all about the layoffs in the tech sector, the overall labor market in the U.S. has remained resilient.

On Friday, the jobs report came in stronger than expected and the unemployment dropped. While inflation has been on the decline, it’s been a stubborn descent.

Don't Miss: Alphabet Stock Teeters on a Breakout. Here's the Trade.

That’s been good for household spending, which means that’s been good for Visa (V) and MasterCard (MA).

Both companies recently delivered a top- and bottom-line beat with revenue growing about 10% year over year. Both stocks have been trading pretty well lately, so let’s take a closer look.

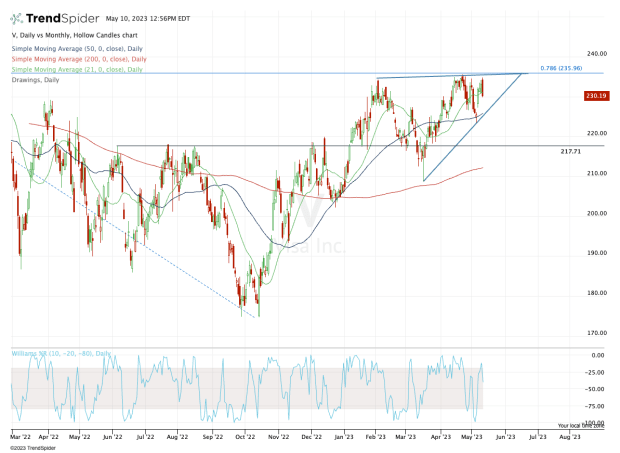

Trading Visa Stock (V)

Chart courtesy of TrendSpider.com

Visa stock continues to push higher but is struggling to break through the 78.6% retracement near $235.

If Visa shares can clear this hurdle, not much stands in the way of them climbing toward $250. That’s what the bulls ultimately want to see.

Don't Miss: Tyson Foods Stock Is Slumping; Here's Where It Could Find Support

On the downside a short-term pullback to the $223 area needs to be met with buyers for the uptrend to remain intact.

If Visa stock breaks below this mark, it will lose the current low for May (as well as last week’s low), and it will be below the 10-day, 21-day and 50-day moving averages.

That scenario would put $217 back in play, followed by the $208 to $210 area.

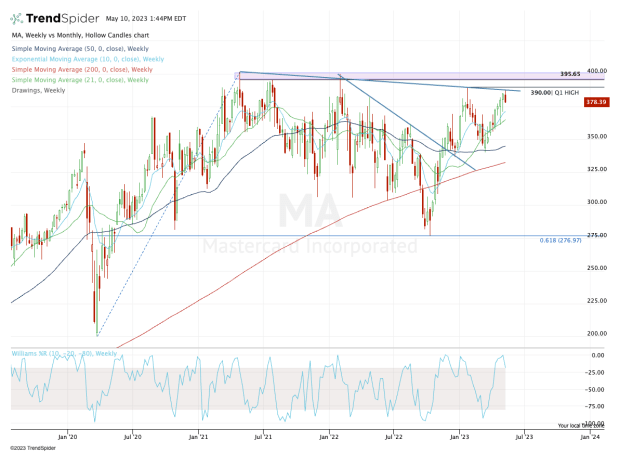

Trading MasterCard Stock (MA)

Chart courtesy of TrendSpider.com

Both Visa and MasterCard have performed well, up 10% and 9% this year, respectively. Over the past year, Visa is up 19% and MasterCard is up 16%.

While both performances top the S&P 500, MasterCard lags Visa. But there’s an interesting observation here: MasterCard is down just 5.5% from its all-time high, while Visa is down more than 9%.

It's not surprising that investors often opt to own both.

Don't Miss: Chip Stocks Are a Leading Indicator; Here's What They're Saying Now

MasterCard had a sharp rally into downtrend resistance, pulled back to the $340 area, then rebounded nicely .

From here, it’s clear that the $395 to $400 area is resistance. To get there, though, MasterCard needs to clear the first-quarter high near $390 and downtrend resistance. If it clear $400, investors can enjoy a sustained breakout.

On the downside, the bulls ideally want to see the 10-day and 21-day moving averages continue to buoy the share price, currently near $380 and $375, respectively. Below these measures opens the door back down toward $350 and the 50-day moving average.

Get investment guidance from trusted portfolio managers without the management fees. Sign up for Action Alerts PLUS now.