Verizon’s previously explosive deployment growth of inexpensive fixed wireless access home internet service is decelerating.

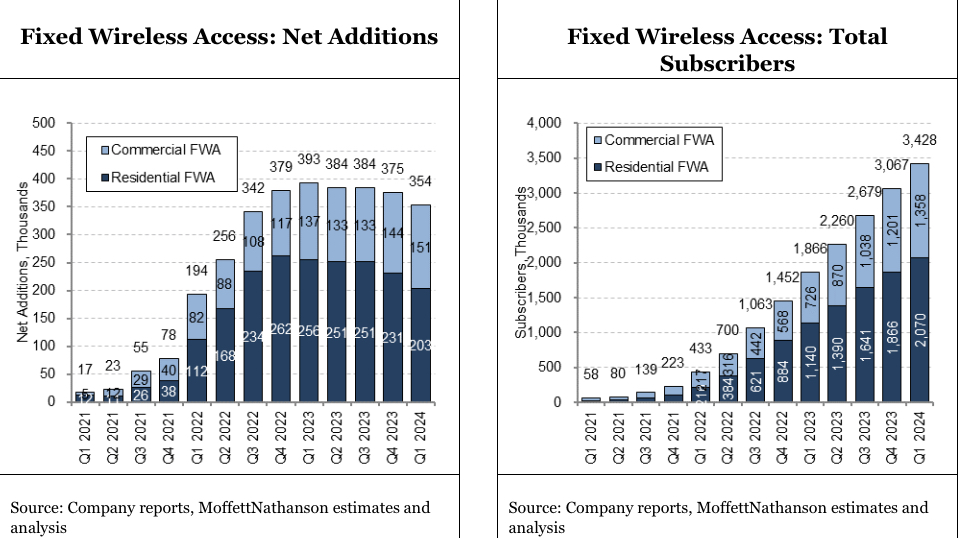

The wireless company reported the addition of 354,000 FWA customers across business and residential channels in the first quarter, down 10% from the 393,000 it tallied in the first quarter of 2023.

The business side of the equation added a record 115,000 customers during the first three months of the year, but residential growth dropped nearly 21% year over year to 203,000 new Verizon fixed wireless access consumers.

Verizon, which first began deploying its cellular-based 5G Home internet service back in 2018, now touts 3.48 million FWA customers. (Here's Verizon's Q1 earnings release.)

“Their results in fixed wireless access remain a puzzle,” equity analyst Craig Moffett noted in a Monday morning note to investors. "Growth is still relatively strong, but their quarterly results continue to decelerate, something we wouldn’t have expected given the early stage of deployment and the steady expansion of their Band 76 C-Band footprint. Their results have never approached those of T-Mobile, particularly in the Consumer segment."

T-Mobile, which touted 4.776 million FWA customers as of the end of 2023 and was still witnessing accelerated fixed-wireless customer growth as of the fourth quarter, reports its Q1 data on Thursday.

For its part, Verizon reported a narrow 0.2% year-over-year expansion in first-quarter operating revenue to $33 billion.

In the wireline segment of its home internet business, it added 49,000 residential Fios Internet subscribers in the first quarter, down from 63,000 in Q1 2023. Verizon now has 7.02 million residential Fios Internet customers.

Meanwhile, Verizon's residential Fios TV business dropped below the 3 million customer line, losing 68,000 customers in Q1 (vs. a loss of 74,000 customers a year ago). Verizon now has 2.88 million residential linear pay TV customers left.