LAND values across the Hunter and Central Coast regions have soared by up to two-thirds in the latest annual figures released by the NSW Valuer General.

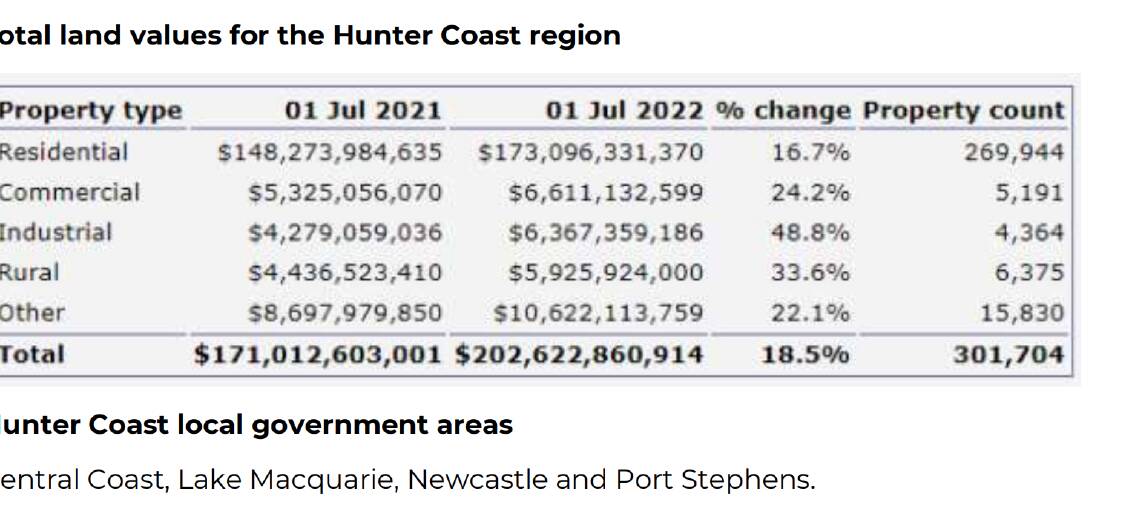

Figures released by local government area show an 18.5 per cent increase in land values for the Newcastle, Lake Macquarie, Port Stephens and Central Coast council areas, with the value of 301,704 properties rising to from $171 billion to $202.6 billion last financial year.

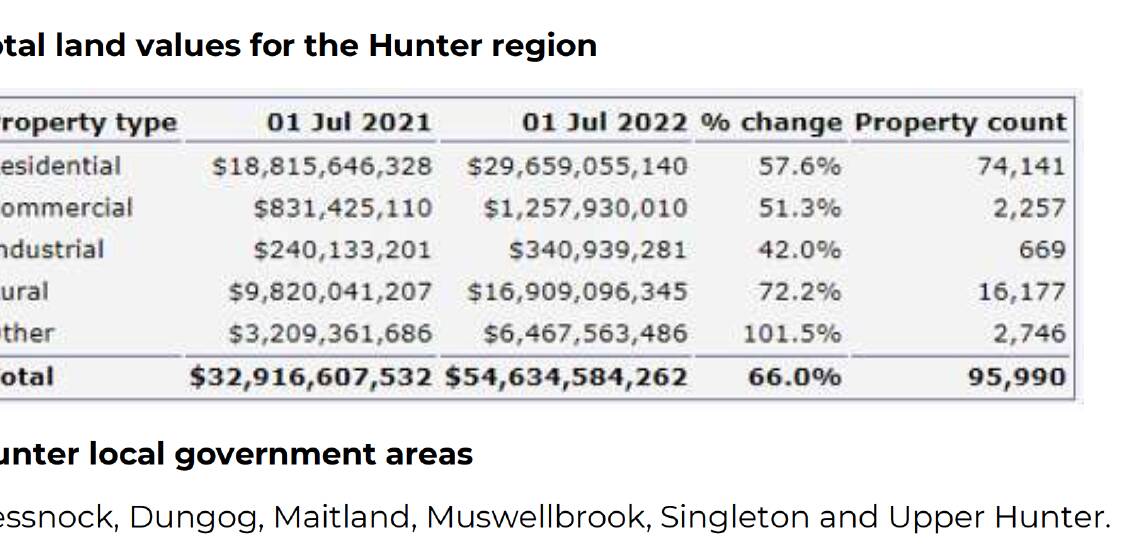

This value increase was described as "strong" by the Valuer General, but it pales beside the "very strong" 66 per cent increase for 95,990 properties in the Cessnock, Dungog, Maitland, Muswellbrook, Singleton and Upper Hunter council areas, which rose in value from $32.9 billion to $54.6 billion in the year to July 1.

Statewide, the Valuer General said land values rose from $2.25 trillion to $2.84 trillion in the year to July 1, 2022, an overall increase of 26 per cent. Residential land rose by 24 per cent, commercial by 22 per cent and industrial by 49.6 per cent.

"Property sales are the most important factor valuers consider when determining land values," the VG's office said in a statement announcing the new calculations, saying they "were assessed following analysis of over 61,000 property sales".

"All of NSW experienced increases in residential land values," the VG said.

"The residential market experienced a continuing trend of buyers focusing on regional areas with purchasers seeking affordability and alternative lifestyle options.

"Regional and coastal markets with accessibility to regional and metropolitan centres were particularly sought after."

The VG said the valuations were used where councils had "ad valorem" calculations in their annual rates. They were also used in calculating investment land tax and the new property tax alternative to stamp duty for first-home buyers.

The stamp duty reforms took effect this week, allowing eligible first home buyers to pay an annual property tax, rather than up-front stamp duty.

"The relevant annual tax is derived from the underlying land value as determined by the Valuer General," a spokesperson said.

Revenue NSW says the annual property tax alternative is available for first-home buyers of houses worth between $650,000 (when stamp duty begins) and $1.5 million, and on vacant land up to $800,000.

It says the property tax rates for 2022-23 and 2023-24 have been set at $400 plus 0.3 per cent of land value for owner-occupied properties, and $1500 plus 1.1 per cent of land value for investment properties.

Opposition leader Chris Minns announced on Monday that Labor would scrap the tax and lift the stamp duty threshold to $800,000 if elected.

Because the new VG figures are based on the 2021-22 financial year, they do not take into account the substantial falls in property prices that have transpired since the Reserve Bank issued the first of eight interest rate increases in May last year, taking the cash rate target from 0.1 per cent to 3.1 per cent.

Property prices have reportedly slumped by about 7.0 per cent, nationally, since the rate rises began, and prices are expected to fall further as the impact of the existing rates continues.

Despite the substantial double-digit increases in the new VG figures, council rates must remain within the limits set by the Independent Pricing and Regulatory Tribunal, which has "pegged" increases of between 3.7 per cent to 6.8 per cent for the 2023-24 financial year.

A Lake Macquarie Council spokesperson said the Lake cap was 3.7 per cent.

"Rates charged in the 2023/24 financial year will incorporate this increase and be based on (updated) land values issued by the Valuer General," the spokesperson said. "Lake council uses a 50:50 split between base rate and ad valorem (land value) when calculating rates.

"If your property value increase is less than the average for your local government area, the increase to the ad valorem component (50 per cent) will be less than the average, so your rates might actually go down.

"On the flipside, if your property value increase is above average, your ad valorem component will increase by more than average and you'll pay more."

The spokesperson said the council had no say in the VG's valuations, but ratepayers were able to lodge an objection to their land valuation with the VG.

The VG said landholders would receive a "notice of valuation" before it was used for rates, giving landowners time to respond.

To see more stories and read today's paper download the Newcastle Herald news app here.