/A%20Virgin%20Galactic%20banner%20displayed%20on%20the%20New%20York%20Stock%20Exchange%20by%20Christopher%20Penler%20via%20Shutterstock.jpg)

President Donald Trump’s recent executive order outlining plans of setting up a permanent U.S. lunar base has sent Virgin Galactic (SPCE) shares soaring in recent sessions.

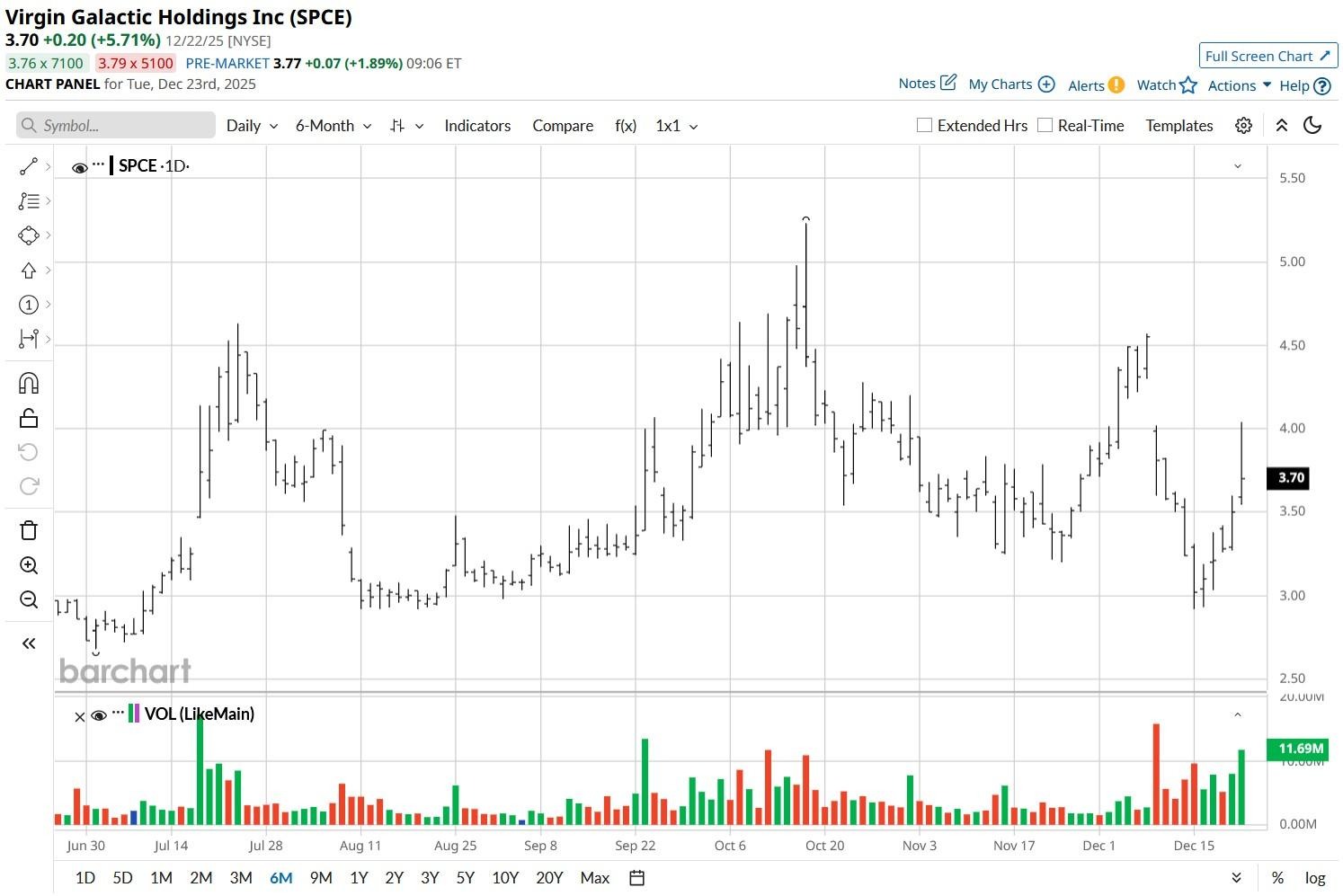

On Dec. 22, the NYSE-listed firm was even seen trading briefly) above its 50-day moving average (MA), indicating bulls will likely remain in control in the near term.

Despite the aforementioned rally, however, Virgin Galactic stock is down over 40% versus its year-to-date high.

Why Has Virgin Galactic Stock Rallied in December?

Trump’s favorable policy backdrop has created sector-wide momentum as investors position for transformative developments in the evolving space economy.

Jared Isaacman’s appointment as NASA administrator has removed regulatory uncertainty and signals a more industry-friendly approach to space commercialization.

Moreover, the prospect of a trillion-dollar SpaceX initial public offering (IPO) next year is serving as a major tailwind for space companies like Virgin Galactic.

All in all, investors are increasingly seeing space exploration as the next major investment theme after artificial intelligence, and that may drive SPCE shares much higher from here in 2026.

Risks of Owning SPCE Shares Heading Into 2026

While space tourism represents a distinct opportunity, Virgin Galactic must demonstrate operational consistency and revenue scalability to capitalize on the current favorable environment.

Heading into 2026, its fundamentals present a more nuanced picture compared to rivals with proven operational capabilities and diversified revenue streams from defense contracts.

SPCE’s focus on space tourism, while pioneering, represents a narrower market opportunity versus its peers engaged in satellite services or defense applications.

Meanwhile, the competitive landscape in commercial space is intensifying as multiple players vie for market share.

Taken together, these challenges warrant caution in playing Virgin Galactic shares at current levels.

How Wall Street Recommends Playing Virgin Galactic

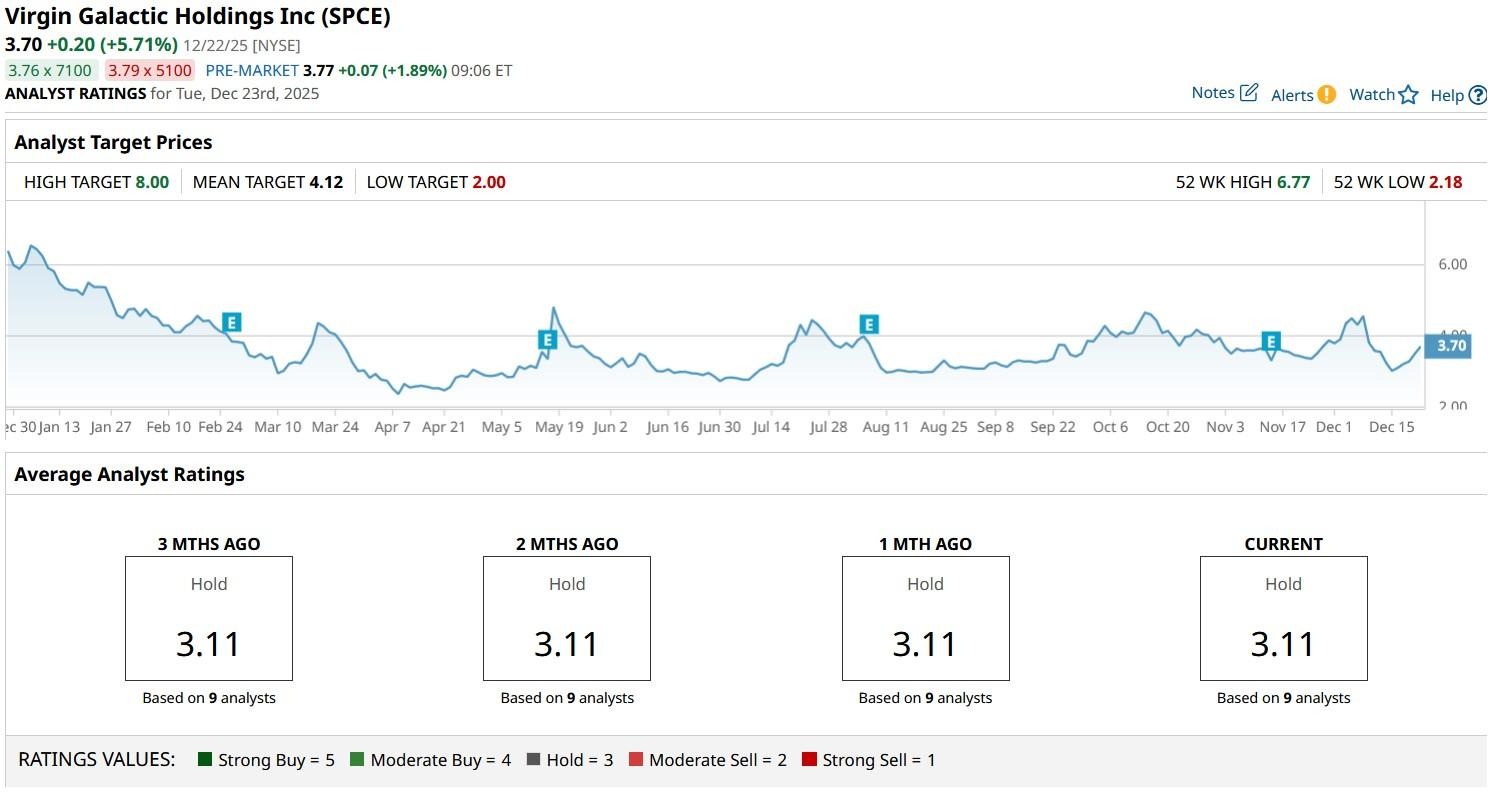

Despite the aforementioned headwinds, however, Wall Street analysts haven’t thrown in the towel on SPCE stock.

While the consensus rating on Virgin Galactic stock currently sits at “Hold” only, the mean target of about $4.12 indicates upside potential of another 17% from here.

This article was created with the support of automated content tools from our partners at Sigma.AI. Together, our financial data and AI solutions help us to deliver more informed market headline analysis to readers faster than ever.