With a market cap of $61.8 billion, Valero Energy Corporation (VLO) is a global energy manufacturer and marketer producing petroleum-based and low-carbon transportation fuels and petrochemical products. It operates through Refining, Renewable Diesel, and Ethanol segments, supplying fuels and related products under well-known brands such as Valero, Diamond Shamrock, and Diamond Green Diesel.

Shares of the San Antonio, Texas-based company have outperformed the broader market over the past 52 weeks. VLO stock has climbed 51.7% over this time frame, while the broader S&P 500 Index ($SPX) has rallied 14.9%. Moreover, shares of the company are up nearly 24% on a YTD basis, compared to SPX's 1.1% gain.

Looking closer, shares of the oil refiner have also exceeded the State Street Energy Select Sector SPDR ETF's (XLE) 20.2% increase over the past 52 weeks.

Despite beating expectations with Q4 2025 adjusted EPS of $3.82 and revenue of $30.37 billion, Valero shares fell marginally on Jan. 29 as investors focused on softer full-year profitability, with 2025 net income declining to $2.3 billion ($7.57 per share) from $2.8 billion ($8.58 per share) in 2024. The market was also cautious about segment-level weakness, particularly in Renewable Diesel, where operating income fell to $92 million from $170 million year-over-year.

For the fiscal year ending in December 2026, analysts expect VLO's adjusted EPS to grow 15.8% year-over-year to $12.29. The company's earnings surprise history is promising. It beat the consensus estimates in the last four quarters.

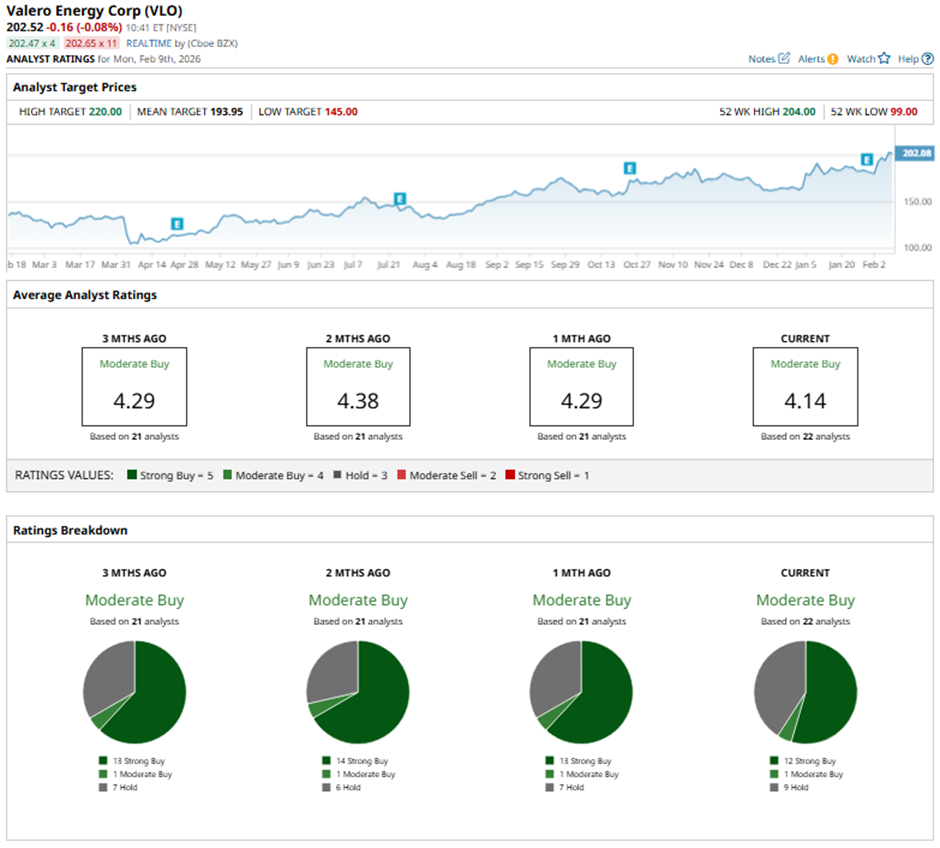

Among the 22 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on 12 “Strong Buy” ratings, one “Moderate Buy,” and nine “Holds.”

On Feb. 9, Citi analyst Vikram Bagri raised Valero’s price target to $212 while maintaining a “Neutral" rating.

As of writing, the stock is trading above the mean price target of $193.95. The Street-high price target of $220 implies a potential upside of 8.6% from the current price levels.